Back in the City, shares in pharmaceutical firm Shire has jumped almost 7% as traders anticipate a takeover battle.

Reuters is reporting that Japanese firm Takeda Pharmaceuticals has made an ‘indicative takeover proposal’ for Shire - which produces the ADHD drug Adderall - worth £43bn, or £46.50 per share.

Last month, Takeda said it was considering making an offer for Shire, so the City has been waiting for the next move. Under takeover rules, Takeda has until 25 April to bid, or walk away.

Shire was founded in Hampshire, but is now based in Ireland for tax purposes. Takeda is particularly interested in its rare diseases portfolio, where it has 40 programmes in its drug pipeline.

Shire are currently up 256p at £40.12, to the top of the FTSE 100 leaderboard.

Russia demands compensation for Trump's metal tariffs

Russia has launched an attempt to win compensation over America’s new tariffs on steel and aluminium.

Moscow has filed an official complaint to the World Trade Organisation, arguing that the 25% tariff on steel, and 10% on aluminium, are ‘safeguard measures’ - ie, designed to protect the US economy, not for national security.

That’s an important distinction - as major exporters can ask for compensation under WTO rules if they are penalised by such safeguards.

As Russia puts it:

Although the United States presented the measures at issue as being adopted to address the threat that imports of steel and aluminium pose to the US national security, they are in essence safeguard measures, and the Agreement on Safeguards and Article XIX of the General Agreement on Tariffs and Trade 1994 (GATT 1994) are applicable to them.

The United States did not provide notification under paragraph 1(c) of Article 12 of the Agreement on Safeguards on taking a decision to apply the safeguard measures to the WTO Committee on Safeguards.

The Russian Federation is a WTO Member that has a substantial interest as exporter of the products subject to the safeguard measures. Therefore, the Russian Federation requests consultations with the United States under paragraph 3 of Article 12 of the Agreement on Safeguards and paragraph 2 of Article XIX of the GATT 1994.

So, Russia now joins China, India and the EU in opposing these tariffs:

Tom Miles (@tgemiles)China, India, EU and now Russia have demanded US compensation for steel and alum #trade #tariffs at the @wto

April 19, 2018

Intriguingly, US has accepted "the request of China to enter into consultations", but told India and EU that "we are open to discuss this or any other issue". Not the same

Updated

UK retail sales fall: What the experts say

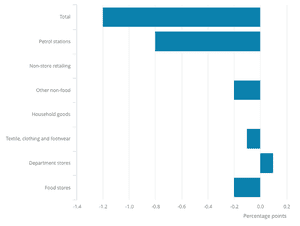

Lisa Hooker, consumer markets leader at PwC, says the 1.2% fall in retail sales last month is disappointing - but there are some reasons for optimism:

“With snow and rain right through March including in the critical run up to Easter, it’s no surprise that shoppers avoided the high street. So, while online retailers benefited to some extent, last month’s retail sales were particularly disappointing.

“Footfall was significantly impacted by the weather, and the first of retailers’ spring/summer fashion and home product ranges would have been of little consolation to shoppers looking to stay warm.

“But, it’s not all doom and gloom. This week, we’ve already seen evidence of wages growing in real terms as inflation has eased. Moreover, our most recent survey* shows that consumer sentiment is recovering and is higher than it was both in December and this time last year. This is particularly true of younger people, with more under 45s saying they think they’ll be better off next year.

Keith Richardson, managing director retail sector at Lloyds Bank Commercial Banking, also blames the icy blast of grim weather for keeping shoppers off the streets.

“While Mother’s Day and an early Easter provided some respite for retailers in March, the impact of two Beasts from the East was brutal.

“The high street felt the worst of the chill as shoppers simply stayed at home to avoid the snow. But it wasn’t just the weather to blame.

“Fashion clearly suffered as nobody wants to buy spring clothing during a blizzard, even from the comfort of their sofa.

Economist Rupert Seggins says the retail sector will have a slight negative impact on growth in the last quarter:

Rupert Seggins (@Rupert_Seggins)UK retail sales fell -0.5%q/q in the first quarter of this year - means the retail sector will be roughly a -0.03% drag on GDP growth. March sales fell -1.2%m/m as the snow storm hit fuel sales, but boosted online sales. pic.twitter.com/8AeY5bkXLg

April 19, 2018

Economics journalist Dharshini David says the weak spending figures might deter the Bank of England from raising interest rates next month:

Dharshini David (@DharshiniDavid)Retail sales volumes have failed to rise at all since end of last summer, according to official numbers. Coupled with drop in inflation, may persuade MPC to defer rate rise to August

April 19, 2018

Rhian Murphy, ONS Senior Statistician, says the wintery weather in March hurt Britain’s high street stores, but boosted web retailers:

“Retail sales fell in the first quarter due to a large decline in March with petrol sales seeing a significant slump as a result of the poor weather keeping many shoppers indoors. However, the snow actually helped boost online spending with department stores in particular seeing growth in their web sales.

“Various shops also reported increased spending on gifts in the run-up to Easter and Mother’s Day, which also helped boost online sales.”

UK retail sales suffer March slide

Newsflash: UK retail sales suffered an unexpectedly sharp fall last month, as the Beast from the East hit the sector.

Sales volumes fell by 1.2% on March, much worse than the 0.5% which economists had expected.

The Office for National Statistics blames bad weather for the decline - backing up what Debenhams reported this morning.

The figures also show that Britain has suffered its weakest quarter for retail sales in a year, with volumes down 0.5% in January-March.

The ONS says:

- In the three months to March 2018 (Quarter 1), the quantity bought in retail sales fell by 0.5% when compared with Quarter 4 (Oct to Dec) 2017, with declines in all sectors except for department stores and non-store retailing.

- The month-on-month growth rate fell by 1.2% due to a large fall of 7.4% from petrol sales; a likely consequence of adverse weather conditions, which impacted travel.

- Department stores were the only sector to show positive growth in March at 0.8%, with feedback from retailers suggesting that online offers for Mothering Sunday and Easter boosted internet sales more than usual during the adverse weather.

- The quantity bought in supermarket stores declined in March, while specialist food stores saw strong growth; possibly due to the easier access to these stores during snow.

Reaction to follow...

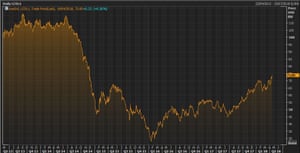

Here’s Reuters’s take on how the nickel price has soared as investors anticipate new sanctions on Russian metal producers:

Nickel surged more than nine percent on Thursday to its strongest level since late 2014 on fears U.S. sanctions on major Russian aluminium producer Rusal may be broadened and could hit key Russian nickel supplier Nornickel.

It was the second straight session of sharp gains for nickel, adding to Wednesday’s 7.5-percent spike, spurred by worries over tighter global supply for a commodity already in deficit.

Three-month nickel on the London Metal Exchange rallied as much as 9.3% percent to $16,690 a tonne, the highest since December, 2014. The metal, used to make stainless steel, was up 7.3 percent at $16,395 by 0702 GMT.

“Pretty clearly there is a lot of smoke. And pretty clearly the U.S. has Russia in its sights for a number of reasons known to them,” said UBS analyst Lachlan Shaw.

“A logical extension would be if you were to broaden sanctions, then Norilsk would fall under that remit.” Russia’s Norilsk Nickel, or Nornickel, is the world’s second-biggest nickel producer.

An official for Nornickel this week dismissed the idea of the prospect of sanctions on the company driving up the nickel price.

The FTSE 100 has hit a 10-week high, as the commodity rally pushes up shares in mining giants and oil producers.

The Footsie is up 17 points at 7334, as it recovers from last month’s selloff.

Energy and raw materials companies are leading the way, with Anglo American up 1.6% and Royal Dutch Shell gaining 0.5%.

Debenhams shares hit 9-year low

Over in the City, shares in Debenhams have slumped by 10% to its lowest level since the 2008 financial crisis.

Traders are unimpressed by its latest financial results, showing an 85% slump in pre-tax profits and a warning that full-year earnings will be lower than many brokers expected.

The company also blamed the ‘Beast from the East’ for hitting sales in March, saying it had to close almost 100 stores as icy, snowy weather gripped the UK. That followed on from a disappointing Christmas, which had already prompted a profits warning in January.

Debs says it is accelerating its “Debenhams Redesigned” strategy - an attempt to boost digital sales, cut costs, and lure more customers through the doors by billing shopping as a “fun leisure activity”.

But...finance director Matt Smith isn’t hanging around to see the results - he’s moving to Selfridges.

Joel Hills (@ITVJoel)Profits have shrivelled, debt has grown and the finance director has just quit. Not a good look at @Debenhams. CEO says “retail market is changing faster than we expected”.

April 19, 2018

Lee Wild, head of equity strategy at interactive investor, says Saudi Arabia is pushing for a high oil price to prop up its fiscal plans:

Despite the influence of US shale, Saudi Arabia still calls the shots on global oil markets, and it’s increasingly obvious the Saudi’s are comfortable with oil at $80 or more.

Add a drop in weekly US oil reserves to the mix and the only way for crude prices is up. Saudi bullishness should be no surprise given it must somehow bankroll Crown Prince Mohammed bin Salman’s expensive reforms and modernisation at home.

Even lumber is being swept higher by the surge in commodity prices:

Amanda Cooper (@a_coops1)TIMBEEEEEEER! 🌳 Lumber hits record highs, now 2nd best performing industrial commodity in the last 12 months. +42% yy vs +16% yy in the S&P500 #OOTT pic.twitter.com/HUErZ409hl

April 19, 2018

Rubber price jumps after Chinese sanctions

The rubber price has, umm, bounced by 5% today, after China announced temporary anti-dumping measures on imports.

The measures will affect halogenated butyl rubber imported from the United States, European Union and Singapore, Reuters reports

YUAN TALKS (@YuanTalks)#China sees a rally in industrial commodity futures on Thursday.#Rubber surged over 5% after China imposed temporary anti-dumping measures on halogenated butyl rubber imported from US#IronOre surged 6%, Nickel up over 4% pic.twitter.com/qfq2YGXMDk

April 19, 2018

The surge in commodity prices this month is quite astonishing:

Jamie McGeever (@ReutersJamie)Putting the pedal to the metal.

April 19, 2018

Aluminium +32% so far this month and nickel +20% just this week, as Russian sanctions and supply shortage concerns take centre stage. pic.twitter.com/TfeHU6Lavk

Shares in Australia’s mining sector has hit a three-month high this morning, following the rally in commodity prices:

fastFT (@fastFT)Improved metals prices saw the ASX 300 Metals & Mining index reach its highest in three months https://t.co/zAlTp60xIJ pic.twitter.com/wBOdCXz8Db

April 19, 2018

Russian sanction fears drive nickel prices higher

Oil isn’t the only commodity to rally today.

Nickel has surged by 9% this morning, hitting its highest level since December 2014.

That follows reports that Russian mining firm Norilsk Nickel could be caught up in US sanctions against Moscow.

That could have serious consequences for manufacturers, as nickel is a key component in rechargeable batteries used in mobile phones and electric cars, for example.

Earlier this month the US imposed sanctions on aluminium-producer United Co. Rusal. That has caused drama in the commodities markets, with aluminium up another 5% today.

Consumers, manufacturers and traders are scrambling to secure supply cut off by Rusal, the largest aluminum producer outside China. Aluminum reached a six-year high and nickel jumped the most intraday since 2009. Alumina, a raw material needed to make aluminum, notched a fresh record.

“It really is unprecedented in terms of the turmoil it’s unleashed,” Robin Bhar, a metals analyst at Societe Generale SA, said by phone from London. “It’s amazing to watch.”

Updated

Hussein Sayed, Chief Market Strategist at FXTM, agrees that supply worries and geopolitical tensions are pushing oil up:

Oil found support after data from the Energy Information Administration showed that crude inventories dropped 1.1 million barrels in the week to 13 April, while gasoline and distillate stockpiles fell by more than 3 million barrels. Now it is OPEC and Co.’s turn to capitalize on the bullish report as they meet in Jeddah on Friday.

While the elimination of oversupply has been a critical factor pushing oil prices, I still believe there’s a significant risk premium being priced in, specifically the fear of supply disruption from the Middle East and possible renewed sanctions on Russia and Iran.

The agenda: Oil at highest level since 2014

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

The oil price is on a tear this morning, hitting its highest levels since late 2014 as stockpiles fall and worries about geopolitical tensions in the Middle East weigh on the markets.

Brent crude has crashed over the $74 per barrel mark this morning, following data yesterday showing a surprise drop in US oil inventories.

US crude (West Texas Intermediate) is also rising, hitting a three-year high of $68.95.

Last week’s US-UK-French military strikes in Syria have also pushed oil prices higher, amid worries that supplies from the region could be disrupted.

In addition, a Reuters report that Saudi Arabia is pushing for higher prices -- perhaps even $100 per barrel -- has caught traders attention. It may show that the Opec cartel will push on with its supply curbs, to keep prices buoyant.

Jasper Lawler of London Capital Group says:

Traders are starting to get excited that the oil market is finally rebalancing with the global supply glut evaporating.

Whilst it may be premature for the OPEC led group implementing supply cuts to cheer, the numbers are certainly pointing to a potential end in sight.

Also coming up today...

We get a new healthcheck on Britain’s retail sector, with sales figures for March released this morning. Economists predict that they fell by 0.5% month-on-month, as grim weather kept shoppers away from the high streets.

Michael Hewson of CMC Markets says:

Today’s retail sales numbers for March could shatter the perception of consumers feeling a little better about their spending habits.

So far this year consumers have been in a fairly cautious mood with retail sales in January and February rising 0.1% and 0.8% respectively. This morning’s March numbers could reverse all or most of these gains with expectations of a decline of 0.5%.

High street chain Debenhams, broadcaster Sky and pest control firm Rentokil are also reporting to the City.

The news from Debenhams isn’t great - pre-tax profits slumped by almost 85% in the last six months:

Joanna Partridge (@JoannaPartridge)Retail woes continue - Debenhams half-year profits have fallen by a huge 85%. That's worse than analysts expected. Like-for-like sales also 2.2% down. And their CFO is leaving too

April 19, 2018

Sarah Butler (@whatbutlersaw)Sales at Debenhams established UK stores fell by 4.1% in the half.. ouch!

April 19, 2018

Sky has reported a 5% rise in like-for-like revenues, and are speaking to the press now....

Mark Sweney (@marksweney)Sky CEO Jeremy Darroch: "I have no interest in running WPP thank you very much. Good luck to them"

April 19, 2018

The agenda:

- 9.30am BST: UK retail sales figures

- 1.30pm BST: US weekly jobless figures

Updated

View all comments >