Speaking on the biggest banking scam in the country's history for the second time this week, the finance minister said that it was worrying to see employees conniving with fraudsters and that no red flag were being raised.

Regulators should have a "third eye" open to detect and check such frauds, he added.

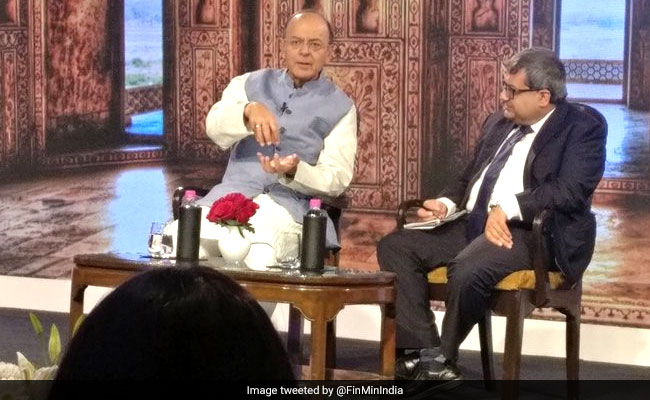

Speaking at the ET Global Business Summit, Mr Jaitley said the industry needs to get into the habit of doing 'ethical' business and that such frauds are "scars" and push reforms and ease of doing business to the background.

Unethical behaviour in the lender-borrower relation has to end, he said. "If needed laws will be tightened further to punish delinquent persons."

He also slammed bank management for failing to do their job saying inadequate supervision and top management being unaware of what was going on in the bank was worrying.

Comments

Prime Minister Narendra Modi had spoken at Global Business Summit organised by the Economic Times on Friday and said, "I want to make it clear that this government has been taking strict action against financial irregularities and will continue to take strict action. System will not tolerate loot of public money."Days after the Punjab National Bank (PNB) fraud -- allegedly masterminded by diamantaire Nirav Modi -- came to light, the prime minister asked the management of financial institutions as well as the supervisory bodies to do their job diligently to check such frauds.