By Daisuke Wakabayashi

Uber, reported a rare quarterly profit on Wednesday that was driven by taking the opposite approach: Waving the white flag in challenging overseas markets.

In March, Uber agreed to sell its ride and food-delivery businesses in southeast Asia to Grab, a rival based in Singapore. Uber received a 27.5% stake in Grab in exchange for withdrawing from the market. And last year, it agreed to combine its ridesharing operations in Russia and other Eastern European countries for a minority stake in a joint venture owned by Yandex, a Russian internet giant. Both deals closed during the first three months of 2018, swinging the money-losing company into profitability. Take away those transactions, and Uber’s business is still burning cash — albeit at a slower pace than in previous quarters.

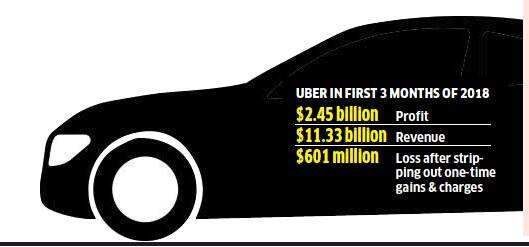

Uber said it made $2.45 billion in the first three months of 2018 on revenue of $11.33 billion. That is an improvement over the previous quarter, when the company recorded a loss of $1.1billion on revenue of $10.9 billion. Stripping out one-time gains and charges, Uber reported a loss of $601 million.

This was not the first quarterly profit at the company. It also recorded a profit in the third quarter of 2016, when it completed another retreat from a tough overseas market, selling its China operations to rival Didi Chuxing. Uber received a 20% stake in the combined entity.

As a private company, Uber is not obligated to report quarterly results. It provides a fairly detailed earnings statement, but its results are not audited and excludes some useful data like user growth and a breakdown of its ride-hailing business versus food delivery.

Dara Khosrowshahi, the chief executive of Uber, said in a statement that the performance of its ride-hailing service exceeded its internal — and undisclosed — projections. He said it planned to continue investing in other areas this year, an indication to investors that they should not expect regular profitability from the company in the near future.

Khosrowshahi has pledged to take Uber public within the next year, raising the pressure on the company to prove that it can turn those losses into profits. Although an IPO is coming, the company also said on Wednesday it was selling existing Uber shares to a trio of investors in a process called a tender offer. Uber said the investment funds Coatue, Altimeter and TPG will buy up to $600 million worth of stock in Uber, valuing the company at around $62 billion. — NYTNS

India a Key Focus: CEO

NEW DELHI: Uber will re-invest profits in its products and technology, emerging markets like India and to scale up its Uber Eats and JUMP businesses globally, its chief executive Dara Khosrowshahi said. In an email to employees, Khosrowshahi said the company's core business has continued to perform very well and the number of trips on the platform grew 43%, while bookings grew 55% to $11.3 billion compared to last year. “We are deliberately reinvesting our profits. Even with these impressive results, we’re not going to let up on the gas. We expect to reinvest our profits back into our products and tech, emerging markets like the Middle East and India,” Khosrowshahi added.