Germany: G7 commotion will bring EU together

Germany’s economy minister has said the G7 meeting has bolstered unity among European Union members.

Peter Altmaier told reports in Brussels that:

“The commotion at the G7 summit in Canada has brought the European Union closer together.

It is important we show unity at all levels.”

Four EU members took part in the G7 meeting - Germany, France, Italy and the UK.

Like Canada, the EU is expected to hit back at America with a range of retaliatory tariffs on July 1st, in response to the US tariffs on steel and aluminium imports.

Chancellor Angela Merkel took an unusually blunt line, saying that Trump’s decision to withdraw from the G7 communique by tweet was sobering and depressing.

She told the ARD broadcaster that:

“We won’t allow ourselves be ripped off again and again. We will act too.

Canadian dollar weakens after G7

The Canadian dollar is dropping this morning, in the face of deteriorating relations between Washington and Ottawa.

The loonie (as it’s known in financial circles) has shed 0.3% against the greenback to C$1.296.

That’s a modest fall, following Trump’s claim that Canadian PM Trudeau was “very dishonest and weak.”

Trump is particularly angry about Canadian milk, where domestic subsidies and high tariffs protect Canada’s farmers from the vicissitudes of the dairy market.

But that centralised ‘supply management’ system does seem to work; it avoids both bankruptcies and gluts by guaranteeing farmers a decent price. Trudeau is determined to support it.

Updated

Ding! European stock markets are open, and rallying despite the lack of progress at the G7 meeting.

In London the FTSE 100 has gained 35 points, or almost 0.5%, with similar gains in Frankfurt and Paris. Spain’s IBEX has jumped by over 1%.

IC Markets (@IC_Markets)European markets open on firm footing today:#FTSE 100 +0.42%#DAX 30 +0.59%#CAC 40 +0.36% #IBEX 35 +1.11%

June 11, 2018

Traders are jittery about the acrimony seen in Canada last weekend, says Mike van Dulken of Accendo Markets, but also hopeful of progress in Singapore.

Van Dulken explains:

Thankfully, there is more optimism about the US President’s meeting with North Korean leader Kim Jong Un in Singapore.

Potential for a meaningful discussions about de-nuclearisation on the Korean peninsula could diffuse some of the tensions between US and North Korea, improve the global mood and gain Trump some brownie points after this weekend’s events at the G7.

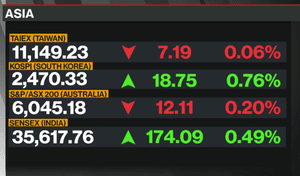

South Korea’s stock market has led the rally in Asia today, on hopes that Donald Trump’s next summit will be more productive than his last one.

The Kospi index has gained 0.75% as traders prepared for the historic Trump-Kim meeting tomorrow. There are also gains in Japan and India, although China’s benchmark index has dropped into the red.

David Madden of CMC Markets says investors are hoping for a breakthrough:

The US President left the G7 summit early in order to prepare for his meeting with Kim Jong Un, the North Korean leader. The meeting will take place today in Singapore. There has been a bit of toing and froing about the meeting, but now it seems as if it is finally going ahead.

Last summer there were some volatile sessions on global stock markets on account of the heightened tensions between the US and North Korea because of the regime’s nuclear weapons programme. The meeting between the two leaders could greatly improve political relations around the world.

Updated

Trump tweets...

President Trump has launched another tirade at the rest of the G7, as he prepared for his summit with North Korea’s Kim Jong-un in Singapore on Tuesday:

Donald J. Trump (@realDonaldTrump)Fair Trade is now to be called Fool Trade if it is not Reciprocal. According to a Canada release, they make almost 100 Billion Dollars in Trade with U.S. (guess they were bragging and got caught!). Minimum is 17B. Tax Dairy from us at 270%. Then Justin acts hurt when called out!

June 11, 2018

Donald J. Trump (@realDonaldTrump)Why should I, as President of the United States, allow countries to continue to make Massive Trade Surpluses, as they have for decades, while our Farmers, Workers & Taxpayers have such a big and unfair price to pay? Not fair to the PEOPLE of America! $800 Billion Trade Deficit...

June 11, 2018

Donald J. Trump (@realDonaldTrump)....And add to that the fact that the U.S. pays close to the entire cost of NATO-protecting many of these same countries that rip us off on Trade (they pay only a fraction of the cost-and laugh!). The European Union had a $151 Billion Surplus-should pay much more for Military!

June 11, 2018

Donald J. Trump (@realDonaldTrump)....Germany pays 1% (slowly) of GDP towards NATO, while we pay 4% of a MUCH larger GDP. Does anybody believe that makes sense? We protect Europe (which is good) at great financial loss, and then get unfairly clobbered on Trade. Change is coming!

June 11, 2018

Donald J. Trump (@realDonaldTrump)Sorry, we cannot let our friends, or enemies, take advantage of us on Trade anymore. We must put the American worker first!

June 11, 2018

The agenda: Markets shrug off G7 debacle; UK trade data due

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

It was a bad weekend for fans of the rules-based international order, as the meeting of top world leaders struggled to meet even the lowest expectations.

Relations between America and the rest of the G7 look worse than ever, after Donald Trump left the meeting early, refused to sign the official communique, and accused his host Justin Trudeau of making ‘false statements’.

Getting all the adults in one room is meant to deliver progress and resolve differences, but not this time. Instead, the G7 has taken another step backwards, with Trump accusing the rest of the world of treating America like a ‘Piggy Bank’.

So, the US is sticking to its new tariffs on steel and aluminium, and Canada is vowing to hit back with its retaliatory tariffs on US goods from July 1 – despite being accused of treachery by Trump’s economic advisor.

The scale of the debacle suggests that the alliances and structures build up over the last 70 years are now creaking alarmingly, raising the dangers of a full-blown trade war.

The financial markets, though, are remarkably unconcerned by events in Quebec.

Asian stocks have risen overnight, with Japan’s Nikkei gaining 0.5%. European markets are expected to rally too; Britain’s FTSE 100 is expected to creep higher today too.

Mike van Dulken (@Accendo_Mike)

#FTSE100 called +16pts at 7697 pic.twitter.com/SKbmPNDxqH

June 11, 2018

Neil Wilson of Markets.com says investors are shrugging off the G7

“Markets appear able to shake off geopolitical risks with stocks showing firmness in the face of a pretty torrid weekend for free trade. Asian shares have risen and futures point to the FTSE opening up around 0.2%, with smaller rises for the DAX and CAC.

After a stormy G7 meeting, the US seems to have turned its back on its allies and is prepared to ratchet up the pressure on trade. Ostensibly this should not be good for risk, though markets appear deaf at present to such rumbings. This is brinkmanship that may ultimately end up working to the advantage of the US; but it is also likely to depress investor sentiment, and therefore growth through the second part of 2018.

Nevertheless, expectations coming into the event were exceptionally low and so there has been little negative reaction in the markets so far.

On the economics front, we get new UK industrial production and trade figures today - plus a new estimate of how the British economy fared in the last three months.

The agenda:

- 9.30am BST: UK industrial production data for April

- 9.30am BST: UK trade balance for April

- Noon BST: NIESR thinktank’s estimate of UK growth in March-May

View all comments >