“The RBI officials were called in as we wanted to understand the 80:20 scheme concerning jewellery import. During the interaction they informed us that the scheme was introduced by the UPA Government and the rules were eased just days before the government’s tenure ended,” said a senior official.

“The RBI officials were called in as we wanted to understand the 80:20 scheme concerning jewellery import. During the interaction they informed us that the scheme was introduced by the UPA Government and the rules were eased just days before the government’s tenure ended,” said a senior official.

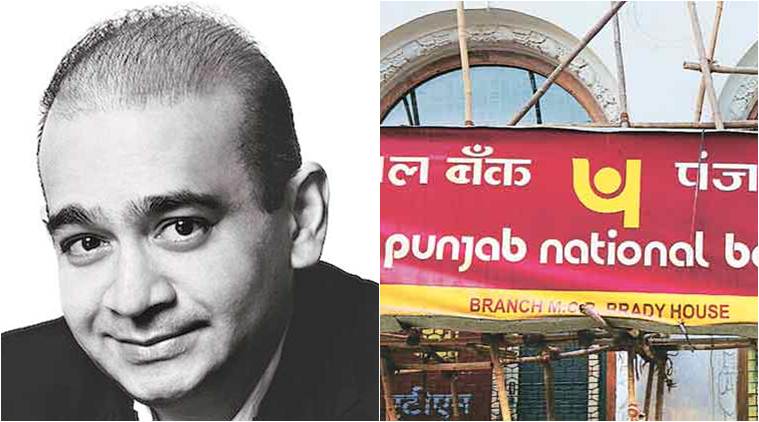

THE CENTRAL Bureau of Investigation (CBI) is planning to write to the Ministry of Finance to seek details on the 80:20 scheme concerning jewellery imports after questioning former deputy governor of the RBI HR Khan Friday. Sources said they suspected the scheme benefited diamantaire, Mehul Choksi and his nephew Nirav Modi who are being probed in the alleged over Rs 13,500 crore fraud caused to Punjab National Bank (PNB).

The decision to write to the Finance Ministry was taken after the examination of senior Reserve Bank of India officials who informed the CBI about the scheme and how it allegedly benefited the accused, agency sources said. The CBI also questioned former deputy governor of the RBI, HR Khan Friday in connection with the ongoing probe. Sources said Khan was questioned about the 80:20 scheme and the Letters of Undertaking (LoUs) through which Choksi and Modi raised loans.

“He was asked on the circular pertaining to the 80:20 issued on May 21, 2014,” said a senior official. The circular laid down conditions under which Star Trading Houses/Premier Trading Houses (STH/PTH), which are registered as nominated agencies by the Director General of Foreign Trade (DGFT), could import gold under 20:80 scheme.

According to the CBI, the scheme introduced in 2013 was relaxed in May 2014 just days before the the counting of votes for the Lok Sabha elections. The central agency is now probing if this move benefited the accused and decided to write to the Finance Ministry on the issue.

“The RBI officials were called in as we wanted to understand the 80:20 scheme concerning jewellery import. During the interaction they informed us that the scheme was introduced by the UPA Government and the rules were eased just days before the government’s tenure ended,” said a senior official.

“We now are planning to write to the Finance Ministry to understand the purpose behind introducing the scheme and the 21 May 2014 notification. We will seek details on the proposal and representations made on the proposal by the Finance Ministry. We are probing if the circular wasn’t issued in haste.”

Officials said that the probe into the 80:20 scheme is limited only to this case. “The questions would concern only the said cases and has nothing to do with other companies who might have benefited under the scheme,” said the official.

While 80 per cent of gold imports under the scheme (India is one of the biggest importers of gold globally) could be sold in the country, at least 20 per cent of imports had to be exported before importers could bring in new consignments. The permission to import the next lot was to be given upon the fulfilment of the export obligation. The policy aimed to discourage gold imports to rein in the widening current account deficit.