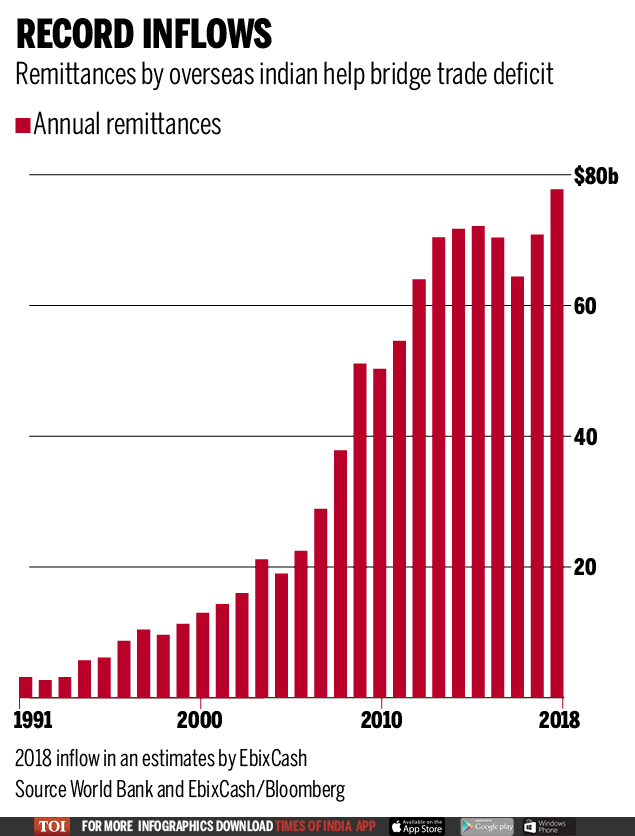

Rupee plunge may push remittances by NRIs to record high of $76 billion

Bloomberg | Oct 25, 2018, 13:08 ISTHighlights

- Flows from an estimated 20 million nationals working abroad will help bolster India’s efforts to cap the current-account deficit

- Without remittances, the gap would have been about five per cent of GDP at mid-year, instead of two per cent, according to Capital Economics

(Representative image)

(Representative image)NEW DELHI: Lured by the sharp slump in rupee against the dollar, Indians living overseas may boost remittances to a record, helping bolster the nation’s efforts to support Asia’s worst-performing major currency.

The country is expected to receive remittances of about $76 billion in 2018, 10 per cent more than in the previous year, according to estimates by EbixCash, the financial exchange unit of US-based insurance software provider Ebix Inc. About three-fourth of the inflows come via Ebix’s outlets, the company said.

Flows from an estimated 20 million nationals working abroad will help bolster India’s efforts to cap the nation’s current-account deficit. Without remittances, the gap would have been about five per cent of gross domestic product at mid-year, instead of two per cent, according to Capital Economics.

“When rupee depreciates so sharply, inbound sources of money get active,” Hariprasad M P, head of treasury at EbixCash, said in an interview on Wednesday. “These inflows are important for the economy at this juncture.”

A global emerging-market sell-off that’s triggered outflows from Indian bonds and stocks saw the rupee setting a string of fresh lows earlier this month. Likely intervention by the Reserve Bank of India in the forex market, a drop in prices of oil -- the nation’s top import -- and easing of rules on overseas borrowings have helped steady the rupee off late.

The rupee fell 0.30 per cent to 73.3725 per dollar as of 9:40 am in Mumbai on Thursday. The currency has gained 1.5 per cent since falling to a record 74.4825 on October 11.

“At the moment, we don’t see downside risk for the rupee at least till December,” said Hariprasad. “It is unlikely to run toward 75 in the near-to-medium term.”

The country is expected to receive remittances of about $76 billion in 2018, 10 per cent more than in the previous year, according to estimates by EbixCash, the financial exchange unit of US-based insurance software provider Ebix Inc. About three-fourth of the inflows come via Ebix’s outlets, the company said.

Flows from an estimated 20 million nationals working abroad will help bolster India’s efforts to cap the nation’s current-account deficit. Without remittances, the gap would have been about five per cent of gross domestic product at mid-year, instead of two per cent, according to Capital Economics.

“When rupee depreciates so sharply, inbound sources of money get active,” Hariprasad M P, head of treasury at EbixCash, said in an interview on Wednesday. “These inflows are important for the economy at this juncture.”

A global emerging-market sell-off that’s triggered outflows from Indian bonds and stocks saw the rupee setting a string of fresh lows earlier this month. Likely intervention by the Reserve Bank of India in the forex market, a drop in prices of oil -- the nation’s top import -- and easing of rules on overseas borrowings have helped steady the rupee off late.

The rupee fell 0.30 per cent to 73.3725 per dollar as of 9:40 am in Mumbai on Thursday. The currency has gained 1.5 per cent since falling to a record 74.4825 on October 11.

“At the moment, we don’t see downside risk for the rupee at least till December,” said Hariprasad. “It is unlikely to run toward 75 in the near-to-medium term.”

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE