With investments of over Rs 300 billion riding on the stock, heads of mutual fund (MF) houses met ICICI Bank Chairman M K Sharma over the succession plan at the private sector lender. It is learnt that Sharma met top MF executives to provide clarifications on the Videocon loan controversy.

Sources said the Rs 21-trillion MF industry raised questions over the bank’s “back-up” or succession plan in case Chief Executive Officer and Managing Director (CEO & MD) Chanda Kochhar steps down.

“After the developments at Axis Bank, there is fear among fund managers that Kochhar, too, may have to step down. The uncertainty is a cause of concern from the stock price point of view. Therefore, a lot of MF executives asked about the succession plan. However, there was no demand from them that Kochhar should step down,” said an industry official.

Industry executives also sought clarifications over the action, if any, taken by the bank’s board when the issue had surfaced two years ago. They also asked why stock exchanges were not informed when the Central Bureau of Investigation (CBI) or the Enforcement Directorate had begun investigating the matter.

The CBI has launched a preliminary investigation into the lending practices at the bank amid allegations of a nexus between Deepak Kochhar, husband of Chanda Kochhar, and Videocon group Chairman Venugopal Dhoot.

The meeting between the chairman and major shareholders, including fund houses, was arranged by ICICI Bank. Sources said Sharma told shareholders that the “institution is bigger than any individual”. An email sent to an ICICI Bank spokesperson went unanswered.

Earlier this month, Axis Bank MD & CEO Shikha Sharma announced that she was cutting short her tenure by over two years after the Reserve Bank of India (RBI) asked the bank’s board to reconsider her reappointment.

“Being big investors in the bank, the MF industry wanted some clarity and comfort from the bank on the risks involved. Before the crisis broke, most fund houses had a favourable stance on the bank, given its widespread reach and brand equity,” said a chief investment officer (CIO) of a fund house.

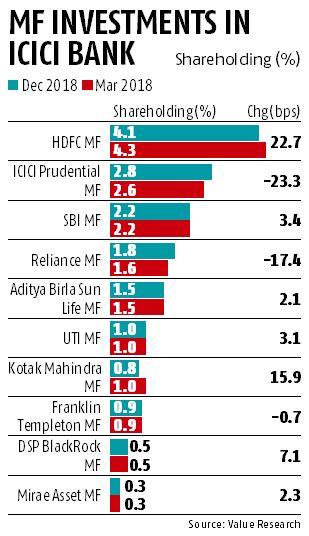

ICICI Bank is the second-most owned stock by MFs with 490 schemes having exposure to the lender.

Nearly 4 per cent of total equity assets, Rs 8.6 trillion as on March 31, of the industry are invested in ICICI Bank.

The stock’s weight in the portfolios of some of the largest schemes in the country, including HDFC Top 200, ICICI Prudential Balanced Fund, Aditya Birla Sun Life Frontline Equity Fund and Franklin Templeton High Growth Companies Fund, is as high as 9 per cent.

Despite the negative news flow, most fund managers refrained from taking big “sell” calls on the bank.

Instead, taking advantage of the weakness in the stock price, fund managers lapped up over 34 million new ICICI Bank shares worth over Rs 9.5 billion in March. The buying helped the stock recoup most of its losses.