But credit demand going up, says a study by banks’ body. (Express Photo by Pradip Das)

But credit demand going up, says a study by banks’ body. (Express Photo by Pradip Das)

MICRO AND small businesses continue to struggle in the wake of demonetisation and implementation of the Goods and Services Tax (GST), with the latest RBI figures showing that their loan default margin doubled over the last year — from Rs 8,249 crore by March 2017 to Rs 16,118 crore by March 2018.

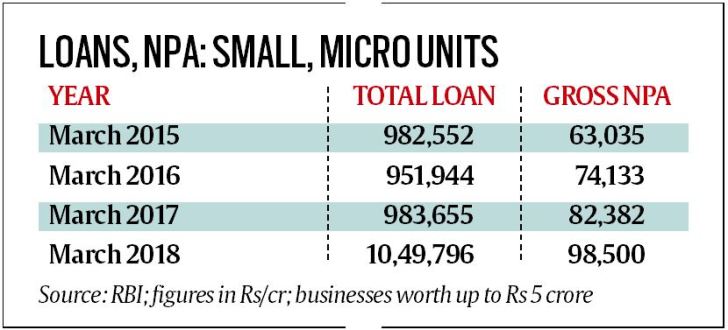

The figures, obtained by The Indian Express under the Right to Information (RTI) Act, show that non-performing assets (NPAs) or bad loans of micro and small units — where the investment in plant and machinery is above Rs 25 lakh but does not exceed Rs 5 crore — rose from Rs 82,382 crore to Rs 98,500 crore by March 2018.

In its RTI reply, the RBI said that the bulk of loan defaults, which rose from March 2017, is accounted by public sector banks which had a share of 65.32 per cent in outstanding loans to small units, down from 66.61 per cent in the previous year.

The RBI’s reply said that outstanding advances to micro and small units increased by 6.72 per cent to Rs 10,49,796 crore by March 2018, as against Rs 9,83,655 crore in March 2017, and credit growth picked up in a significant way recently.

The 8.2 per cent growth in GDP for the April-June period of the financial year 2018-19 announced by the government Friday has coincided with this recovery in credit offtake since January this year. GDP growth had fallen to 5.7 per cent in April-June of 2017-18 in the wake of demonetisation.

The government and RBI announced the withdrawal of old Rs 500 and Rs 1,000 bank notes on November 8, 2016. The sudden move created a cash shortage, leading to a fall in demand and a dip in GDP growth close to 1.5 per cent. Many small units were hit hard after the note ban with several units reporting huge losses even after 21 months.

In a separate study on micro, small and medium enterprises (MSME) released two weeks ago, the RBI acknowledged that the sector has witnessed two major recent shocks — demonetisation and GST.

“For instance, contractual labour in both the wearing apparel and gems and jewellery sectors reportedly suffered as payments from employers became constrained after demonetisation. Similarly, the introduction of GST led to increase in compliance costs and other operating costs for MSMEs as most of them were brought into the tax net,” says the MSME study by Harendra Behera and Garima Wahi of RBI’s Monetary Policy Department.

However, another report prepared by the Indian Banks’ Association and Boston Consulting Group (BCG) shows that mini and micro businesses — where investment in plant and machinery does not exceed Rs 25 lakh — have registered a significantly higher year-on-year credit growth compared to overall small ticket loans.

According to the report, private banks largely have a high percentage of centralised credit and risk assessment staff, as a result of which they have lower gross NPAs in the retail and MSME segments. Medium-sized PSU banks have 23 per cent gross NPAs — the highest in the industry in the “medium” segment, it said. “Despite high NPAs, banks continue to increase lending to medium enterprises; there is a need to be vigilant in this segment, and credit underwriting is extremely important,” the report said.

At the same time, the report said, credit growth has picked up in the small business segment. “We are committed to promote responsible credit and I believe there is need to establish a robust framework that helps lenders and consumers to utilise the access to finance responsibly,” V G Kannan, CEO, IBA, said.

The higher year-on-year growth compared to overall small ticket loans can be attributed to the increasing formalisation and digitization of MSMEs, the BCG-IBA report said. “New private banks have grown at an impressive rate of 22 per cent in FY18, which is almost at par with NBFCs,” the IBA-BCG report said.

In a recent survey conducted by SMERA Ratings Ltd, more than 60 per cent of respondents felt that their systems were not ready for the new tax regime.

A study by Small Industries Development Bank of India (SIDBI) indicated that post demonetisation and GST, the relative credit exposure initially declined for most MSMEs but recovered fully by March 2018.

During demonetisation, many smaller districts, which were witnessing higher growth, felt greater shock compared to larger centres, the MSME study by RBI has said.

According to this study, credit growth fell significantly and turned negative during November 2016-February 2017. Therefore, it said, it seems demonetisation accentuated the slowdown in credit growth, particularly to the industrial sector. However, the credit growth to the MSME sector recovered after February 2017 to reach an average of 8.5 per cent during January-May 2018.