Early-stage venture capital investor India Quotient, an early backer of companies like online lending platform Lendingkart and vernacular messaging platform ShareChat, has made a first close at over $30 million for its new fund targeting $50-60 million.

Early-stage venture capital investor India Quotient, an early backer of companies like online lending platform Lendingkart and vernacular messaging platform ShareChat, has made a first close at over $30 million for its new fund targeting $50-60 million.The venture firm has roped in Gulf-based billionaire of Indian origin Dr. BR Shetty as a major backer with a $10 million commitment, with remaining capital coming from other HNIs and institutions like Government of India’s fund of funds managed by SIDBI.

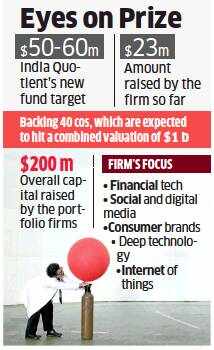

India Quotient has till now raised $23 million across two funds, backing a total of 40 companies which are expected to hit a combined valuation of $1 billion, according to a statement. Overall the portfolio companies have raised $200 million in capital.

The new fund is a significant step up for India Quotient in terms of the corpus. It’s first fund of $5 million was closed in 2012 while the second fund, which raised $18 million, closed in 2015. The firm does not plan to change the strategy of backing seed stage companies, but the corpus gives it an ability to put more capital in each of them.

“A lot of our companies go out and raise money very soon, but we want to do less of that. We will put the first $1 million in the company ourselves and fund it for two years as most early-stage companies right now are getting funded for only 12 months,” said Anand Lunia, founding partner at India Quotient.

“A lot of our companies go out and raise money very soon, but we want to do less of that. We will put the first $1 million in the company ourselves and fund it for two years as most early-stage companies right now are getting funded for only 12 months,” said Anand Lunia, founding partner at India Quotient.According to Lunia, what differentiates the firm is its small team primarily comprising four partners, which is an exception given the size of the fund. Other partners at the firm include Madhukar Sinha, a former executive at Aavishkaar who has been with India Quotient since its early days, besides Prerna Bhutani and Gagan Goyal, both former entrepreneurs.

Some of India Quotient’s bets in areas like social, which include Sharechat and video sharing application Clip, and in financial technology like Lendingkart and Loantap have already attracted follow-on rounds of funding. Other notable companies in its portfolio include cosmetics brand Sugar, job portal IIMJobs and fashion portal FabAlley.

India Quotient will continue to focus on areas like financial technology, social and digital media, consumer brands and deep technology segments such as internet of things.

The fund expects to reach a final close in the next six months. Existing investors who have backed the fund include Flipkart co-founder Binny Bansal, Singapore-based family office RB Capital and venture debt firm Anicut Capital founder Ashvin Chadha.

“The massive challenges that India and developing world face in healthcare, finance, education can only be met by innovation. I believe the future in these sectors will be defined by entrepreneurs who use technology to offer solutions to the masses,” said Shetty, founder of UAE Exchange and London-FTSE-listed NMC Hospitals, on his investment in India Quotient.