NEW DELHI: The government has asked all departments to enable electronic payment options such as Bhim-UPI QR code at their cash counters as part of plans to boost digital transactions.

NEW DELHI: The government has asked all departments to enable electronic payment options such as Bhim-UPI QR code at their cash counters as part of plans to boost digital transactions.According to an official, Ajay Prakash Sawhney, secretary, Ministry of Electronics and Information Technology (MeitY), told bureaucrats at a closed-door session on ‘Civil Services Day’ last week that a lot of ground still needs to be covered in terms of bringing the majority of merchants and highway tollpayers to the digital platform.

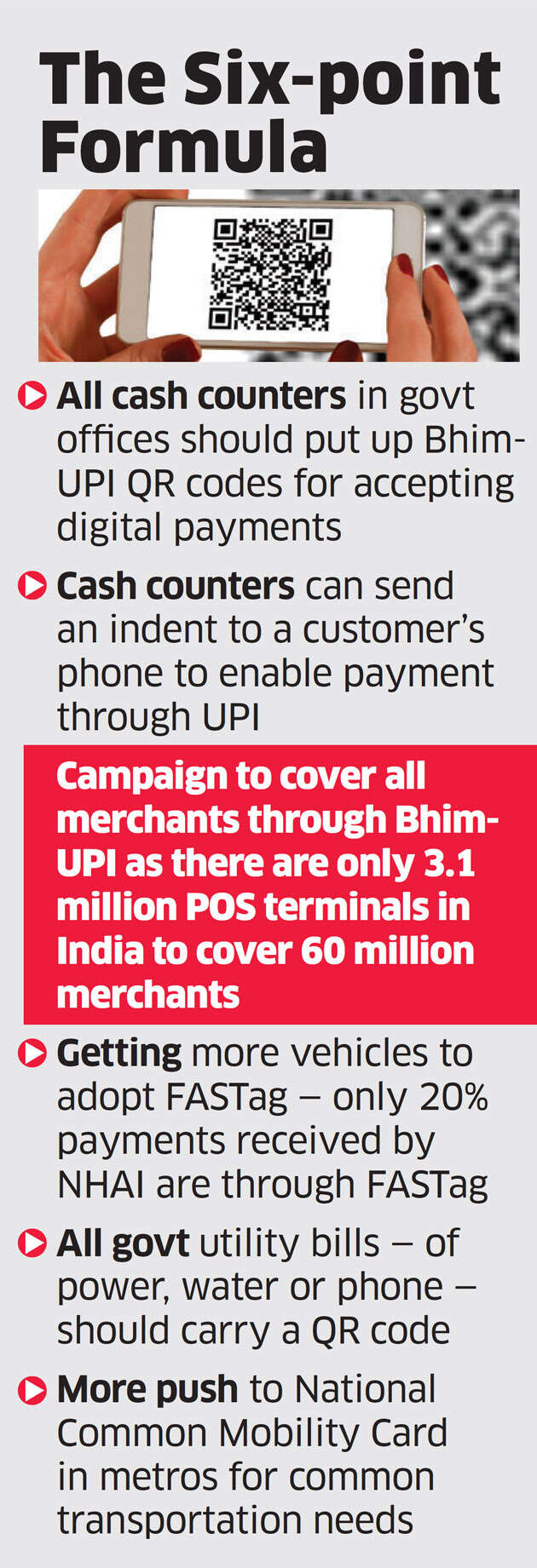

His six-point formula to achieve this includes displaying Bhim-UPI QR codes at all cash counters in government offices to enable digital payments or invoking a facility to send an indent to a customer’s phone to enable payment through united payments interface (UPI).

Bhim (Bharat Interface for Money) is a mobile application developed by the National Payments Corporation of India (NPCI) — the umbrella organisation for all retail payments systems in the country — to enable digital payments through UPI.

“There are only 3.1 million POS (point-of-sale) terminals in India compared with nearly 60 million merchants. FASTag is being promoted for vehicles to pay toll, but only 20% of toll payments received by NHAI are through FastTag,” Sawhney said at the meeting.

The departments were told that saturating and bringing all merchants on board the Bhim-UPI QR platform is “a very imerportant activity”. Sawhney said cash counters in government departments are a major source of payments received and the “simplest thing” is to put a QR code — static or dynamic — to enable cashless payments.

“The dynamic code would require a screen facing the customer as well as the cashier. A third option, which can be enabled on any government cash counter, is to ask for the mobile number of the payimer and send a requisition or indent of the payable amount on the phone — through UPI the person can then make a payment very easily,” Sawhney said. He said similarly all government utility bills —of power, water or phone — should print a QR code on the bill or the bill’s envelope itself. “Printing Bhim QR Code is a major enabler. If on the envelope, a customer can make a payment even without opening the bill,” he said.

The secretary said Bhim UPI is a “policy favoured instrument” and a big contributor to digital payment platforms. “Many countries have adopted digital payments.

We are told China did digital payments of $5.5 trillion in a year. Size of our economy is $2.2 trillion. But digital payments in such countries are dominated by 1-2 players and are not open platforms like our UPI.

Digital transactions in India have seen big growth in volume — from about 10,000 million transactions in 2016-17 to 20,540 million in 2017-18. Among them, Bhim UPI has shown remarkable breakout,” Sawhney said. He said the National Common Mobility Card (NCMC) needs to be promoted across metros and that MeitY is starting a “regulatory send box”, where startups can create new modes of online payments.

Sawhney also referred to a 2016 estimate that pointed to potential saving of Rs 2 lakh crore if the country goes for digital payments, as the cost of handling and transporting cash would go down.

In this regard, a bureaucrat pointed out that several departments, like the Railways, were charging internet fee for online bookings and not offering discounts the way fuel pumps do.