To get oil suppliers to revise their payment terms, India would have to negotiate hard and offer compelling trade-offs in a market where crude prices are soaring and moving fast towards the $100 per barrel mark.

Deepak Mahurkar, partner and leader – oil & gas industry – PwC India, said while haggling for a better commercial term, India, which is a major consumer of oil, could look at providing storage facility, swap with crude from other countries and other such incentives for a deal.

The two other aspects on which India usually bargains with global oil suppliers is credit period and the currency in which it trades with them. In the past, it was able to get an extension of credit period and had imported oil in rupee currency from Iran.

"These are usually commercial negotiations. So, if you want a better term you need to offer something better. It could be a crude swap, it could be storage or anything which favours the suppliers. Let's analyse it from that perspective rather than saying that it is not possible (to negotiate a better payment term with the oil suppliers). We should see what has India got to offer to the supplier in return," said Mahurkar

On Monday, Prime Minister Narendra Modi, after a marathon meeting with the executives of oil companies and the union petroleum minister, called on the global oil suppliers to relook at payment terms to offer relief to sliding rupee, which has tumbled below 70 against the US dollar.

On Monday, Prime Minister Narendra Modi, after a marathon meeting with the executives of oil companies and the union petroleum minister, called on the global oil suppliers to relook at payment terms to offer relief to sliding rupee, which has tumbled below 70 against the US dollar.

Global crude prices have risen 50% in dollar terms and 70% in rupee terms since the beginning of the year. Since India meets 80% of the oil requirement through imports it has been hit hard. As it spends more dollars to buy crude, the rupee has depreciated to record low in recent times.

And as the deadline for US sanctions against Iran on November 4 draws closer, India is moving fast to stunt any further impact it may have on its currency.

Anoop Bhatia, VP and sector head, Icra, believes India may not find it easy to change payment terms with any other oil supplying country except Iran.

"India will not have the power to change the payment terms with any other country other than Iran. We are also taking the risk of annoying US. Will they (oil marketing countries) change payment terms for India? Why will they give up their dollar earnings? They will also not like to extend the credit period for more than two months for India. Only Iran may do it because it is under pressure of US sanction," said Bhatia.

He said Iran may consider trading oil against other commodities and could allow imports in the rupee.

Bhatia said other than the exchange risk, India would also face cost impact after November 4. According to him if Iran's oil supply was cut off from the market, it will create a shortage and send the crude prices shooting up. And since India is a major buyer of crude, its oil import bill, which is already bloated, could swell further.

Mahurkar said revision in payment on the currency terms with oil suppliers was imperative for India as it would offer a big relief to India at a time dollar has risen to an uncomfortable level.

"Switching to any other currency other than the dollar for trading in oil would be a big relief. You (India) are able to get a cover. If you can get the arbitrage covered you are not unnecessarily spending Indian rupee. The dollar is also fluctuating. So, if the dollar falls after six months, and if you are able to settle the payment after six months, it will not hurt so much," he added.

Both Mahurkar and Bhatia feel that the US may offer some kind of waiver to India as long as Iran sanction was concerned.

"We are trying hard. One of the arguments that we are making is that in the current turmoil, in the developing economy circumstances, it is difficult to change source (of oil) at short notice for India. We may get the waiver of time. This is the only argument that India has otherwise there are enough sources of crude in the world to meet our supplies," the PwC energy expert said.

Bhatia said the US may not ask India to stop its entire oil imports from Iran but may cap the volume of oil imports. "Even the US would be sensible to allow some imports. Some volume of oil may be allowed," added Bhatia.

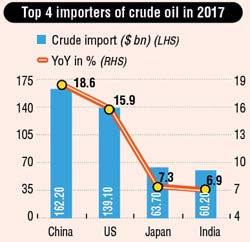

He said India's crude import from the US has dipped significantly in recent months. Today, India is the third largest consumer of oil in the world after the US and China. Its oil imports were up 1.8% in 2017 at 4.37 million barrel per day. Iraq is its biggest supplier, followed by Saudi and Iran. Last year, India imported 4.71 lakh barrel per day of crude from Iran.

This year India reportedly imported an average of 5.7 lakh barrels per day this year or about 27% of Iran's exports.

CRUDE REALITY

- 5.7 Lakh barrel per day - India’s average import of crude oil this year

- 4.37 million barrel per day - India’s oil imports in 2017

- 4 November - US sanctions on Iran to come into effect