Loans up to Rs 1 crore for MSMEs in 59 minutes: 10-step guide to the new portal

TIMESOFINDIA.COM | Updated: Nov 3, 2018, 19:54 ISTHighlights

- Announcing a slew of measures as a "Diwali gift" for the sector, PM Modi said GST-registered MSMEs will be sanctioned a loan of Rs 1 crore in just 59 minutes through a new portal

- The portal is set up by the Small Industries Development Bank of India (Sidbi)

(Representative image)

(Representative image)NEW DELHI: In a much-needed relief to the small and medium businesses, the government on Friday launched the quick loan disbursal portal for the MSME sector. Announcing a slew of measures as a "Diwali gift" for the sector, Prime Minister Narendra Modi said that the GST-registered micro, small and medium enterprises will be sanctioned a loan of Rs 1 crore in just 59 minutes through a new portal.

The portal has been set up by the Small Industries Development Bank of India (Sidbi).

Before you login to the new portal, keep the below mentioned things ready:

* GST Identification Number and password

* Income tax returns (ITRs) in 'XML format' and PAN details with date of incorporation

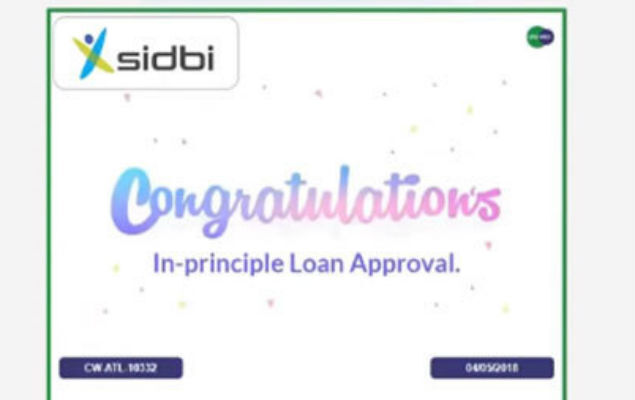

* 6-month bank statement (PDF format) and netbanking details

* Company information

Here's your 10-step guide on how to get quick loan approval on this new portal:

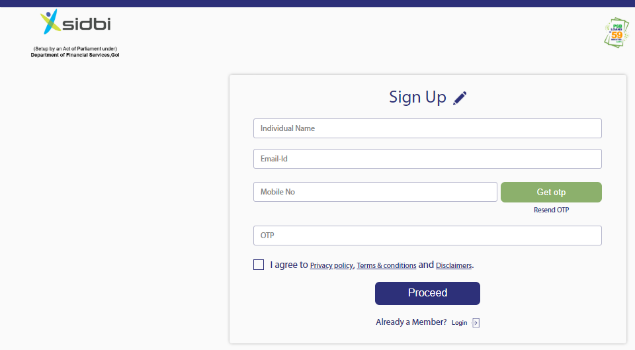

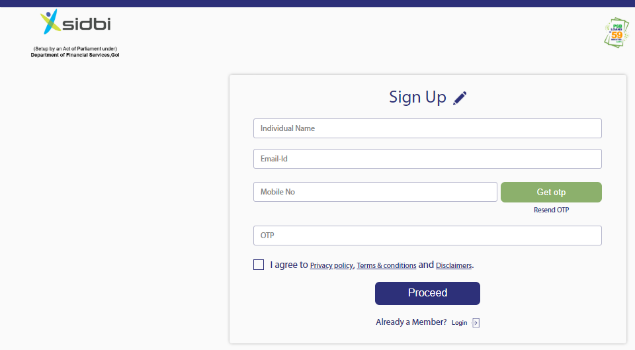

1) Register: Enter with your name, email address and a mobile number on which you will get an OTP to complete the registration process.

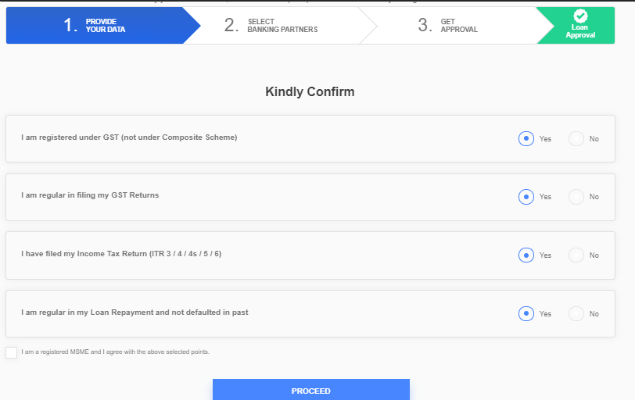

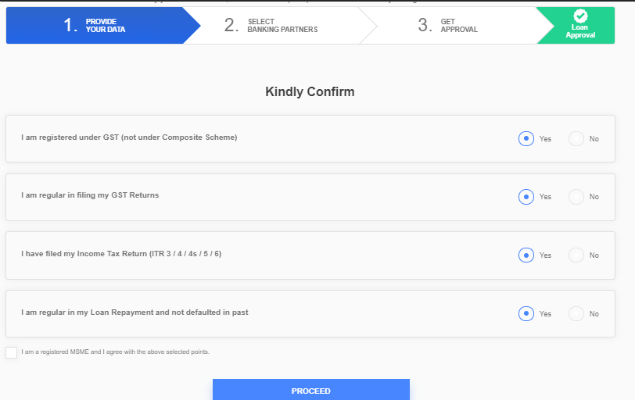

2) Answer simple questions: Answer four simple questions such as whether you are registered with GST and have been filing your GST returns regularly and have never defaulted on a loan. Select "I am a registered MSME and I agree with the above selected points" and click on 'Proceed'.

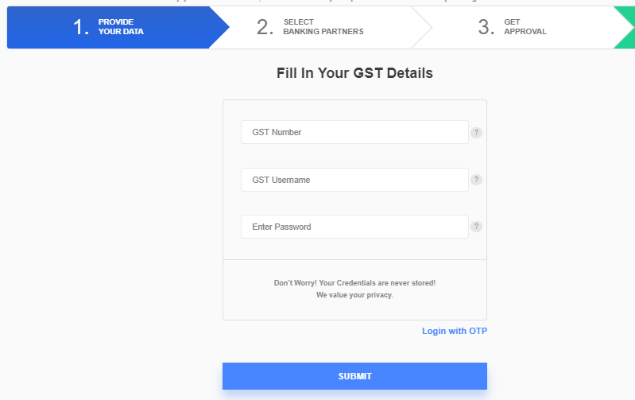

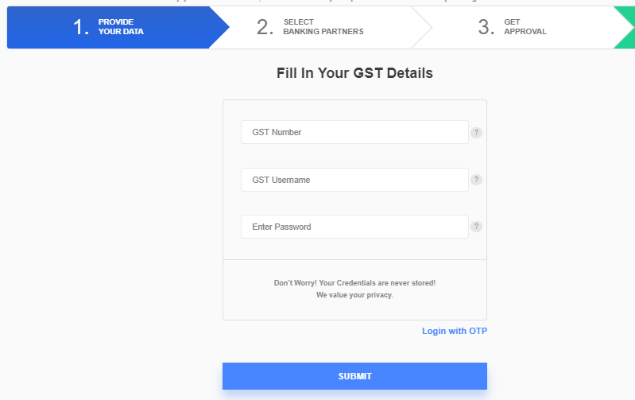

3) GST details: Enter Goods and Services Tax or GST details like number, username along with password.

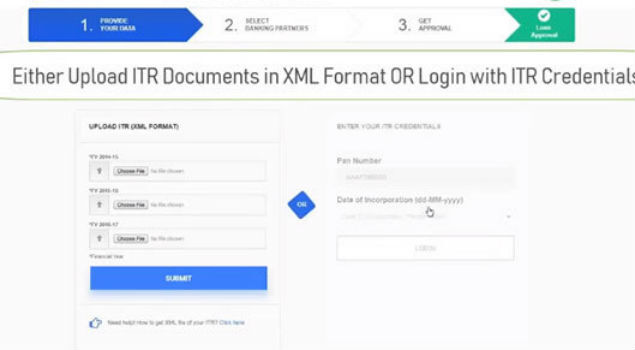

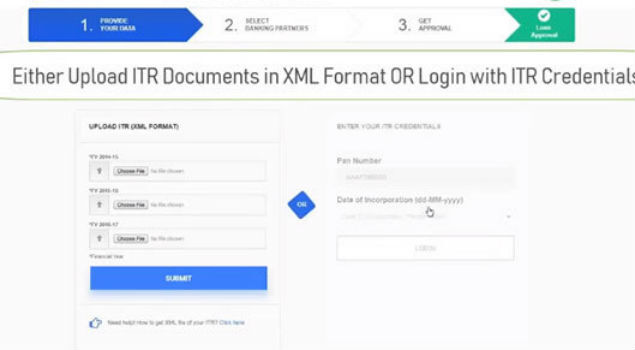

4) Enter you tax information: Upload your tax returns in 'XML format' or login with your Income Tax returns (ITR) credentials — your PAN and date of incorporation.

5) Bank details: Enter your bank details by uploading bank statements, or else you may choose netbanking option.

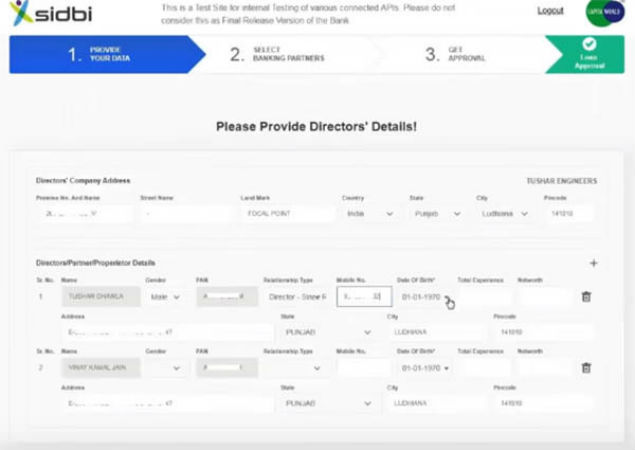

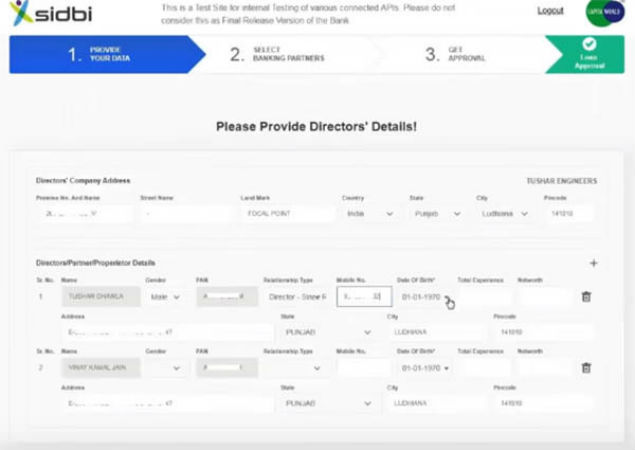

6) Give company information: Provide necessary information like address, details of properties among some other details.

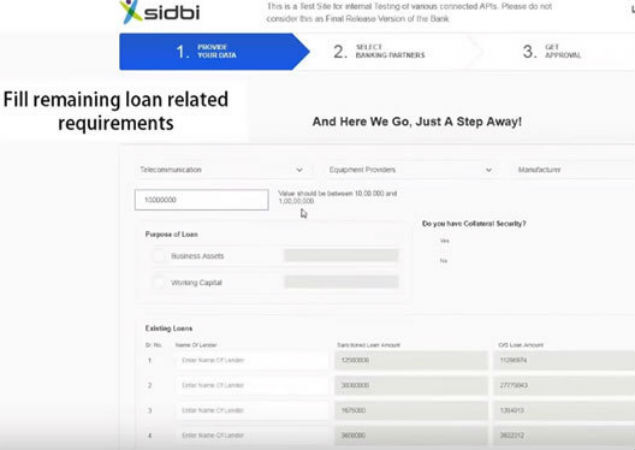

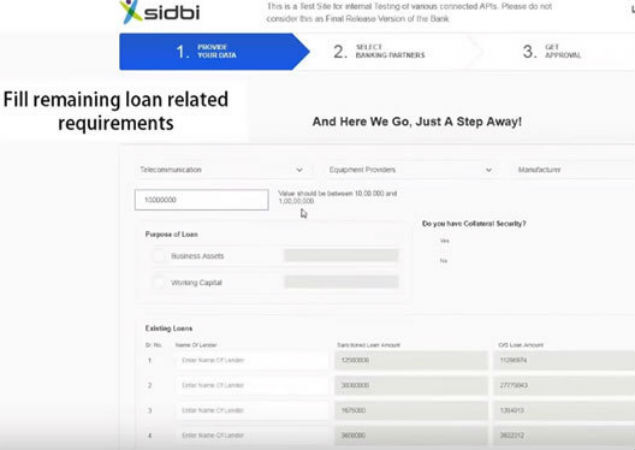

7) Enter loan details: Provide details of your business and the purpose of loan. You also need to mention any collateral security and previous loans (if taken).

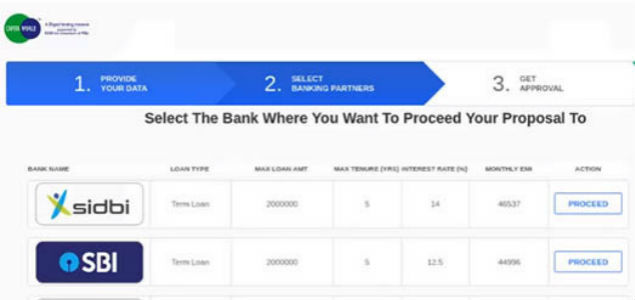

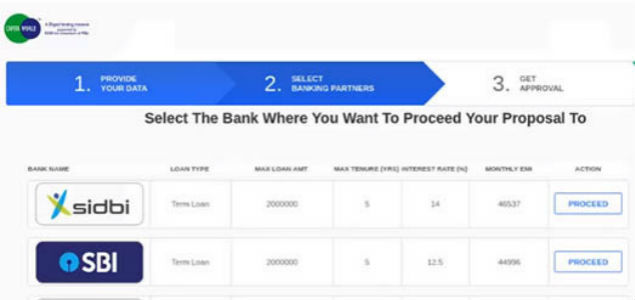

8) Select a bank: Select a bank from the given list from which you want to start your loan.

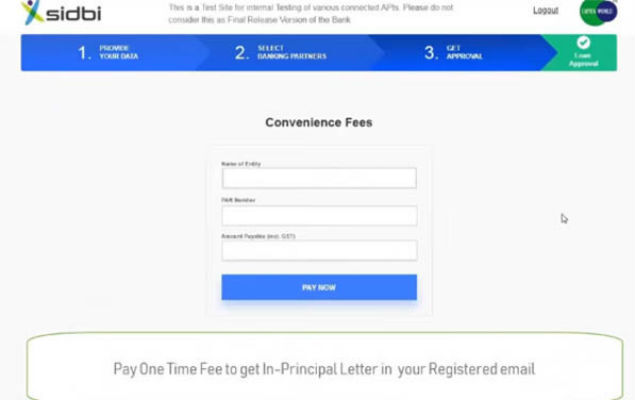

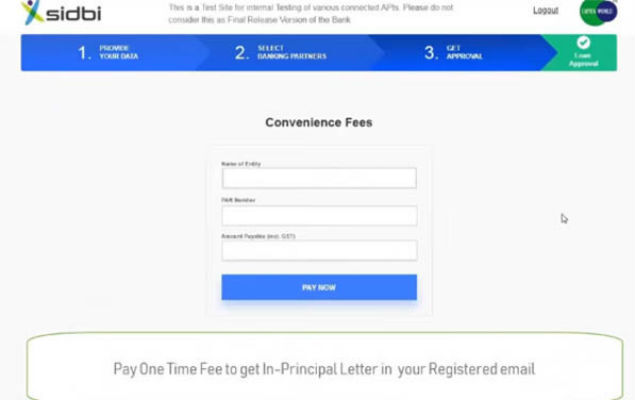

9) Fee: Loan seekers need to pay one time charge

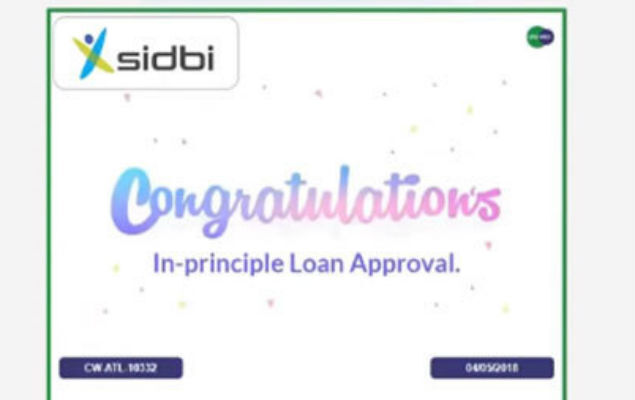

10) Approval letter: Once you pay the fee, your approval letter will be ready and it can be downloaded.

It must be noted that this approval of loan doesn't mean actual disbursal as banks may ask for further clarification.

The portal has been set up by the Small Industries Development Bank of India (Sidbi).

MSME Support & Outreach programme will provide Small and Medium Enterprises easier availability of credit, access t… https://t.co/WaXAPIj5u3

— PIB India (@PIB_India) 1541160506000Before you login to the new portal, keep the below mentioned things ready:

* GST Identification Number and password

* Income tax returns (ITRs) in 'XML format' and PAN details with date of incorporation

* 6-month bank statement (PDF format) and netbanking details

* Company information

Here's your 10-step guide on how to get quick loan approval on this new portal:

1) Register: Enter with your name, email address and a mobile number on which you will get an OTP to complete the registration process.

2) Answer simple questions: Answer four simple questions such as whether you are registered with GST and have been filing your GST returns regularly and have never defaulted on a loan. Select "I am a registered MSME and I agree with the above selected points" and click on 'Proceed'.

3) GST details: Enter Goods and Services Tax or GST details like number, username along with password.

4) Enter you tax information: Upload your tax returns in 'XML format' or login with your Income Tax returns (ITR) credentials — your PAN and date of incorporation.

5) Bank details: Enter your bank details by uploading bank statements, or else you may choose netbanking option.

6) Give company information: Provide necessary information like address, details of properties among some other details.

7) Enter loan details: Provide details of your business and the purpose of loan. You also need to mention any collateral security and previous loans (if taken).

8) Select a bank: Select a bank from the given list from which you want to start your loan.

9) Fee: Loan seekers need to pay one time charge

10) Approval letter: Once you pay the fee, your approval letter will be ready and it can be downloaded.

It must be noted that this approval of loan doesn't mean actual disbursal as banks may ask for further clarification.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE