Finance ministry mandarins have been pitching for a rating upgrade citing various factors. But on Monday they got rather a rudimentary lesson from Fitch Ratings — You can’t cross the sea merely by standing and staring at the water.

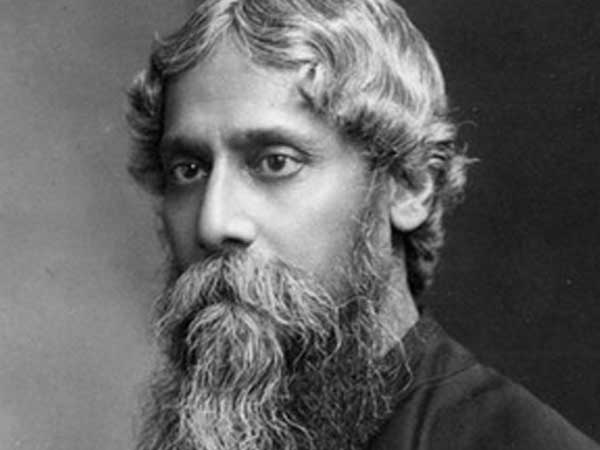

Thomas Rookmaaker, Fitch Ratings director for Asia Pacific sovereign ratings, quoted Rabindranath Tagore to remind the government that substantial action on the ground is missing for a rating upgrade.

Talking to Bloomberg Quint about attempts in vain by successive Indian governments to reduce the Central government’s fiscal deficit to 3 per cent, he said: “The track record of successive Indian governments in implementing the FRBM Act is not great, as we all know. You can’t cross the sea merely by standing and staring at the water, as Rabindranath Tagore once said. You have to do things as well. It’s about implementation.”

With this statement, Rookmaaker joins a battery of economists and the Reserve Bank of India (RBI) that are wary of the government’s efforts on fiscal consolidation. The minutes of the April meeting of Monetary Policy Committee (MPC) showed that most members were concerned about fiscal slippages, from both the central and state governments.

The RBI in its first bi-monthly monetary policy for the financial year this month kept its policy stance unchanged at “neutral”, but highlighted upside risks to inflation from the staggered impact of state government house rent allowances, increasing global commodity prices and a potential increase in minimum support prices (MSP).

Last week, Fitch Ratings in a statement retained India's rating with a stable outlook despite government’s arguments for a rating upgrade. Moody’s is the only agency that has upgraded India’s ratings (in November 2017). However Fitch Ratings and S&P have not upgraded India’s ratings. Moody’s had upgraded India’s local and foreign currency issuer ratings for India to Baa2 from Baa3, with a stable outlook, from positive. This had put Moody’s ratings one notch above the other major ratings agencies, S&P (BBB- Stable) and Fitch (BBB-Stable).

“Weak fiscal balances, the Achilles' heel in India's credit profile, continue to constrain its ratings. General government debt amounted to 69 per cent of GDP in FY18, while fiscal slippage of 0.3 per cent of GDP in both FY18 and FY19 relative to the government's own budget targets of last year, implies a general government deficit of 7.1 per cent of GDP,” Fitch had said in its statement.

India’s rating balances a strong medium-term growth outlook and favourable external balances with weak fiscal finances and some lagging structural factors, including governance standards and a still-difficult, but improving, business environment, it said.

Foreign reserves equal 8.3 months of current external payments while gross and net external debt levels also compare well. However, net FDI inflows fell to $ 23.7 billion in the first three quarters of FY18 from $ 30.6 billion a year earlier, and, unlike in many of India's peers, are now insufficient to cover a widening current-account deficit. Fitch expects the basic balance to widen to -1.3 per cent of GDP in FY20 from -0.5 per cent of GDP in FY18.

The Indian economy is less developed on a number of metrics than many of its peers. Governance continues to be weak, as illustrated by a low score for the World Bank governance indicator (46th per centile versus the 'BBB' median of 59th percentile). India's ranking on the United Nations Human Development Index (31st percentile versus the 'BBB' median of 68th percentile) also indicates relatively low basic human development, the global rating agency said. While India rose 30 places in the World Bank's Ease of Doing Business ranking in 2017, it has ample potential to improve its position further, as it still ranks below both the 'BBB' and 'BB' medians, it said.

The authorities are in the process of cleaning up the banking sector, including through the allocation of $ 32 billion in capital injections for public-sector banks. These banks are likely to need additional government capital, however, in particular after a recent high-profile fraud case involving $ 2.2 billion in Punjab National Bank. Most of the capital injection is likely to be absorbed by losses associated with NPL resolution, rather than to fund new ending. Fitch expects the sector-wide NPL ratio to rise to 11.5 per cent of total loans by end-FY18, up from 4.6 per cent in FY15, due mainly to stricter implementation of standards.