Cash crunch: Finance Minister Arun Jaitley said the “temporary shortage” in certain states is being “tackled quickly” and that there is “more than adequate” currency in circulation.

Cash crunch: Finance Minister Arun Jaitley said the “temporary shortage” in certain states is being “tackled quickly” and that there is “more than adequate” currency in circulation.

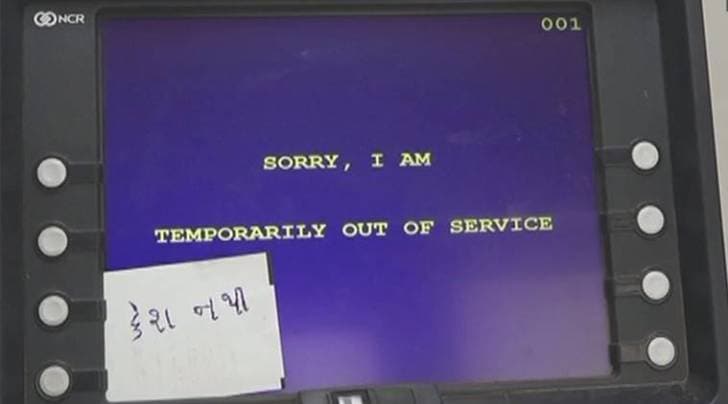

ATMs in several states, including Andhra Pradesh, Telangana, and poll-bound Karnataka have run out of cash, creating a panic among people. While the Centre has argued that the grim situation is a result of “unusual spurt” in demand for cash, the Opposition is leaving no stone unturned to attack the Modi government over the current crisis.

What is the current cash crunch?

As many as six states–Gujarat, eastern Maharashtra, Madhya Pradesh, Bihar, Andhra Pradesh and Telangana–have complained of cash shortage with ATMs going dry. There have been reports of non-availability of cash in Delhi too–a stark reminder of the post-demonetisation phase.

What is the government’s stand on the crisis?

Finance Minister Arun Jaitley said the “temporary shortage” in certain states is being “tackled quickly” and that there is “more than adequate” currency in circulation. Jaitley said he has reviewed the currency situation in the country. The government is checking with banks and the Reserve Bank of India to ensure adequate supply of currency. Economic Affairs Secretary Subhash Chandra Garg said that the government will step up printing of Rs 500 notes by five times in order to meet an “unusual spurt” in demand for cash.

How much has the demand increased?

According to the government, the demand for cash has gone up from the monthly average of Rs 19,000-20,000 crore in the country to about Rs 40,000-45,000 crore per month, in the first 13 days of April itself. This unusual spurt in demand is seen in states including Andhra Pradesh, Telangana, Karnataka, MP and Bihar, where many of the ATMs are running dry and bank branches short of cash.

How much cash does the government actually has?

According to the Economic Affairs Secretary, the government currently has Rs 1.75 lakh crore of currency in reserves, which is sufficient to take care of the increased demand. The government says its stock preparation is enough to tackle any kind of cash crunch arising at any point of time. In the last few days, the government has stepped up currency printing. As against Rs 500 crore worth of notes being printed per day, it is now being increased to Rs 2,500 crore per day. Though the government has halted printing of Rs 2,000 notes recently as about Rs 6.7 lakh crore worth of Rs 2,000 notes have already been pumped into the market, it has no plans immediately to restart production of Rs 2,000 notes.

When will the situation improve?

The secretary said that there are two ways in which the situation can become normal. If the demand becomes normal, then the government doesn’t need to increase supply. In the second scenario, the government should meet as much demand as is there, but that could create a new normal for currency usage. “We are prepared for the new normal. We are prepared for both scenarios,” said the economic affairs secretary.