The Chinese tech major shipped 54 million handsets, up 41% year-on-year, research firm Canalys reported, adding that Honor accounted for two thirds of the near 16 million jump that Huawei made this quarter. (Image Source: Reuters)

The Chinese tech major shipped 54 million handsets, up 41% year-on-year, research firm Canalys reported, adding that Honor accounted for two thirds of the near 16 million jump that Huawei made this quarter. (Image Source: Reuters)

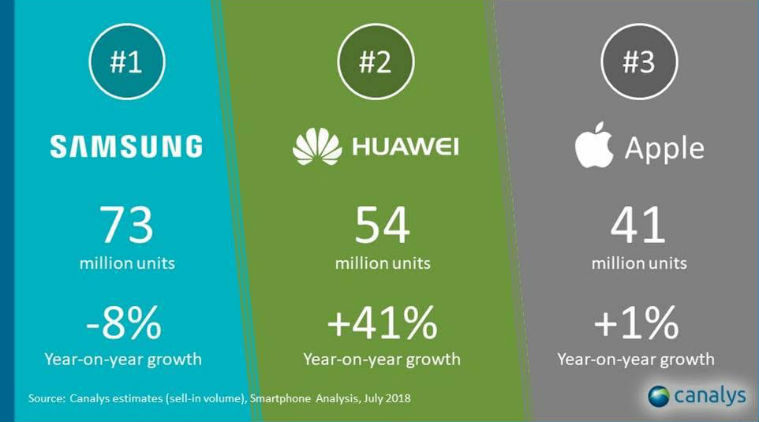

Powered by the popularity of its flagship P20 and the growth of its Honor sub-brand in markets like India, Huawei has surpassed Apple to become the second largest smartphone vendor in the world behind Samsung. The Chinese tech major shipped 54 million handsets, up 41% year-on-year, research firm Canalys reported, adding that Honor accounted for two thirds of the near 16 million jump that Huawei made this quarter.

Samsung is still the top smartphone vendor with 73 million shipments despite dropping 8 per cent in shipments while Apple fell to third, shipping 41 million iPhones and growing 1 per cent year-on-year. “Huawei’s strategy has evolved significantly over the last six months,” said Mo Jia, Canalys Analyst based in Shanghai, said adding: “Honor, which has long been a major brand in China but relatively small overseas, has taken a pivotal role in this strategy.” Canalys estimated that Honor’s share of Huawei smartphone shipments increased from 24 per cent in Q2 2017 to 36 per cent this quarter as it shipped close to 4 million Honor-branded smartphones outside of China. Canalys noted that the sub-brand, wits its independent sales force, has become particularly potent in markets like Russia and India.

Tarun Pathak, Associate Director at Counterpoint Research, said the Honor brand is offering a broad and refreshed portfolio at affordable price which is driving growth in the overseas market. “Honor, which is already strong in the e-commerce segment, is now adopting a multi-channel strategy through branded stores in the South East Asia market. We expect store counts to increase in the future.” Huawei performed well on its own too with 7 million units of its latest flagships, the P20 and P20 Pro, being shipped worldwide. “Huawei has accelerated its adoption of new technologies this year, focusing on AI with its NPU chipsets and on imaging with its triple-camera setup,” said Jia. “Its efforts have paid off. The P20 and P20 Pro sold faster than their predecessors in their launch quarter. Outside of China, the P20 and P20 Pro more than doubled the shipments of the P10 and P10 Plus.”

Huawei’s ascension to the No 2 slot is also because Apple’s traditional Q2 dip in numbers. “Q2 has always been seasonally weak for Apple,” said Canalys UK-based Senior Analyst Ben Stanton, adding that while the iPhone X succeeded in generating volume in the previous quarters despite its price, it has been unable to sustain that volume this quarter. “But for an Apple flagship, this is normal. In addition to this, models such as the iPhone 7 and 7 Plus are also losing steam, given a high sell-in in Q1. But an uptick in iPhone 8 and 8 Plus, helped in part by the Product Red campaign, was enough to offset this trend,” he said. Canalys estimates that Apple shipped over 8 million iPhone Xs in Q2, down from 14 million in the previous quarter.

Powered by the popularity of its flagship P20 and the growth of its Honor sub-brand in markets like India, Huawei has surpassed Apple to become the second largest smartphone vendor in the world behind Samsung. (Image Source: Canalys)

Powered by the popularity of its flagship P20 and the growth of its Honor sub-brand in markets like India, Huawei has surpassed Apple to become the second largest smartphone vendor in the world behind Samsung. (Image Source: Canalys)

Underlining the significance of Huawei overtaking Apple, Stanton said: “It is the first time in seven years that Samsung and Apple have not held the top two positions.” He said Huawei’s exclusion from the US has forced it to work harder to gain market share in Asia and Europe. “Further momentum in Huawei’s Honor and Nova sub-brands is likely to sustain its rate of growth. Huawei’s momentum will obviously concern Samsung, but it should also serve as a warning to Apple, which needs to ship volume to support its growing Services division. If Apple and Samsung want to maintain their market positions, they must make their portfolios more competitive.”