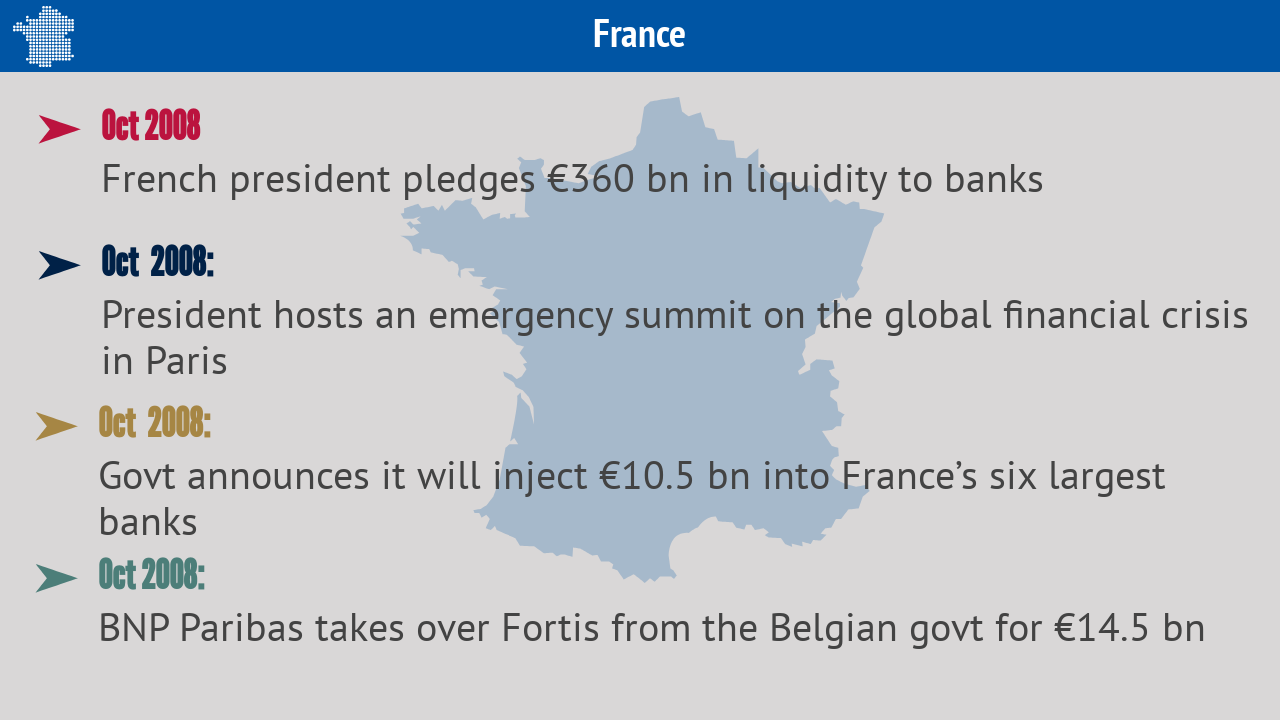

Almost all major economies in the world announced stimulus packages and infused funds into the economy to check the impact of the crisis. Many companies were nationalised and some chose to merge as it became difficult to sustain alone

Moneycontrol News

@moneycontrolcom

First Published on Sep 15, 2018 12:27 pm