Lokesh Sharma said in an email: “All transactions relevant to our family are compliant with applicable laws.”

Lokesh Sharma said in an email: “All transactions relevant to our family are compliant with applicable laws.”

When tax monitors started probing offshore entities set up by Mossack Fonseca in the British Virgin Islands (BVI)

following the Panama Papers revelations two years ago, at least one Indian client of the law firm took an unusual step.

New records investigated by The Indian Express show a 30-fold increase last year in the authorised capital of a BVI entity linked to Delhi-based sports promoter Lokesh Sharma. They show that he also added members of his family as shareholders.

On April 7, 2016, The Indian Express had reported during its investigation of Panama Papers records that Sharma, managing director of Twenty First Century Media Private Limited (TCM), was linked to three offshore entities in the BVI.

They included two of his own — Margarita Services Ltd (2011) and Mardi Gras Holdings Ltd (2015) — and Peppermint Management Corp Ltd (2013), which was listed in RoC records of 2014-15 as a 100 per cent subsidiary of TCM. The global data leak of 2016 also showed that Sharma was the sole shareholder in Margarita and Mardi Gras, and the ultimate beneficial owner of Peppermint, which had a relatively high total paid-up capital of $1 million.

One month after the Panama Papers revelations, Mardi Gras Holdings was placed on a list of 69 entities — mostly set up by Indian clients — that was sent on May 3, 2016, by BVI’s Financial Investigation Agency (FIA) to Mossack Fonseca for detailed information.

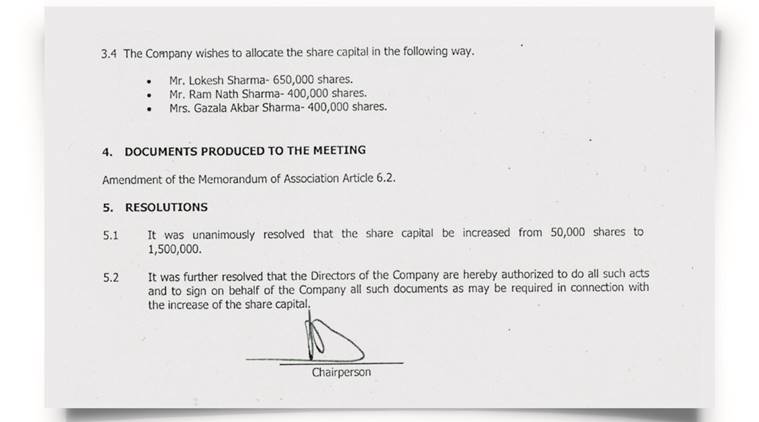

The 217 new documents linked to Sharma include the minutes of a board meeting in New Delhi on March 31, 2017, to increase the authorised share capital of the company from 50,000 to 1,500,000 with the value of each share of $1.

The minutes show that the redistributed share capital of Mardi Gras Holdings was to be split between Sharma with 650,000 shares, his wife Gazala Akbar Sharma with 400,000 shares, and his father Ram Nath Sharma with 400,000 shares.

According to the new records, the same Maharani Bagh address in New Delhi is listed for all three shareholders in passport copies and utility bills. The records also include emails from February 2 to February 24, 2017, between Mossack Fonseca employees on the increase in share capital of Mardi Gras Holdings for “investments activities”.

One email dated February 2, 2017, states that additional shares have been issued and paid for. “Shareholders have paid money for the additional shares and the purpose of increasing the share capital is for the shares to be issued against the application money received from shareholders…,” the email states.

A form on source of funds states that the company is engaged in “consultancy services” and that its main activities are in the UK. The new records include a letter dated March 29, 2017, from Peppermint to Mossack Fonseca, which starts by referring to “information that you have requested for your due diligence purposes”. The letter further states: “Directors of Peppermint Management Corp are Lokesh Sharma and Karan Sharma. Registered Shareholder of Peppermint Management Corp is Twenty First Century Media Private Limited.” It lists Lokesh Sharma (99.98%) and his father (0.02%) as registered shareholders of Twenty First Century Media Private Limited.

The new data shows that Karan Sharma, identified as a resident of Dublin, joined Mardi Gras Holdings and Peppermint as director on October 12, 2015. Meanwhile, records show, tax authorities in the BVI continued to send queries on these offshore entities. On August 1, 2017, Mossack Fonseca sent its response to queries sent five days earlier by BVI’s International Tax Authority on Mardi Gras Holdings and Margarita.

In its response, the law firm named Lokesh Sharma as the beneficial owner of Mardi Gras Holdings but did not provide corresponding details for Margarita. On August 28, 2017, records show, Mossack Fonseca sent Sharma its resignation notice as the registered agent for Margarita Services Ltd.

Responding to queries from The Indian Express, Lokesh Sharma said in an email: “All transactions relevant to our family are compliant with applicable laws.”