PM promises loans for small businesses in less than 1 hr

TNN | Updated: Nov 3, 2018, 08:41 ISTHighlights

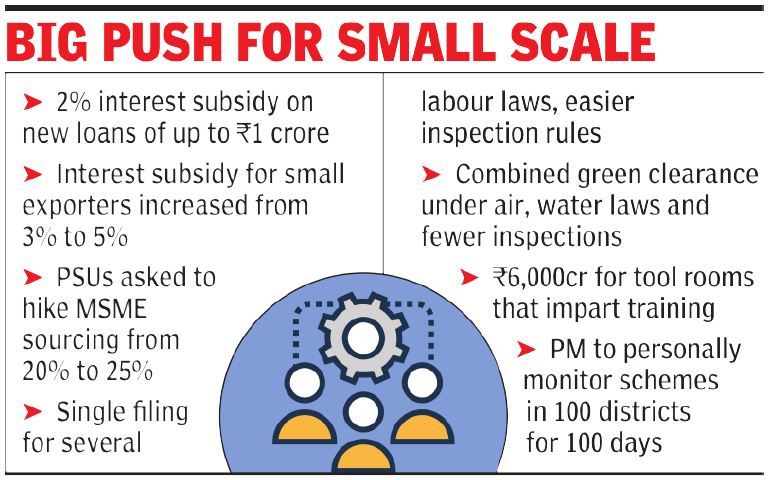

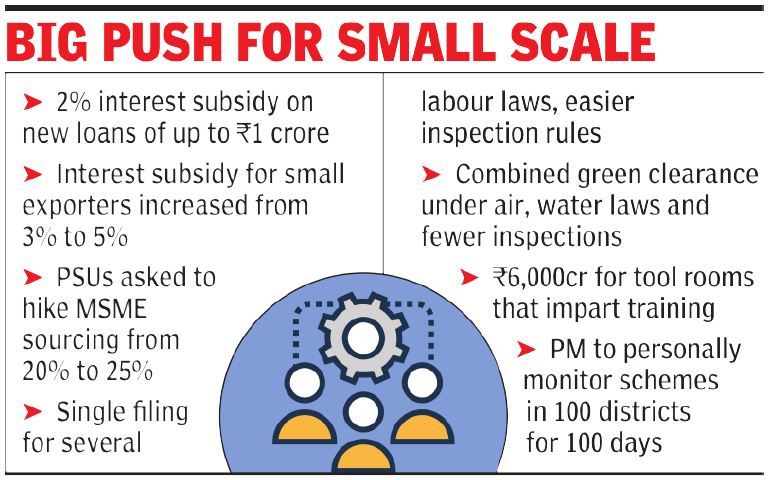

- In the next 100 days, the PM also plans to monitor implementation of scheme across 100 districts.

- Additional 2% subsidy for small exporters for pre- and post-shipment credit

- PSUs asked to procure 25% of their goods from small enterprises, with a new quota of 3% purchases introduced for women entrepreneurs.

Prime Minister Narendra Modi visits an exhibition stall, at the launch of the Support and Outreach Initiative for MSMEs, in New Delhi (PTI)

NEW DELHI: Prime Minister Narendra Modi unveiled a 12-point action plan on Friday for micro, small and medium enterprises (MSMEs) — including subsidised loans, higher procurement and easier labour and green rules — as he sought to address concerns of small businesses, many of whom have been critical of demonetisation and the goods and services tax.

The outreach comes against the backdrop of a credit crunch, sluggish manufacturing activity and increased competition from imports, especially from China. The announcements have political implications, too, as the government looks to counter opposition attacks that jobs have not grown ahead of the forthcoming state elections and next year’s Lok Sabha polls.

“In this age of globalisation, the 12-point action plan will strengthen MSMEs and help write a new chapter for them,” Modi said, announcing the measures he described as “Diwali gifts” for the sector. In the action plan, the provision for a 2% interest subsidy for new or incremental loans of up to Rs 1 crore taken by MSME units through a new portal that promises to approve loans in 59 minutes is seen to be most significant.

In the next 100 days, the PM also plans to monitor its implementation across 100 districts. In the action plan, there will be an additional 2% subsidy for small exporters for pre- and post-shipment credit, the PM announced, in what was seen as an attempt to boost exports and bridge the current account deficit to ease pressure on the rupee that has depreciated around 15% in 2018.

The subsidy — which came with steps to ease cash flow due to payments held up with large buyers — is seen as a move to address credit woes of small businesses that have been adversely impacted by the liquidity crunch in the system after IL&FS defaulted on repayment and banks and mutual funds became wary of lending to the sector. The government has been trying to get RBI to ease rules for non-banking finance companies that are a major source of funding for MSMEs.

Apart from credit, the bouquet of steps focused on enhanced market access for which the government has decided to tap public sector companies and government departments.

As part of the scheme, PSUs have been asked to procure 25% of their goods from small enterprises, instead of 20% at present, with a new quota of 3% purchases introduced for women entrepreneurs.

Modi also asked all state-run firms to register on the government e-marketplace, or GeM, the online procurement platform for government agencies, and get their vendors to register. This will help MSME units to provide goods and services through the platform.

The outreach comes against the backdrop of a credit crunch, sluggish manufacturing activity and increased competition from imports, especially from China. The announcements have political implications, too, as the government looks to counter opposition attacks that jobs have not grown ahead of the forthcoming state elections and next year’s Lok Sabha polls.

“In this age of globalisation, the 12-point action plan will strengthen MSMEs and help write a new chapter for them,” Modi said, announcing the measures he described as “Diwali gifts” for the sector. In the action plan, the provision for a 2% interest subsidy for new or incremental loans of up to Rs 1 crore taken by MSME units through a new portal that promises to approve loans in 59 minutes is seen to be most significant.

In the next 100 days, the PM also plans to monitor its implementation across 100 districts. In the action plan, there will be an additional 2% subsidy for small exporters for pre- and post-shipment credit, the PM announced, in what was seen as an attempt to boost exports and bridge the current account deficit to ease pressure on the rupee that has depreciated around 15% in 2018.

The subsidy — which came with steps to ease cash flow due to payments held up with large buyers — is seen as a move to address credit woes of small businesses that have been adversely impacted by the liquidity crunch in the system after IL&FS defaulted on repayment and banks and mutual funds became wary of lending to the sector. The government has been trying to get RBI to ease rules for non-banking finance companies that are a major source of funding for MSMEs.

Apart from credit, the bouquet of steps focused on enhanced market access for which the government has decided to tap public sector companies and government departments.

As part of the scheme, PSUs have been asked to procure 25% of their goods from small enterprises, instead of 20% at present, with a new quota of 3% purchases introduced for women entrepreneurs.

Modi also asked all state-run firms to register on the government e-marketplace, or GeM, the online procurement platform for government agencies, and get their vendors to register. This will help MSME units to provide goods and services through the platform.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE