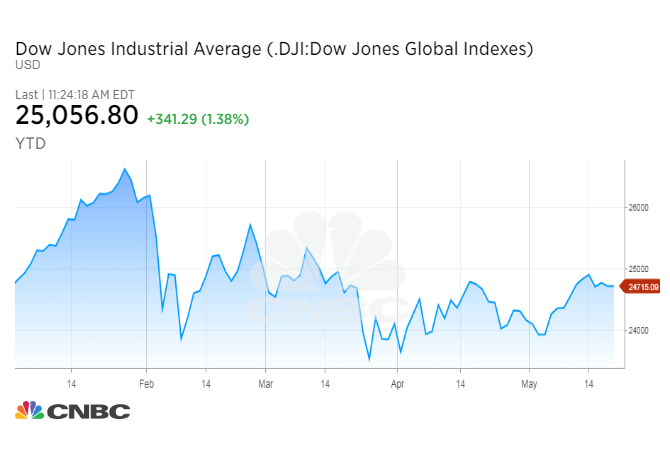

U.S. interest rates have shot up to levels not seen in years recently, giving stock investors a new concern. But a Goldman Sachs strategist says it's not time to worry just yet.

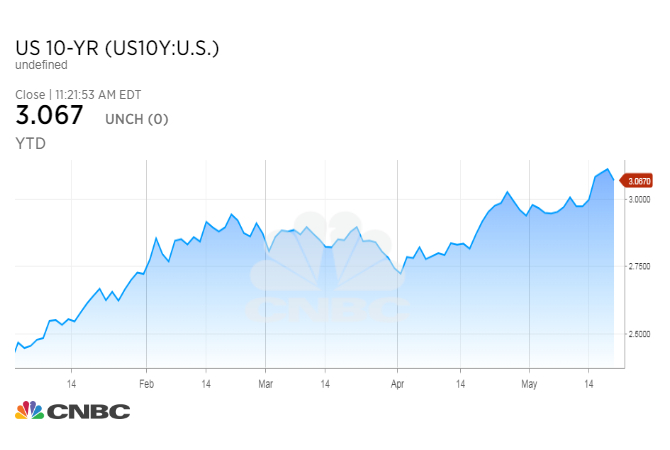

David Kostin, Goldman's chief U.S. equity strategist, wrote in a note Friday that investors should not worry about rising borrowing costs and their effect on stock valuations until the 10-year Treasury yield zeroes in on 4 percent. The benchmark note yielded 3.07 percent on Monday.

"A rise in interest rates should lead to a fall in equity prices, all else equal. An equity's value is equal to the present value of a perpetual stream of future dividends, which are highly sensitive to the discount rate," said Kostin. "However, lower equity prices are not an inevitable consequence of higher interest rates. We expect negative valuation changes if the level of rates approaches 4%." He also said stock prices could take a hit before that level is reached if rates rise too rapidly.