Have added some new products in the last 2-3 years which also include components required for BS-VI, Sudhir Jain, Group CFO, Minda Industries.

Minda Industries has been one of the biggest multibaggers in the last 2 years. The stock is however down 11 percent in 2018 so far.

Sudhir Jain, Group CFO, Minda Industries with introduction of BS-VI norms and certain products like air bags and reverse parking systems have been made compulsory from July’19, has resulted into additional orders for the company.

In anticipation of these orders, we had invested into these product systems. All four wheelers will have to comply with these norms.

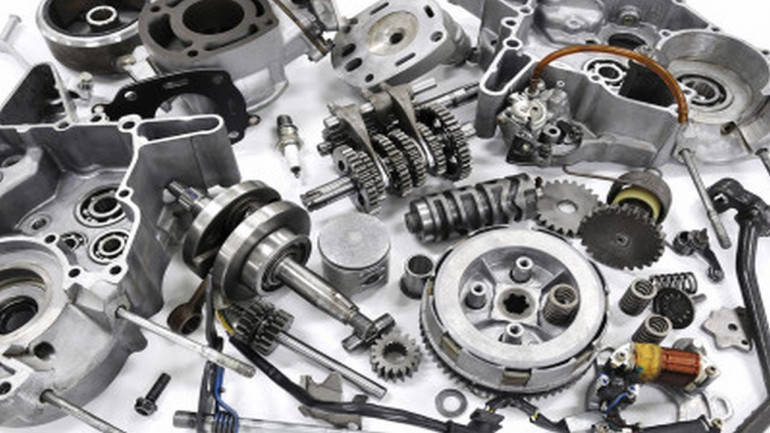

The auto component company makes around 20 different type of products for two-wheeler, four-wheeler, three-wheelers and off road, said Jain in an interview to CNBC-TV18.

The price point of air bags and reverse parking systems without camera are better than other products, said Jain.

Talking about performance of the company, he said the topline has been growing 25 percent CAGR, year after year and half the growth comes from existing products and rest growth comes from new products that the company adds each year.

They have added some new products in the last 2-3 years which also include components required for BS-VI.

He said as the economy and the per capita income improved, the demand for high-end vehicles went up.

The company is also into manufacturing alloy wheels and the penetration of alloy wheels from steel wheels has gone up 20 percent and is expected to go up to 30 percent in 2-3 years, said Jain.

With regards to margins, he said they are targeting 12.5 percent EBITDA in the next 2-3 years.