Veteran analyst Dick Bove is about to put some skin in the game as an activist investor in the banking industry.

After a career in financial services that has spanned some 53 years, his new adventure will see him switch to strategist for a Hilton Capital Management effort that seeks to capitalize on what he sees as a major opportunity.

That comes amid a friendlier regulatory environment and a shift in monetary policy that will see the flow of money slow and interest rates rise. The result, he said, will be a big opportunity for dealmaking as well as other chances to make money in a new phase of growth for real estate.

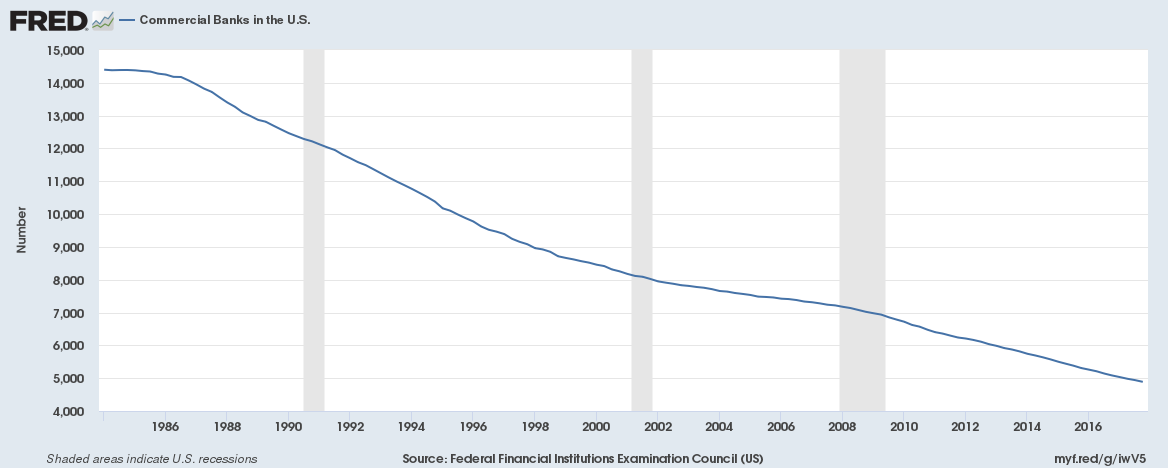

"All the people who are enormously anti-bank and pro-regulation are gone," the Florida-based Bove said during an interview at the New York offices of Rafferty Holdings, the holding company for Hilton Capital. "We are going into a golden age of banking."

This is not, however, a golden age for bank analysts.

A turn to passive investing, in which investors use exchange-traded funds to track indexes rather than individual stock selection, has made times tougher for sell-side professionals on Wall Street. Many big institutions have dramatically cut what they're paying for analysis, and the trend is likely to continue.

For Bove, that climate presents an opportunity to put his long-held ideas to work.