Experts advise traders to keep a stop below 10,600 for all long Nifty positions.

The Nifty rallied 6.2 percent in April after falling 8 percent in February and March which resulted in a strong bull candle on Monday's daily candlestick chart. Formation of a strong bullish candle suggests that momentum is strong and there is a higher possibility now for the index to hit levels closer to 10,900, experts suggest.

The index has been forming higher highs and higher lows on the daily chart for the last three trading sessions which indicates that the supports are gradually shifting higher.

However, owing to relentless strength displayed by the bulls in the last five weeks a pause or minor correction can’t be ruled out going forward. Experts advise traders to keep a stop below 10,600 for all long positions.

The Nifty which opened at 10,705.75 on Monday slipped marginally to hit an intraday low of 10,704.60. It hit an intraday high of 10,759 before closing 47 points higher at 10,739.35.

related news

“The Nifty has successfully closed the gap zone between 10,736-10,702 levels registered on February 5 as it signed off the April 30 session with a small bullish candle,” Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in said.

“However, on the monthly charts, it has registered a robust bullish candle which has erased all panic losses witnessed in March. If the index continues to trade above this gap area, then it could take the index to 10,928 levels,” he said.

Mohammad said investors should use corrections as a buying opportunity as long as the Nifty sustains above 10,600 levels. "We are advising traders to remain long with a stop below 10,600 on a closing basis."

India VIX rose 2.85 percent to 12.36 on Monday. Lower volatility suggests that bulls are holding a tight grip on the market. Volatility has been falling for the last four consecutive weeks.

We have collated top 15 data points to help you spot a profitable trade:

Key support and resistance levels for the NiftyThe Nifty closed at 10,739.3 on Monday. According to pivot charts, its key support level is placed at 10,709.6, followed by 10,679.9. If the index starts moving upwards, the key resistance levels to watch out are 10,764.0 and 10,788.7.

Nifty BankThe Nifty Bank index closed at 25,531.6. The important pivot levels, which will act as crucial support, are placed at 25,458.43, followed by 25,385.27. On the upside, the key resistance levels are placed at 25,611.13, followed by 25,690.67.

Call options dataIn terms of open interest, the 11,000 call option has seen the most call writing so far at 56.89 lakh contracts. This could act as a crucial resistance level for the index in the May series.

The second-highest build-up has taken place in the 10,800 call option, which has seen 34.29 lakh contracts getting added so far. The 10,900 call option has accumulated 26.11 lakh contracts.

Call writing was seen at the strike price of 11,000, which added 5.77 lakh contracts, followed by 10,800, which added 3.3 lakh contracts and 11,200, which added 2.35 lakh contracts. Hardly any call unwinding has been seen.

Maximum open interest in put options was seen at a strike price of 10,500, which added 38.68 lakh contracts till date. This could be a crucial resistance level for the index in May series.

The 10,600 put option 31.89 lakh contracts so far and the 10,400 put option has now accumulated 31.37 lakh contracts. Put writing was seen at the strike price of 10,600, which added 6.56 lakh contracts, followed by 10,700, which added 6.47 lakh contracts and 10,800, which added 2.8 lakh contracts.

Put unwinding was seen at the strike price of 10,300, which shed 1.42 lakh contracts, followed by 10,200, which shed 1.14 lakh contracts.

Foreign institutional investors (FIIs) sold shares worth Rs 385.47 crore, while domestic institutional investors bought shares worth Rs 261.98 crore in the Indian equity market, as per provisional data available on the NSE.

Fund flow picture

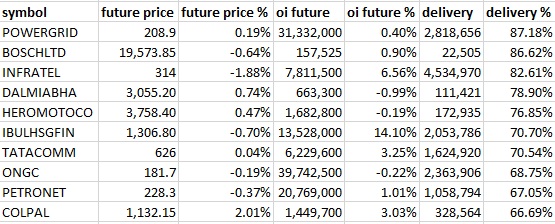

High delivery percentage suggests that investors are accepting delivery of a stock which indicates investor bullishness.

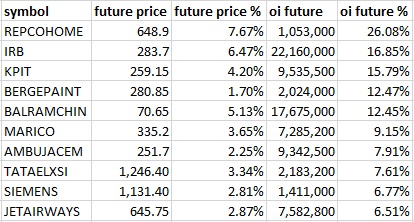

A decrease in open interest along with an increase in price mostly indicates short covering.

An increase in open interest along with a decrease in price mostly indicates build-up of short positions.

PC Jeweller: Multiple block deals were seen in this counter, but two of them stood out for their sheer size. Alphagrep Commodities traded 67.59 lakh shares at Rs 171 apiece. QE Securities traded over 44 lakh shares at Rs 168 apiece.

Sumeet Industries: Niraj Modi bought 10 lakh shares at Rs 15.90 apiece.(For more bulk deals )

Analyst or board meet/briefings:Axis Bank: The company had an investor conference on April 30.

Godrej Properties: An investor and analysts conference will be held on May 4.

Yes Bank: Multiple investors met the management recently.

Stocks in newsBombay Burmah: The CFO of the firm has resigned with effect April 30.

Ceat: The company’s Q4 net profit rose over 16 percent YoY to Rs 77 crore.

Hindustan Zinc: Q4 net profit has fallen 18 percent YoY to Rs 2,505 crore.

HCL Technologies: Keki Mistry resigns as Non-Executive Independent Director with effect from April 30

Rolta India: VL Ganesh resigns as CFO with effect from April 30

M&M: Total sales in April rose 22 percent YoY to 48,097 units.

Maruti Suzuki's April sales at 1.73 lakh units, up 14.4% YoY.

Tata Motors April domestic sales up 86% YoY to 53,511 units.

IHH Health, Munjal-Burmans raise bids for Fortis Healthcare by 7-9% on the last day of receipt of bids.

Larsen & Toubro: The firm has sold its electrical & automation business to Schneider Electric for Rs 14,000 crore.

One stock under ban period on the NSESecurity in ban period for next day's trade under the F&O segment includes companies in which the security has crossed 95 percent of the market-wide position limit. For May 2, PC Jeweller is present in this list.