On an afternoon in late October 2008, in a conference room overlooking Delta Air Lines' Atlanta campus, Richard Anderson got word.

The Department of Justice had just approved the carrier's some $2.6 billion-merger with Northwest Airlines, a deal that gave birth to the world's biggest airline at the time.

The airline's general counsel told Anderson, the Delta CEO who ran the company until 2016, that it could close in a few days.

"How about now?" Anderson recalls asking. "We want this to be irreversible."

The tie-up, which was unveiled 10 years ago this month, set off a frenzied deal-making decade among airlines. The industries had faced bankruptcies, low-cost competitors, a brutal recession and a spike in fuel prices.

U.S. passenger airlines had lost a record $60 billion from 2001 through 2005, according to Airlines for America, an industry trade and lobbying group. Consolidation was necessary to stabilize, said Douglas Steenland, who was the CEO of Northwest Airlines at the time of the 2008 merger with Delta.

For years, "the public was in essence being subsidized by airline employees through wage cuts and through the shareholders, through loss of their equity," he said.

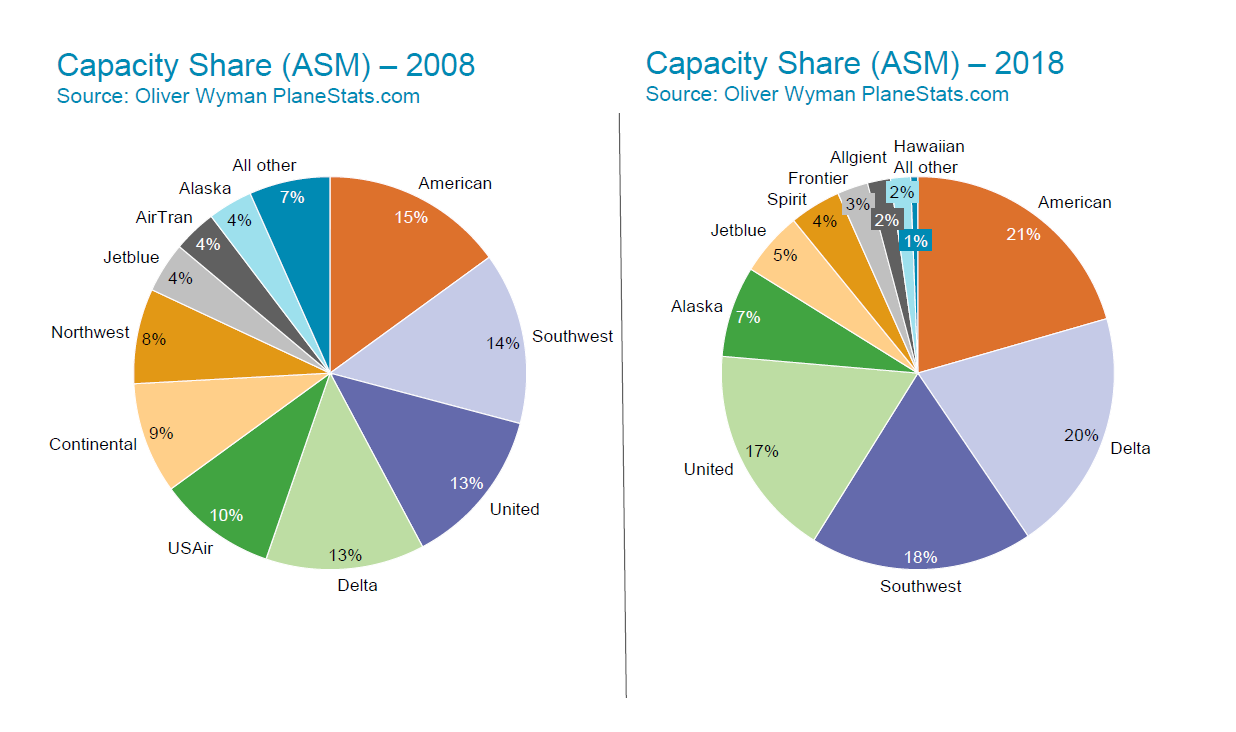

The merge-or-die mentality eventually shrunk the number of big U.S. airlines from seven to four. Those four companies control three-quarters of the U.S. commercial air travel market. Regardless of how loud cries are for boycotts due to bad personal experiences — like the violent dragging of a passenger off a flight that was serving United Airlines last year — the industry's merger mania has also left passengers with fewer alternatives.