Shares of real estate, non-bank finance companies (NBFCs) and housing finance companies (HFCs) continued to remain under pressure on Tuesday with stocks such as Dewan Housing Finance Corporation (DHFL), Indiabulls Real Estate, Indiabulls Housing Finance and Can Fin Homes slipping over 10 per cent in intra-day trade.

In the past six trading days, the Nifty Realty index has slipped 13 per cent to its 52-week low of 232 levels. The Nifty Financial Services index, too, has underperformed the market by falling 6.4 per cent, as compared to 3.9 per cent decline in the Nifty 50 index during the period.

Analysts see no respite for NBFCs at the bourses in the near-term, given that the sentiment has turned sour given liquidity issues at IL&FS. On a fundamental basis, analysts argue that tighter liquidity conditions can translate into lower growth and margins going ahead. Despite the correction sharp seen thus far in the last month, 30 per cent of NFBC stocks are still above their five-year average price-to-book value (P/BV), suggests analysts at UBS.

“Mutual funds have deployed 17 per cent of their debt asset under management (AUM) in NBFCs. NBFCs' book had a 14 per cent CAGR over FY13-18 and moved from 21 per cent of bank credit in FY10 to 34 per cent now. The reversal in liquidity implies funding for NBFCs may remain tight. The recent adverse sentiment in the bond market could mean even higher borrowing costs for them. They are likely to see lower growth and/or margins ahead, wrote Gautam Chhaochharia, head of India research, UBS Securities in a recent co-authored report.

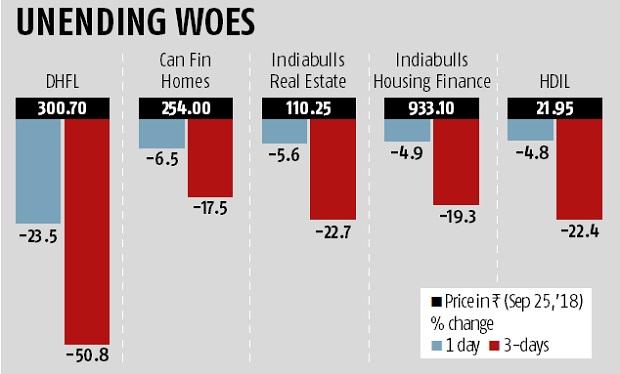

Among stocks, DHFL plunged 35 per cent to hit a fresh 52-week low of Rs 256 on the National Stock Exchange (NSE) in intra-day trade on Tuesday, but recovered partially to Rs 301 (down 23 per cent). The stock has and has tanked 51 per cent in past three trading days.

Some analysts, however, have a contrarian view and believe the recent correction could present a good buying opportunity. “Rising rates is a real risk for NBFCs, but is not an unknown. High rates impact NBFCs’ profitability but are a cyclical phenomenon…” said a note by HSBC.

“Even good stocks have been beaten down in the recent carnage and the fall presents a good opportunity to cherry pick. However, one must look at earnings visibility, quality of promoter and balance-sheet strength before investing in these stocks. Among the realty sector, I prefer Oberoi Realty,” said G Chokkalingam, founder and managing director at Equinomics Research.

Analysts at Emkay, however, suggest Bajaj Finance along with Mahindra & Mahindra Financial Services Limited and HDFC Limited are better placed to ride out the recent storm.

“Private Banks like ICICI Bank and HDFC Bank would be key beneficiaries due to shift in borrowing profile for NBFCs,” write Jignesh Shial, Kushan Parikh and Himanshu Taluja of Emkay Global in a recent co-authored report.