Use arbitrage funds to ride the volatility

Narendra Nathan | TNN | Oct 29, 2018, 14:41 ISTHighlights

- With polls coming up, volatility may continue for some more time

- Arbitrage funds are useful for investors with low risk appetite

(Representative image)

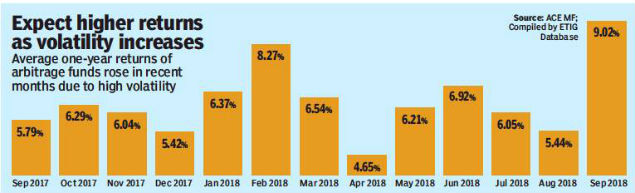

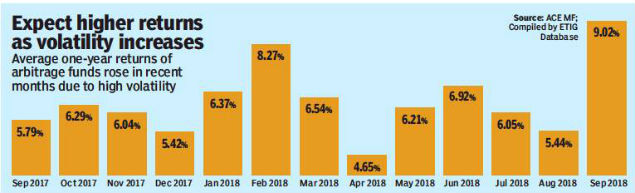

(Representative image)NEW DELHI: Volatility is good news for investors in arbitrage funds as their returns go up during periods of market turmoil. This is because arbitrage funds generate returns by harnessing the price differential between the cash and futures market—they buy in the cash market and sell in the futures market. This cash-futures difference widens during volatility. Of late, average absolute returns from arbitrage funds have jumped (see chart) and in September it was at 0.7514% (9% annualised).

Two factors led to this jump. First was the increased volatility in the market. “Increased volatility will continue till the general elections in 2019 and arbitrage funds should continue to generate good returns,” says Vijay Singhania, Founder & Director, Trade Smart Online. The second reason is the increased currency volatility and high hedging cost of dollar. “Foreign portfolio investors (FPIs) who play in arbitrage markets hedge their dollar risks and the participation of FPIs has come down now amid high currency hedging costs,” says Deepak Gupta, Equity Fund Manager, Kotak Mutual Fund.

Who should invest?

Arbitrage funds are useful for investors with low risk appetite. However, investors must also realise that its NAV volatility can be very high in the short-term. Hence, Melvin Joseph, Founder, Finvin Financial Planners says, “Arbitrage funds are suited for educated investors, who understand how they work. They also need to understand that returns will be high during high volatility periods and will be low during low volatility.”

Taxation advantage

Though they offer debt-like returns, arbitrage funds are treated as equity funds for taxation purposes. While the taxation advantage is less after the imposition of long term capital gains tax (LTCG) and dividend distribution tax, they still offer an edge if you park funds for short to medium durations. However, your holding period is critical. “Arbitrage funds are good if your holding period is less than three years,” says Joseph. This is because three years is the cut off between short-term capital gain (taxed at your tax slabs) and LTCG (taxed at 20% after allowing indexation benefits) in debt funds.

Growth or dividend?

Investors with a holding period of up to one year can go with the dividend option. They can opt for the growth option if their holding period is between one and three years.

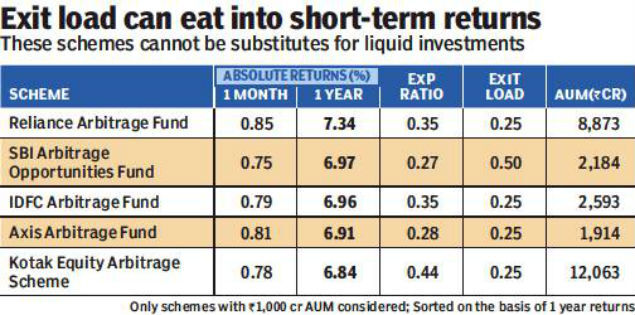

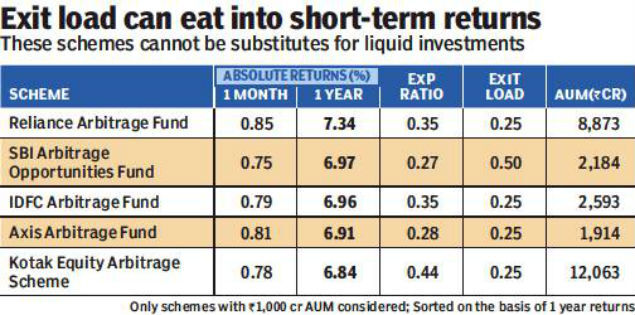

Exit load

Since NAV movements can be volatile within monthly derivative cycles, fund houses usually charge small exit loads for redemptions within a month (see table). Investors should not use equity arbitrage funds as a substitute for liquid funds to park money for a few days.

Two factors led to this jump. First was the increased volatility in the market. “Increased volatility will continue till the general elections in 2019 and arbitrage funds should continue to generate good returns,” says Vijay Singhania, Founder & Director, Trade Smart Online. The second reason is the increased currency volatility and high hedging cost of dollar. “Foreign portfolio investors (FPIs) who play in arbitrage markets hedge their dollar risks and the participation of FPIs has come down now amid high currency hedging costs,” says Deepak Gupta, Equity Fund Manager, Kotak Mutual Fund.

Who should invest?

Arbitrage funds are useful for investors with low risk appetite. However, investors must also realise that its NAV volatility can be very high in the short-term. Hence, Melvin Joseph, Founder, Finvin Financial Planners says, “Arbitrage funds are suited for educated investors, who understand how they work. They also need to understand that returns will be high during high volatility periods and will be low during low volatility.”

Taxation advantage

Though they offer debt-like returns, arbitrage funds are treated as equity funds for taxation purposes. While the taxation advantage is less after the imposition of long term capital gains tax (LTCG) and dividend distribution tax, they still offer an edge if you park funds for short to medium durations. However, your holding period is critical. “Arbitrage funds are good if your holding period is less than three years,” says Joseph. This is because three years is the cut off between short-term capital gain (taxed at your tax slabs) and LTCG (taxed at 20% after allowing indexation benefits) in debt funds.

Growth or dividend?

Investors with a holding period of up to one year can go with the dividend option. They can opt for the growth option if their holding period is between one and three years.

Exit load

Since NAV movements can be volatile within monthly derivative cycles, fund houses usually charge small exit loads for redemptions within a month (see table). Investors should not use equity arbitrage funds as a substitute for liquid funds to park money for a few days.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE