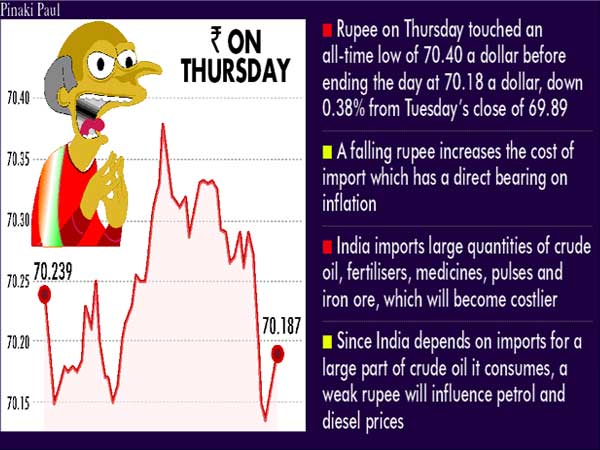

The Indian rupee has fallen more than 9 per cent year-to-date and around 2 per cent in August against the greenback. On Thursday, it touched an all-time low of 70.40 a dollar before ending the day at 70.18 a dollar, down 0.38 per cent from Tuesday’s close of 69.89 due to a slew of factors.

Many economists expect the rupee to fall further in line with other emerging market economies as they face quite a few headwinds, which could lead to further weakening of the local currency against the dollar. The dollar index has broken above the key resistance market of 95 which could take it to 100-mark.

“The continued strength of the US economy and potential rate hikes by Fed could further weigh on EM currencies. The escalating trade issues could also pose greater risk to emerging market currencies. The major concern for the rupee comes from rising trade deficit and threat of higher CAD/GDP. Along with the breach of the dollar index above 95-mark, we have also seen the rupee break the top resistance level of 69. The rupee-dollar break above 69 opens the possibility of it going anywhere between 73 & 75 levels (from a technical perspective),” said Rusmik Oza, senior vice-president (head of fundamental research) at Kotak Securities.

While a fall in the rupee slows economic growth, impacts corporate earnings and causes market volatility, it also hits the common man hard impacting not just his grocery bill, but also his planned vacation abroad or studies in a foreign country besides hurting his investments. A depreciating rupee, however, is good for exporting sectors and helps in job creation.

Amar Pandit, a certified financial planner, said, “When the rupee depreciates with respect to the dollar, it affects businesses that export or import goods and services. IT, pharma and other export-oriented industries are likely to benefit whereas import-oriented businesses stand to lose. However, these trends are short term and do not usually have permanent effects on those businesses or the stock markets. So, rupee movements as such do not impact long-term investments.”

Let us first see how a weak rupee impacts you:

GROCERY BILL

A falling rupee increases the cost of import, which has a direct bearing on inflation. India imports large quantities of crude oil, fertilisers, medicines, pulses and iron ore, which will become costlier. Since India depends on imports for a large part of crude oil it consumes, a weak rupee will influence petrol and diesel prices. Fuel is directly connected to the cost of transportation and as a result, the prices of goods that are transported from one state to another state using trucks such as vegetables, manufacturing items will become costlier thereby impacting your household budget.

Cost of FMCG or fast moving consumer goods, such as soaps, detergents, deodorants and shampoos, of which crude oil is an input, are likely to become more expensive.

Gems and jewellery and electronic items too will become expensive.

Prices of mobile phones, especially the entry-level variants, could go up in the coming days as the continuous fall in rupee will hike input costs, according to handset makers. “Looking at the market scenario at the moment, with the increase of dollar, which is even expected to rise further, the cost incurred in mobile handsets will increase and this will lead to an overall hike in the final cost of the handsets,” Intex Technologies (India) director Nidhi Markanday said.

Impact on EMIs

Overall, if the rupee doesn’t strengthen then inflation will go up, forcing the Reserve Bank of India (RBI) to raise interest rates. Already the RBI has raised the repo rate twice this year to a total of 50 basis points to curb inflation. Repo rate is the rate at which commercial banks borrow from the central bank. Banks have always been prompt to pass on the cost of higher interest rates to the borrowers and so far a host of lenders such as HDFC, Kotak Mahindra Bank, Union Bank and Karnataka Bank have raised their lending rates. Other banks are expected to raise lending rates soon. This means you need to be prepared to pay higher EMIs on home loans, car loans and personal loans. On the same lines, bank loans for companies will become expensive. The rupee weakness will also make it expensive to raise foreign loans.

Impact on investments

Whenever the rupee falls, industry sectors that are linked to exports get benefited such as information technology, pharmaceuticals/ chemicals, engineering services companies with contracts outside India. In the same way importers lose money if the rupee falls. Since India imports 80 per cent of its crude needs, stocks of oil marketing companies (OMC) will be negatively impacted. Oil prices have increased to levels not seen since 2014 when a global glut had led the oil market into a tailspin. Any loss to these OMCs could lead to fall in their share prices resulting in losses for their shareholders.

Similarly, India imports raw materials such as copper, electronic goods such as cellphones, I-Pads which co-mpanies share price too wo-uld get negatively impacted.

Gaurav Jain, vice-president and co-head, corporate ratings, Icra, said, “The weakness in rupee against US dollar will have an impact on the pharma exports to US, which accounts for 40 per cent of the total exports of top pharma companies in our sample set. The exports had de-grown last year and the regulatory environment and pricing pressure is expected to further shrink exports in dollar terms. The weakness in rupee is beneficial for exports across sectors. Hence, the depreciation of rupee will compensate the decline in value to an extent, but not fully.

However, exports wh-ich are billed in other currencies, including euro, will be subject to their cross-currency equations with rupee. Hence the impact will largely be only on US exports.

“Investors will have to rejig their portfolio and have more weight on export-oriented sectors and reduce weight in the industry sectors that makes impact due to rupee depreciation,” said the chief investment officer of a mutual fund house.

Impact on foreign study

Those looking to study overseas will have to shell out more money considering the increased value of the dollar against rupee.

Suresh Kumar, director, Truematics, said, “Most of the students who had enrolled for their overseas education during March-April will have to pay the fees during August and September. Rupee was at 65 or 67 then and the weakness in the currency now will increase their outgo by an average Rs 40,000 to Rs 45,000.”

“In case of US, it can even go up to Rs one lakh as the education fee is higher in that country. Except for Europe or Australia, where the transaction can happen in euro or Australian dollar, remittance to most of the other countries will get affected by rupee’s weakness against US dollar. Students enrolled in some of the Asian universities too will get impacted as they have to pay in US dollar. Apart from fee, students also will incur higher travel expenses. The weakness in rupee has led to upward revision of budgets of most students going abroad,” added Kumar.

Foreign travel gets costly

The falling rupee is bad news for itinerant Indians and vacationers to a foreign country. However, that holiday package you booked in advance before the rupee fell is safe.

Karan Anand, head, relationships, Cox & Kings, said, “August-September is off-season as far as overseas vacations are concerned. Hence, the impact will be minimal on vacation travel. People who have commitments abroad will not cancel travel due to rupee weakness. However, if the weakness in South African Rand and Turkish Lira continues, we expect some increased travel to these destinations in the coming months.”