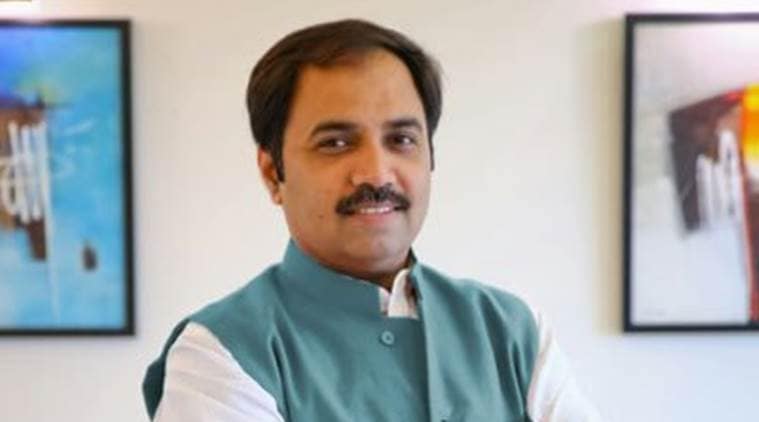

Maharashtra Minister for Labour and Skill Development Sambhaji Patil Nilangekar

Maharashtra Minister for Labour and Skill Development Sambhaji Patil Nilangekar

Maharashtra Minister for Labour and Skill Development Sambhaji Patil Nilangekar, a BJP leader from Latur who was booked by the CBI two years ago for allegedly being party to a criminal conspiracy for cheating the Union Bank of India and Bank of Maharashtra to the tune of Rs 49.30 crore, has reached a one-time settlement (OTS) of

Rs 51 crore with the two banks.

Confirming the development, Nilangekar told The Indian Express on Tuesday that the settlement was reached as per the laid down banking procedures. “All the necessary legal procedures have been followed in the case. The one time settlement has been reached with the two banks. And there is no violation of any law,” he said.

Nilangekar said Victoria Agro Food Processing Private Limited, for which he was a guarantor, had taken a loan of Rs 20 crore each from the Latur branches of Bank of Maharashtra and Union Bank of India. “The loan was taken in 2009,” he said.

The company paid the interest amount for initial two years. But from 2011, it failed to pay the interest and principal amount. The unpaid interest and loan amount had accumulated to Rs 76 crore and the loan got classified as a non-performing asset (NPA). “The company was auctioned for Rs 25 crore with both banks sharing the amount,” he said. As a result, the banks have waived Rs 51 crore as per the one-time settlement.

Confirming the move, Bank of Maharashtra deputy general manager in Pune, N Waghchavare said: “As per the settlement, the bank will get Rs 12.50 crore.” The loan amount was Rs 20 crore and the interest on it was Rs 21.75 crore. He said the decision regarding the one-time settlement was taken by the managing committee of the bank, which has at least 10 members. “The settlement was reached after following all the legal procedures that are required when a loan becomes an NPA,” Waghchavare said.

Nilangekar said he was a guarantor to the loan that was taken for setting up a grain-based alcohol plant in Latur’s Sakol. The company was run by Nilangekar’s brother-in-law in partnership with another individual. “I was only a guarantor and not the owner or the partner,” he said.

Chief Minister Devendra Fadnavis had defended Nilangekar during a discussion in the state assembly on July 22 in 2016. “It is incorrect and unfair to say that Nilangekar had committed some fraud or was party to it. A case has been lodged against him since he had stood as a guarantor to a loan borrowing firm,” Fadnavis had said.

In the FIR registered by its Banking Securities and Fraud Cell on March 23, 2014, the CBI

had accused Nilangekar of “commissioning offences of criminal conspiracy and cheating.” Nilangekar had dismissed the charges as “baseless and incorrect.”