After the failure of Air India sale process, the government is now discussing a Rs 11,000-crore bailout package for the ailing airline.

The civil aviation ministry is in discussions with the finance ministry for a Rs 11,000 crore bailout package for Air India, PTI reported quoting sources. The fund would be utilised to reduce high cost working capital loans, it added.

“There will be some restructuring hopefully. Air India first has to be delivered as a commercially operating entity, then at some point of time its disinvestment can be thought of,” economic affairs secretary Subhash Chandra Garg told FC. He said funds for the proposed restructuring would not be an issue. “Air India needs to be financed, whatever are its needs.”

“Cleaning up the balance sheet of Air India airline will make it attractive for investors as and when the government decides to once again attempt strategic stake sale of the airline,” PTI said quoting sources.

Query sent to civil aviation secretary RN Choubey remained unanswered.

When contacted, an Air India spokesperson said the matter “comes under the domain of the ministry of civil aviation and we should not be commenting on it.”

Last month, the government had sought Parliament’s approval to infuse Rs 980 crore into Air India during the current financial year after stake sale efforts failed.

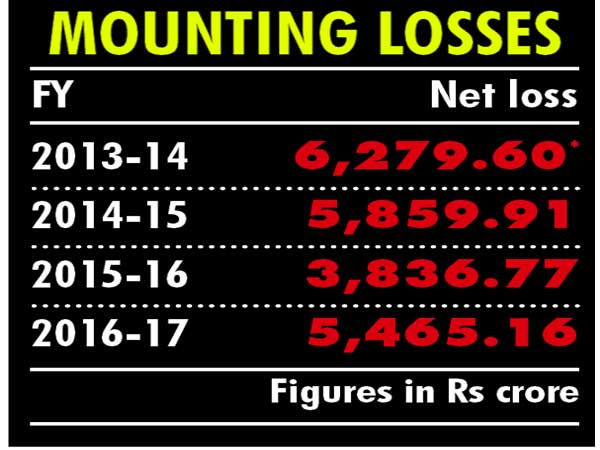

A fresh restructuring would mean more funds. This could run into several thousand crores of rupee as the carrier is in deep financial stress.

Air India is saddled with a debt of nearly Rs 50,000 crore and is incurring losses to the tune of Rs 5,000 crore annually. It is surviving on the Rs 30,231crore bailout package cleared by the previous UPA II government in 2012.

Experts said any restructuring to turn around the loss-making entity would take years. Also, the plan to retain ‘swadeshi’ tag for the national carrier rejecting any investment proposals from foreign carriers would make the task of finding a strategic investor more difficult.

The Air India divestment plan included strategic sale of 76 per cent in Air India, 100 per cent of low-cost international arm Air India Express and 50 per cent in its ground-handling joint venture Air India SATS Airport Services. Global consultancy EY was the transaction adviser for the process. The government wanted to retain 24 per cent stake in the entity post-disinvestment. There was, however, not a single bidder for the airline even after the government had extended the deadline for bids to May 31 from May 14.

The initial setback in selling off Air India seems to have come as a blessing in disguise for the government. It has got more time to fine-tune the process besides preventing a stress sale ahead of the general elections.

In a reflection of financial crunch at the airline, salaries have been delayed for the staff for five consecutive months.

In the current financial year, the airline has received an equity infusion of Rs 650 crore up to June.