David Madden, CMC Markets analyst, says investors are “caught in the middle” between the US and China.

Stock markets are broadly lower today as traders are increasingly worried about the prospect of a trade war. Tensions between the US and China are escalating, and we are not any closer to an agreement being reached.

We are expecting the Dow Jones to open down 115 points at 24,975 and we are calling the S&P 500 down 9 points at 2,770.

Back in the UK, the takeover battle for Virgin Money is over -- putting hundreds of jobs at risk.

Clydesdale and Yorkshire Bank Group (CYBG) has sealed a £1.7bn deal to merge with Virgin, turning two small challenger banks into one larger one. The move could be a blow to the North East economy, where Virgin owns many of Northern Rock’s assets.

My colleague Julia Kollowe explains:

Clydesdale and Yorkshire Bank Group (CYBG) and Virgin Money have agreed to create the UK’s sixth-largest bank, with 6 million personal and small business customers and total lending of £70bn.

The banks expect to make £120m of annual savings by by 2021 by reducing overlap between their operations. This will result in a 16% reduction in the combined group’s 9,500-strong workforce that CYBG hopes to achieve by attrition – that is, when people leave they will not be replaced. It declined to say how many of the combined group’s 250 branches will be closed.

However, the plan is to retain Virgin Money’s head office in Gosforth, Newcastle, for at least three years.

More here:

Markets hit by trade war worries

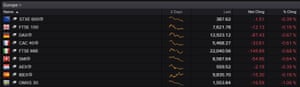

European stock markets have started the week on the back foot, as fears of a global trade war intensify.

The Stoxx 600 index, which tracks Europe’s largest companies, has dropped by 0.5% after America and China imposed tit-for-tat tariffs on Friday.

Chinese media have launched a stinging attack on Trump, calling his government “selfish” and “rude” for imposing new charges on imports from China

China’s Global Times said Beijing had no choice but to retaliate:

“It reinforces the difference in images of the two countries: one challenges the foundation of global trade through sudden attacks; and one that is prepared to defend itself in a trade war that it cannot avoid.”

Rebecca O’Keeffe, Head of Investment at interactive investor, says markets are finally beginning to wake up to the risks of a global trade war.

The negotiating style of President Trump had allowed investors to assume that his threats were hyperbole and part of his unique diplomatic style, and that he would step away from the brink rather than risk undermining the positive impact his previous policies have had on the stock market.

However, the US decision to press forward and take on China makes the risks far more pronounced and the real danger is that the Chinese retaliation may start a chain reaction that is difficult to stop – especially as Trump likes to have the last word.

The current position on tariffs is unlikely to cause a full-blown rout for markets, but the prospect of further escalation and reprisals could cause considerable damage to the global economy, increasing the risks and anxiety.

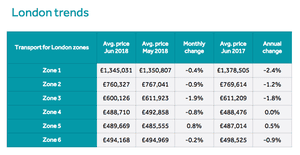

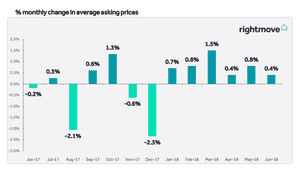

In another sign of economic weakness, London house prices have fallen for the 10th month in a row.

Rightmove reports that asking prices in the capital are down 0.9% compared with May, and are 1.0% lower than a year ago. That’s the 10th monthly fall in a row, as the once-hot London property market continues to cool.

London is particularly vulnerable to the threat of a ‘hard Brexit’, as tens of thousands of financial jobs could be lost.

Prices have dropped particularly sharply in the centre over the last 12 months (although the average property is still priced north of £1.3m).

Property prices in the north are still rising, though, helping to push the national asking price up by 0.4% this month.

Lack of supply in Northern areas is helping to keep prices up, says Miles Shipside, Rightmove director and housing market analyst:

“The reduction in property choice for buyers in the north compared to a year ago is a result of property for sale being snapped up, meaning it’s more of a sellers’ market there.

In marked contrast the jump in buyer choice in southern regions shows there are signs of a sellers’ market in some areas.”

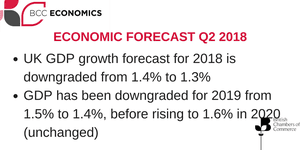

Here are all the key points from the British Chamber of Commerce’s new economic forecasts:

- UK GDP growth forecast for 2018 is downgraded from 1.4% to 1.3%, down from 1.5% to 1.4% in 2019, rising to 1.6% in 2020 (unchanged)

- Quarter-on-quarter GDP growth is forecast to rise by 0.4% in Q2 2018, from 0.1% growth in Q1.

- Growth in household consumption for 2018 is expected to slow to 1.0%, before rising to 1.4% in 2019 and 1.7% in 2020

- Inflation will continue to ease, but will not fall below the 2% target until 2020.

- The next interest rate rise, by 0.25%, is forecast to occur in Q4 2018, followed by a further increase to 1.0% in Q2 2019, with no further rises expected over the remainder of the forecast period

- Unemployment will remain at 4.4% in 2018, rising to 4.5% in 2019 and 2010

- Average earnings growth will continue to slightly outpace inflation over the forecast period, with growth of 2.7%, 2.9%, and 3.0%, compared with inflation of 2.5%, 2.3%, and 1.9%

- Export growth of 2.8% in 2018, 2.9% in 2019, and 2.9% in 2020 is expected. This compares with import growth of 1.7% in 2018, 2.5% in 2019, and 3.0% in 2020

- Growth in the construction sector is expected to slow significantly in 2018, with 0.7% growth, compared to 5.7% in 2017. The sector picks up slightly in the remainder of the forecast period, with 1.3% and 1.5% in 2019 and 2020 respectively

- Services sector growth is expected to slow to 1.2% in 2018, before picking up to 1.5% in 2019 and 1.9% in 2020

- Business investment is expected to remain weak, with growth across the forecast period of 0.9% in 2018, 1.2% in 2019, and 1.7% in 2020

The BCC’s gloomy forecasts could actually be too optimistic, if the Brexit process ends messily or if Donald Trump manages to create a full-blown trade war.

Suren Thiru, head of economics at the British Chambers of Commerce, explains that the UK is vulnerable to external shocks:

“While Brexit uncertainty and the weakness in sterling have weighed on overall UK growth, it is the failure to deal with the longstanding structural issues from weak productivity to the deep imbalances in the UK economy that continue to undermine the UK’s growth potential.

“The risks to the outlook are on the downside. A messy departure from the EU would likely slow UK GDP growth further over the medium term. The prospect of an escalating trade war is now a key downside risk to our forecast as it could mean much weaker export and business investment growth than implied by the current forecast.

The agenda: BCC cuts UK growth forecasts

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Britain is facing its weakest growth since the financial crisis, as uncertainty over Brexit and fears of a global trade war hit confidence.

So warns the British Chambers of Commerce (BCC), which has just downgraded its growth forecast for the UK. It fears that consumer spending, business investment and trade are all weakening, leading to weak wage growth and stretched households.

In short, Britain is trapped in a ‘torpor’, it warns, with growth expect to fall to just 1.3% this year. That would be the weakest performance since 2009 (down from a previous forecast of 1.4%).

The service sector is expected to struggle, with growth slowing to 1.2% in 2018 (that would be the weakest outturn since 2010.)

The BCC has also cut its forecast for 2019 from 1.5% to 1.4%. It predicts that Britain’s net trade position will weaken in the next few years, as exporters struggle but imports pick up.

Adam Marshall, director general of the BCC, says the government must act to help businesses through the ‘testing times’ ahead:

“A decade on from the start of the financial crisis, the UK now faces another extended period of weak growth amidst a backdrop of both domestic and global uncertainty.

“Our forecast should serve as a wake-up call to government - as it demonstrates that ‘business as usual’ is not an option when it comes to the economy.

“With firms facing ongoing Brexit uncertainty, increasing global protectionism and instability in some parts of the world that will impact on costs and profits, now is the time for more robust action to support business confidence and investment.

Marshall also warns that MPs can’t simply fixate on Brexit, given the other problems in the country:

Businesses across the country want to see far more urgency around fixing the fundamentals here at home and a concerted effort to lower the high costs of doing business.

Also coming up today...

Tensions between the US and China are rising, after president Trump approved tariffs on $50bn of Chinese goods last Friday. China swiftly hit back by imposing its own tariffs on US products.

These geopolitical tensions are weighing on the markets; Europe’s Stoxx 500 index has dropped by 0.3% in early trading after losses in Asia.

European investors should also keep an eye on Germany, where a deepening row over migration could bring down the government. Angela Merkel is refusing to bow to pressure from her own interior minister to turn away asylum-seekers who have registered in other European countries.

Merkel hopes to find a Europe-wide solution, but pressure is building on the chancellor.

Otherwise it looks like a quiet day, leaving the City free to anticipate England’s opening World Cup game (KO: 7pm BST).

Updated

View all comments >