Salesforce quelled speculation on Monday that it had been involved in a bidding war for MuleSoft, revealing in a filing that competition was not a factor in driving the price up to a hefty $6.5 billion.

Rather, MuleSoft was just insisting that Salesforce pay up, and quickly.

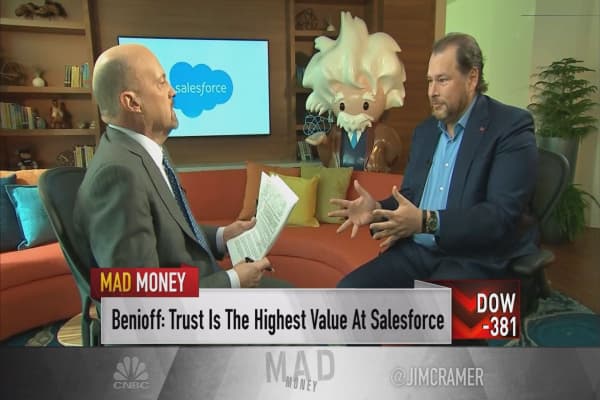

According to the timeline published by Salesforce, the cloud software vendor originally offered $38 a share for MuleSoft on March 2, half in cash and half in stock. Five days later MuleSoft CEO Greg Schott came back to Salesforce's Marc Benioff and said the price tag was $45 a share, and that the deal had to be announced by March 19.

Salesforce agreed, and the deal was made public on March 20, at $44.89 a share, a 32 percent premium over MuleSoft's stock price from the day before. It was more than twice the size of Salesforce's prior biggest deal — its $2.8 billion purchase of Demandware in 2016 — and according to some analysts was the most expensive software deal in history on an enterprise value to revenue basis.

The price was so high that analysts speculated there must have been a competing offer from Google, Microsoft, Oracle or SAP. Salesforce Chief Financial Officer Mark Hawkins was even asked about other bids on the conference call following the announcement and said only that the details would be published soon.

In the case of Demandware, another company was already in talks to buy it when Salesforce began the negotiation process, according to a filing. Salesforce was also in talks to buy LinkedIn, which was ultimately acquired by Microsoftfor $26.2 billion.