JAIPUR: As per the data made available by the Rajasthan Transport Department, there has been 32.16 per cent increase in the green tax collection in Rajasthan. This is a positive news for the government as many cities in the state are dealing with acute environmental pollution.

JAIPUR: As per the data made available by the Rajasthan Transport Department, there has been 32.16 per cent increase in the green tax collection in Rajasthan. This is a positive news for the government as many cities in the state are dealing with acute environmental pollution.Green tax is levied on pollutants or goods that repeatedly harm the environment. Rajasthan government initiated green tax in the year 2006-07 to curb the growing pollution in the state. According to the rules, green tax is collected at the time of registration of vehicles and renewal of the certificate of the registration under Motor Vehicles Act, 1988.

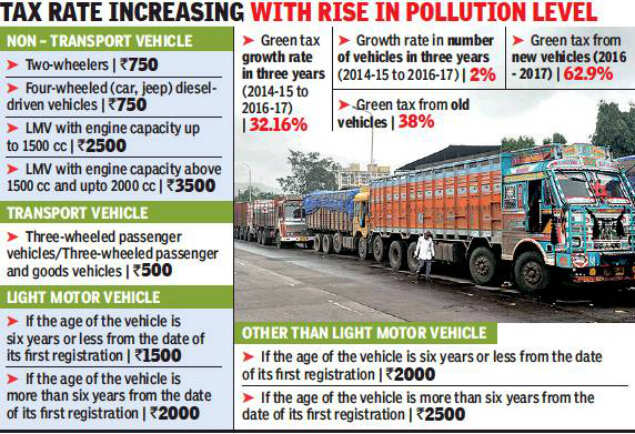

Additional Commissioner of Transport, Ram Chandra Yadav, while talking to TOI said that the reason for the increase in green tax collection is the time-to-time increase in the rate of green tax. “As the pollution is increasing, tax rates have also been increased by the government. Diesel vehicles are taxed heavily as compared to green fuel vehicles. Same applies to the heavy vehicles as they spread more pollution. The tax is being spent in various ways as mentioned by the government,” Yadav said.

Surprisingly, there is only 2% increase in the registration of vehicles in the last three years. In the year 2016-17, 62% green tax has been collected from new vehicles and only 38% from old vehicles.

Surprisingly, there is only 2% increase in the registration of vehicles in the last three years. In the year 2016-17, 62% green tax has been collected from new vehicles and only 38% from old vehicles.Jaipur city had collected the highest green tax in 2016-17 followed by Jodhpur and Udaipur. Even in districts, Jaipur is on the top in green tax collection, followed by Jodhpur and Ajmer districts. The lowest amount of tax is collected from Shahjhanpur and Ratanpur cities, while the lowest tax collection among the districts is from Bharatpur.

The green tax collected is given to the Rajasthan Transport Infrastructure Development Fund (RTIDF) from where it is being utilised in the work of metro, Rajasthan State Road Transport Department etc. Out of the total tax collected, taxes on vehicles was 7.49% in Rajasthan.