Government wants easier norms for banks, in line with global rules

Sidhartha | TNN | Updated: Oct 25, 2018, 10:09 ISTHighlights

- The government feels that the current norms are tougher than global standards

- During a meeting, the issue of prompt corrective action (PCA) for weak banks was also flagged

(Representative image)

(Representative image)NEW DELHI: The government has made a strong pitch before RBI to ensure that capital and other norms for Indian lenders are eased and in line with global standards, amid indications that the regulator may soften the rules for weaker banks, which are struggling under the weight on bad debt.

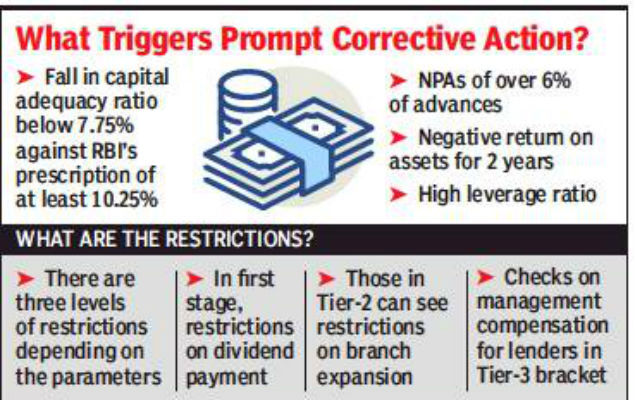

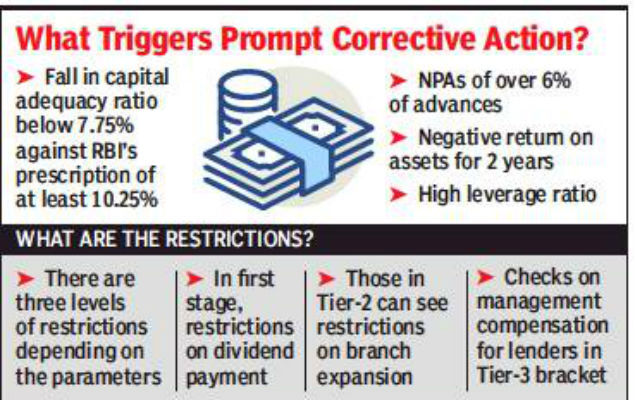

During discussions with RBI, including at this week’s board meeting, government representatives have suggested that the capital requirement for banks, along with risk weights and capital conservation buffer should be in line with the Basel norms, sources told TOI. The government feels that the current norms are tougher than global standards. At the meeting, the issue of prompt corrective action (PCA) for weak banks was also flagged, after some of the lenders had expressed their concern at a recent meeting with finance minister Arun Jaitley.

The PCA norms have put curbs on operations of at least 11 state-run lenders, which the government believes is putting brakes on lending and economic recovery. At least two lenders — Dena Bank and Allahabad Bank — are facing restrictions on expansion of business. The tighter rules came into effect from April 2017, when state-run lenders had started feeling the pressure of bad debt, following an asset quality review initiated by RBI.

Sources indicated that in the coming days RBI may ease the prompt corrective action rules to address the concerns. A few weeks ago, RBI deputy governor Viral V Acharya had defended the regulatory action and argued that business has not been affected due to PCA norms.

In recent years, RBI has tightened the norms, that the government believes has hampered lenders, especially the public sector players, which are grappling with a pile of bad debt. Banks are required to maintain a specified capital adequacy ratio, which is linked to loans given by them. The capital requirement is also a function of the risk that a loan carries, with riskier ones having a a higher weight, requiring banks to set aside more capital.

Unlike earlier, RBI and the government are more appreciative of each other’s actions and discussions have been productive, sources said. In the past, there have been differences between the two, some of which have spilled out into the open, including on interest rates as well as regulatory issues.

In some of the cases, the government has suggested that direction may be correct but banks should be given sufficient time to stabilise before norms are tightened.

During discussions with RBI, including at this week’s board meeting, government representatives have suggested that the capital requirement for banks, along with risk weights and capital conservation buffer should be in line with the Basel norms, sources told TOI. The government feels that the current norms are tougher than global standards. At the meeting, the issue of prompt corrective action (PCA) for weak banks was also flagged, after some of the lenders had expressed their concern at a recent meeting with finance minister Arun Jaitley.

The PCA norms have put curbs on operations of at least 11 state-run lenders, which the government believes is putting brakes on lending and economic recovery. At least two lenders — Dena Bank and Allahabad Bank — are facing restrictions on expansion of business. The tighter rules came into effect from April 2017, when state-run lenders had started feeling the pressure of bad debt, following an asset quality review initiated by RBI.

Sources indicated that in the coming days RBI may ease the prompt corrective action rules to address the concerns. A few weeks ago, RBI deputy governor Viral V Acharya had defended the regulatory action and argued that business has not been affected due to PCA norms.

In recent years, RBI has tightened the norms, that the government believes has hampered lenders, especially the public sector players, which are grappling with a pile of bad debt. Banks are required to maintain a specified capital adequacy ratio, which is linked to loans given by them. The capital requirement is also a function of the risk that a loan carries, with riskier ones having a a higher weight, requiring banks to set aside more capital.

Unlike earlier, RBI and the government are more appreciative of each other’s actions and discussions have been productive, sources said. In the past, there have been differences between the two, some of which have spilled out into the open, including on interest rates as well as regulatory issues.

In some of the cases, the government has suggested that direction may be correct but banks should be given sufficient time to stabilise before norms are tightened.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE