The dollar's breakout is gaining steam, driving it to fresh highs for the year, amid signs its rally will keep on going.

"It's all about momentum at this point," Mark McCormick, head of foreign exchange strategy at TD Securities, said before the Fed statement. Strategists say the dollar has been boosted by the fact U.S. data have been positive, the Fed is in a hiking cycle and President Donald Trump has been more tempered in his comments on trade, as the administration attempts to negotiate with China. Plus upcoming talks with North Korea signal an easing of some global tensions.

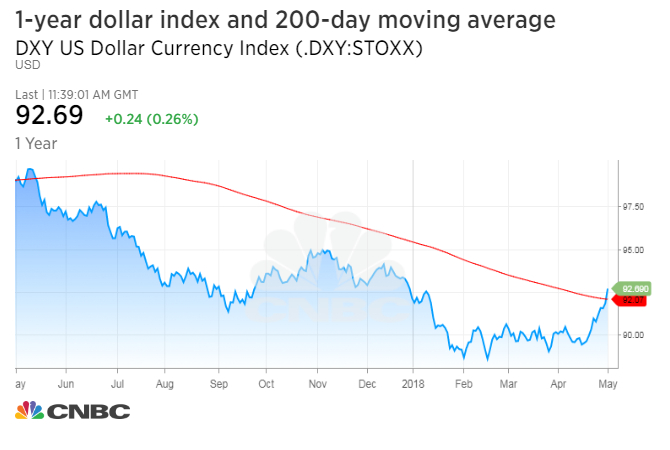

The dollar index rose to its highest level since December, on Wednesday, a day after it broke and closed above its 200-day moving average, setting it up for a further advance. According to Bespoke, the dollar on average has continued to make gains in the one month and three month periods after it closes above the 200-day, if it has been trading below that level for an extended time. The 200-day is a price momentum index and is basically created by averaging the closes of the last 200 trading days.

"It's like a bear coming out of a deep slumber that's been in hibernation for a year. People are waking up to the idea that the U.S. [central bank] is the only rate hiker in the world," said Boris Schlossberg, managing director, foreign exchange strategy with BK Asset Management. He said it's possible dollar/yen, now around 110, could hit 120 by year-end, or that the euro could slide down to $1.10.

The dollar is up more than 3.5 percent in just two weeks.

"Over the last two weeks, you saw major, major longer-term areas of congestion give way and as long as you don't have a rapid change of turn in economic growth, I think the continuation trade in the dollar really starts to take off as long as the U.S. economy muddles along," said Schlossberg. "Nobody [major economy] is running hot, and we're the only one running moderately OK. We're the only one that has a major hawkishly minded central bank."

The dollar index hit a new high for the year Wednesday before giving back its gains after the Fed released its 2 p.m. ET statement. But it then reversed course again and was trading at new highs in later afternoon trading.

"They really didn't change what they're saying. They are still hiking," said Win Thin, senior currency strategist at Brown Brothers Harriman. The market, positioned for a hawkish sounding Fed, viewed the statement as slightly dovish but still on track to raise interest rates.

McCormick said the fact other currencies have also made significant technical moves is driving the action in the greenback. For instance, the euro broke the key $1.20 level this week, and U.K. sterling sank below the 1.40 level and was at 1.36.