A robust rally in technology stocks, ahead of the March quarter results announcement by Infosys, helped the benchmarks propel for the sixth straight session.

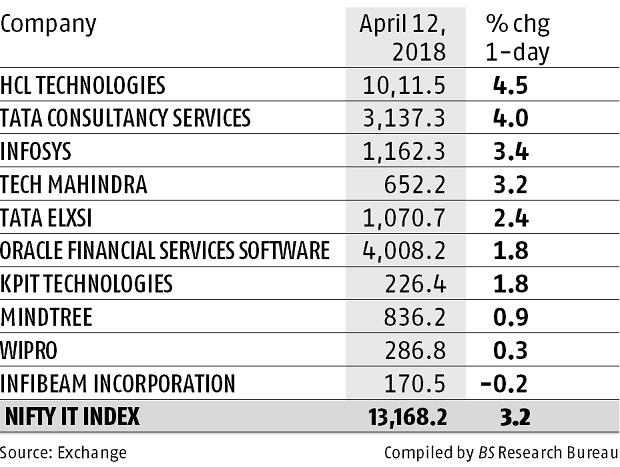

Showstopper BSE IT index gained 3.2 per cent on Thursday — the most since January 16 — buoyed by sharp gains in Tata Consultancy Services (TCS) and Infosys. Shares of TCS gained 4 per cent, helping it once again surpass the Rs 6-trillion mark in market capitalisation. Infosys gained 3.4 per cent ahead of its results. The IT services major will kick off the earnings season on Friday after market hours.

The BSE Sensex finished the day at 34,101.13, up 161 points, or 0.47 per cent. TCS and Infosys alone contributed 136 points to its rally. The index of 30 blue-chip companies has gained 1,082 points, or 3.3 per cent, after making positive strides in each of the past six sessions.

“The IT sector is at an inflection point following a prolonged deceleration. Our view is based on up-scaling the value proposition, accelerating the demand environment, strong operational and strength in balance sheet and cash generation,” said Apurva Prasad and Amit Chandra, analysts at HDFC Securities.

“Most fourth-quarter previews point to strong double-digit growth for IT companies, particularly HCL Tech and TCS, on the back of an improvement in the US economy and verticals such as BFSI (banking, financial services and insurance) and retail, and cross-currency tailwind,” said Hemang Jani, head (advisory), Sharekhan.

Market players said the Street would monitor the 2018-19 guidance during the announcements of March-quarter financials.

Analysts expect acceleration in growth this financial year. “The revenue growth rate for the industry is likely to be between 7 per cent and 9 per cent, while the Street will be content with 6-8 per cent guidance by Infosys,” an analyst said. Recent underperformance and attractive valuations were other factors responsible for Thursday’s rally.

The valuation for the IT sector is at a 3 per cent discount to the benchmark Nifty. Historically, the sector has traded at a premium of 18 per cent, according to HDFC Securities. “Valuations will be supported by the strength of its balance sheet, strong cash generation and efficient capital allocation,” the brokerage said.