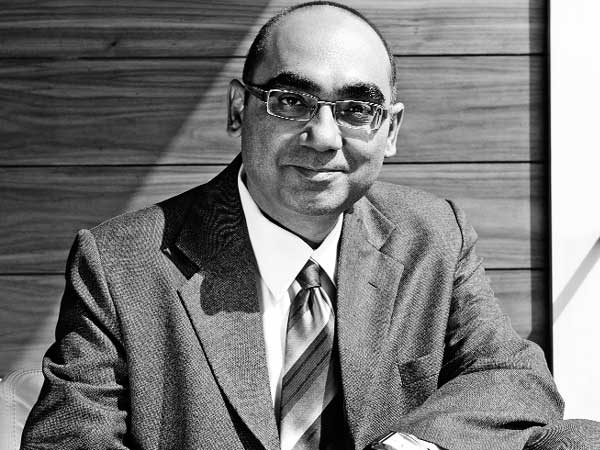

Joint managing director and chief executive officer at DHFL, one of India’s leading housing finance company, Harshil Mehta has spent over two decades in the financial services industry and his expertise spans diverse functions includingcredit appraisal, operations and service quality. He was earlier MD and CEO of Aadhar Housing Finance, a joint initiative of DHFL and International Finance Corporation (IFC) of the World Bank Group, aimed at enabling access to home finance, amongst low income group customers in the developing states of India. Harshil’s earlier stints include prominent entities such as ICICI Bank, Transamerica Commercial Finance, Chicago, a Fortune 500 company and leader in inventory financing, and prior to that, Whirlpool India. In his second stint with Transamerica’s Indian business, he set up its Indian subsidiary and launched the inventory finance programme that was subsequently

acquired by ICICI Bank. Harshil Mehta, in a chat with Prakash Jha spoke about the housing loan industry, government initiatives and policies needed to revive the realty sector and much more. Excerpts:

The Indian realty sector seems to be in dumps for some time. What do you say?

There has been considerable growth in the affordable housing space which has in turn boosted the affordable housing finance sector. In the wake of the implementation of RERA, a number of real estate projects have seen a leap in their delivery timelines. With the real estate sector likely to see high levels of transparency under RERA, homebuyers are getting easier access to home loans. Housing finance companies are gaining comfort in extending loans to homebuyers under the new real estate law.

Additional measures, such as the Real Estate Investment Trusts (REITs), the Benami Transactions (Prohibition) Amendment Act 2016, higher tax breaks on home loans, the Goods and Services Tax (GST), land related reforms, optimising development control rules, rationalising of the stamp duty and registration charges, digitalisation etc. have also been introduced to boost housing sector. These have attracted private and foreign investments in the housing sector, having a positive multiplier effect on GDP.

The government is striving to push affordable housing. How will it affect the realty sector players?

The government has taken several noteworthy steps towards generating greater credit offtake and supplies in the affordable housing industry, while also putting in place a stringent regulatory environment. The country-wide implementation of Real Estate Regulatory Authority (RERA), has indeed been a milestone step towards stronger governance and greater transparency for developers, customers, financial institutions like banks and housing finance companies and other important stakeholders. It is a timely implemented initiative of the government’s mission towards industry development and a catalyst to meet the objectives of ‘Housing for All by 2022’.

Over the last 3 decades, DHFL has been enabling affordable housing finance to the low and middle income segment through innovative products meeting their requirements. We believe that this industry is poised for growth led by the various policies and initiatives undertaken by the government in the last few quarters. Undoubtedly, there’s tremendous potential in affordable housing and evidently, the government understands the impact of exponential urbanisation and the need to serve the growing demand of affordable housing. The initiatives undertaken by the government have been bearing fruit, catalysing the potential.

In addition to metros, what are your plans for Tier 2-3 cities? What is the expected revenue from these markets?

We foresee continued healthy demand from the Tier 2 and 3 markets. Higher transaction volumes in Tier-II and Tier-III (non-metro) cities and fiscal incentives on housing loans along with more options in the affordable housing segment aided robust off-take of the housing finance industry. DHFL focuses primarily on the lower and middle income (LMI) groups which are concentrated in Tier 2 and 3 markets across India and has developed a business model and an attractive suite of products to cater to them. DHFL’s business model is designed to focus on the LMI segment in Tier 2 and 3 markets. A factor that has helped DHFL stay ahead in the affordable housing sector is its large distribution and localised network in Tier 2 and 3 markets. DHFL maintains pan-India distribution network in over 349 locations which further services 500+ locations.

Despite the competitiveness in this space, where do you see the profitability coming from?

There is enormous market potential for the affordable housing sector in India. Over the past few quarters the Government has already been taking several noteworthy steps to build a conducive environment for the growth of the affordable housing sector. Although the industry is served by several large financial institutions, companies like DHFL are very well placed with strong competitive advantages to serve LMI customers in the tier 2 and 3 markets thereby driving financial inclusion across the country.

I believe, competition is healthy and HFCs not only help to broad base the market but also drive financial literacy thereby creating opportunities and developing the industry landscape. DHFL through its deep understanding of this target segment and strong distribution network has been leveraging these opportunities which is reflected in our steady growth. While the industry potential is very strong, a legacy-driven, committed company such as DHFL will continue to drive financial inclusion thereby fulfilling dreams of millions.

What is the average size of disbursement for DHFL now? How do you view this in the next few years, given the push towards affordable housing?

DHFL’s average loan ticket size at the portfolio level stands at Rs. 15.2 lakh. DHFL’s robust performance continues to be driven by its strong focus on the LMI segment in Tier 2 and 3 markets. The affordable category has received a strong boost led by the government’s various incentives and efforts to stimulate the industry. All these efforts have started to show visible impact on the ground. Benefits from the recent Credit Linked Subsidy Scheme under Pradhan Mantri Awaz Yojana have further given a boost to the consumer’s loan eligibility thereby ensuring ownership of a home.

What is DHFL’s business plan for this fiscal?

FY 2017-18 was a very exciting year for DHFL. We have been maintaining a strong growth momentum much above industry benchmark. The affordable housing landscape is rich with potential and we have taken several strategic steps to be able to leverage opportunities. We aim to keep up this momentum with 30 per cent growth on our overall disbursements. The company has been reporting revenue growth at a CAGR of more than 20 per cent for the last 5 years. With strong business fundamentals and core organisational growth drivers in place, DHFL is well placed to capitalise on industry opportunities and is committed to its mission to bring transformational changes in the lives of its customers.

Reinforcing the 34-year-old vision of enabling home ownership dreams and supporting the national mission, DHFL launched a unique initiative ‘Griha Utsav’ in 2017, a first-of-its-kind housing expo in tier II and III towns. The platform brings prospective home buyers and developers under one roof to provide affordable housing and finance solutions. Till date, DHFL has conducted over 53 Griha Utsavs across India.

Where do you see the industry in the next four year (2022), by what time the government has promised to provide housing for all?

The affordable housing sector has been witnessing growth over the last few quarters. With various reforms laid on affordable housing, the sector is driving the industry momentum forward. According to India Ratings as of June 2017, the AUM of the affordable housing sector was around Rs 1.5 trillion and is expected to increase four times to Rs 6 trillion by FY22. An overall positivity propelled by a combination of factors, is expected to push growth in the housing finance industry over the long term. Increased government support to developers as well as buyers augurs well for the industry. The government’s efforts to incentivise the housing finance industry, coupled with greater transparency in the sector, continues to provide an upward thrust to the housing finance market, with CRISIL Research forecasting finance penetration in urban areas to increase between FY 2016-17 and FY 2021-22.

Led by the initiatives, this is undoubtedly a golden era for the affordable housing finance industry. With the fundamental building blocks in place and the road paved ahead for stronger growth, affordable housing finance companies focused on the LMI segment with strong heritage and a differentiated business model, are well placed to tap into this significant potential to create a legacy of transformational changes in affordable housing in India.

prakashjha@mydigitalfc.com