Amazon is set to secure ‘Future’ rights from Biyani

Digbijay Mishra and Shilpa Phadnis | TNN | Updated: Oct 17, 2018, 05:28 IST

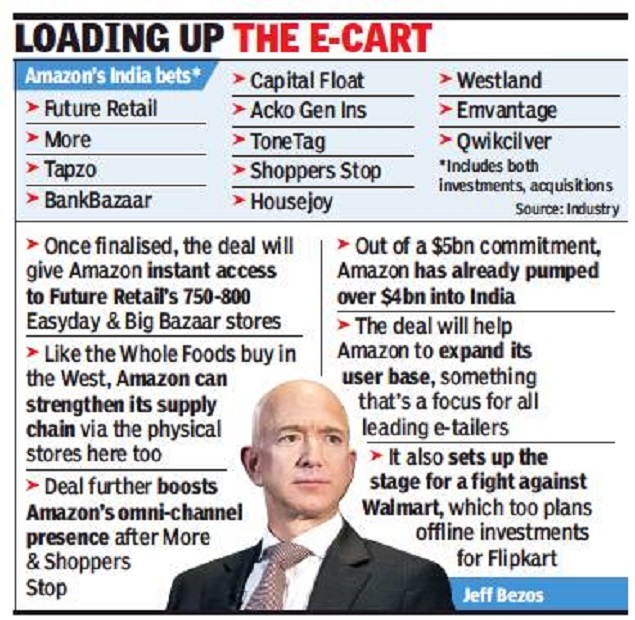

BENGALURU: The right to ramp up ownership holding and business exclusivity are key factors determining Amazon’s impending investment in the Kishore Biyani-led Future Retail. The American e-commerce giant is set to pick up a stake of just under 10% in Future Retail, which is likely to be approved by the latter’s board on October 29, people familiar with the matter said.

Amazon is expected to pick up shares — through the foreign portfolio investors route — at a hefty premium to the prevailing share price for gaining business exclusivity and future shareholding rights, they added. Future Retail shares ended 14% higher at Rs 494 apiece after television channels reported that Amazon was on track to buy a 7-8% stake in the Indian company. This gives Future Retail, which operates Big Bazaar and Easy Day supermarkets, a Rs 25,000-crore market value, though its 52-week record level is significantly higher.

An emailed questionnaire to a Future Group spokesperson on the details of the potential deal with Amazon remained unanswered. Biyani didn’t respond to repeated calls.

Amazon’s investment has strategic underpinnings and could evolve alongside regulatory and business developments. The Seattle-headquartered online retailing behemoth is placing huge bets on an omni-channel play in its pursuit of leadership in Asia’s third-largest economy. It is expected to face stiff resistance from Walmart, which acquired local e-commerce leader Flipkart, and Chinese internet giant Alibaba which has investments in Paytm Mall and e-grocer BigBasket.

And that explains Amazon’s eagerness to gain exclusivity with India’s largest retailer, Future Group. Incidentally, domestic organised retailing pioneer Biyani has had talks with Alibaba-Paytm even as talks with Amazon gathered momentum. TOI reported earlier that Alibaba had approached the country’s top conglomerates with interest in retailing to pursue its own omni-channel strategy.

Amazon is expected to pick up shares — through the foreign portfolio investors route — at a hefty premium to the prevailing share price for gaining business exclusivity and future shareholding rights, they added. Future Retail shares ended 14% higher at Rs 494 apiece after television channels reported that Amazon was on track to buy a 7-8% stake in the Indian company. This gives Future Retail, which operates Big Bazaar and Easy Day supermarkets, a Rs 25,000-crore market value, though its 52-week record level is significantly higher.

An emailed questionnaire to a Future Group spokesperson on the details of the potential deal with Amazon remained unanswered. Biyani didn’t respond to repeated calls.

Amazon’s investment has strategic underpinnings and could evolve alongside regulatory and business developments. The Seattle-headquartered online retailing behemoth is placing huge bets on an omni-channel play in its pursuit of leadership in Asia’s third-largest economy. It is expected to face stiff resistance from Walmart, which acquired local e-commerce leader Flipkart, and Chinese internet giant Alibaba which has investments in Paytm Mall and e-grocer BigBasket.

And that explains Amazon’s eagerness to gain exclusivity with India’s largest retailer, Future Group. Incidentally, domestic organised retailing pioneer Biyani has had talks with Alibaba-Paytm even as talks with Amazon gathered momentum. TOI reported earlier that Alibaba had approached the country’s top conglomerates with interest in retailing to pursue its own omni-channel strategy.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE