Today, the Permian basin in Texas and New Mexico is the nation's biggest shale oil producing region. But in just a few years, drillers could be pumping enough Permian crude to outmatch every nation in the world except Russia and Saudi Arabia.

Output from the region is forecast to more than double between 2017 and 2023, jumping to 5.4 million barrels a day, according to a new estimate from IHS Markit.

That would help the United States graduate from an emerging player in export markets to an established power. IHS thinks the United States could be shipping 4 million bpd to foreign customers, up from 1.1 million bpd last year.

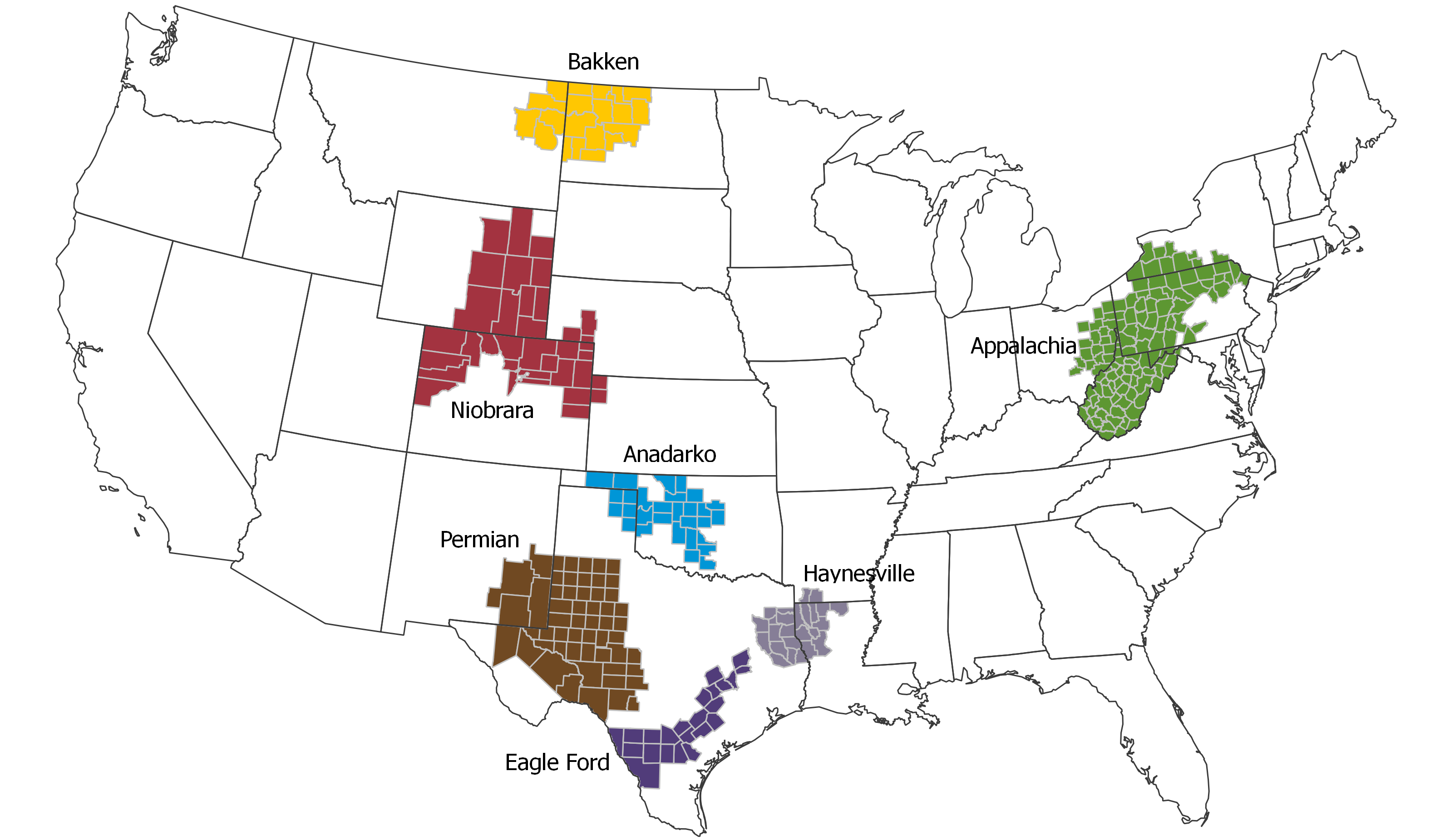

The Permian is one of the nation's shale regions, where drillers use advanced methods to unlock oil and natural gas from rock formations. They pummel the shale rock with water, sand and chemicals — a process known as hydraulic fracturing — and recover oil and gas through horizontal wells.

U.S. shale oil and gas regions, source: Energy Information Administration

U.S. shale oil's prospects looked uncertain after oil prices plunged in 2014. However, frackers ilearned to cut costs and drill more efficiently, and the Permian has led a rebound in the U.S. drilling, pushing total production towards 11 million bpd.

At current levels around 3.2 million bpd, the Permian is already pumping more than producer nations like Kuwait, Nigeria and Mexico. If the IHS forecast pans out, the Permian would also leapfrog today's output from Canada, China and Iraq.

That means if it were part of OPEC, the Permian would surpass Iraq to become the cartel's second biggest producer. To be sure, Baghdad intends to build out its capacity to 6.5 million bpd by 2022, but its expansion plans have long been delayed by conflict and instability.

IHS also expects production of natural gas and natural gas liquids will double during the period.

Making the IHS forecast a reality will be expensive. Permian frackers will have to drill about 41,000 new wells and invest $308 billion through 2023.

But the biggest challenge will be building enough infrastructure to bring the surging Permian supplies to market, says IHS. This year, the lack of pipeline capacity to move the crude has led to steep discounts for the region's crude.

That situation illustrates a mismatcth between frackers and pipeline, storage and logistics companies, according to Jim Burkhard, head of crude oil markets at IHS.

"The former are focused on fast growth while the latter require sustained high utilization of infrastructure over decades for projects to be viable," he said in a statement.

Still, IHS has baked bottlenecks into its forecast, meaning the forecast is not a "best case" scenario, said Raoul LeBlanc , head of the IHS Markit Performance Evaluator.

"That the outlook still expects the Permian to exceed existing (and already lofty) expectations speaks to the region's unique and growing prominence to world oil market," he said in a press release.