Event Highlights

- BJP attacks Congress over PNB scam

- PNB on Rs 11,000-crore fraud

- Opposition Tears Into Govt

- Cong's Five Questions to Govt

- PNB's Statement

- Nirav Modi Says He'll Pay Back Loans

- Finance Ministry Seeks Status Report From ED

- Rs 1.79 Billion Worth Banking Fraud Reported Till December 21, 2017

- Nirav Modi in Switzerland?

- Priyanka Chopra Sues Nirav Modi

- Who Lent What to Nirav Modi

- How The Scam Came to Light

- Two PNB Officials Named

- Nirav Modi Leaves India

- Gitanjali Shares Take a Beating

Stay tuned as Aditya Nair brings you LIVE updates:

The Punjab National Bank (PNB) on Thursday said it had detected USD 1.77 billion fraud in which billionaire jeweller Nirav Modi allegedly acquired fraudulent letters of undertaking (LoUs) from one its branches for overseas credit from other Indian lenders. Complainant bank claims overseas branches used this fund to clear their own liability (of Axis Bank and Allahabad Bank). So far, 95 documents including import documents and application etc. have been seized.

Union Minister Ravi Shankar Prasad clarifies on Rs 11,400-crore Nirav Modi fraud case. He says, "Nirav Modi has bypassed banking channels and those who have tried to derail the banking system of the country will not be spared. The government has issued a lookout notice for fugitive Nirav Modi and there will be a thorough investigation. Taxpayer's money will not be lost. So far, we have seized Nirav's assets worth Rs 1,300 crore during this period...Nirav Modi was not part of the delegation of Prime Minister Narendra Modi. He came on his own. He did not meet the PM at all...Congress should not do politics of photos; we can also release the photographs of Congress leaders also, but we don't want to stoop to such levels. Revenue of Gitanjali Gems doubled between 2011 and 2013. With whose blessing did this happen? Congress president Rahul Gandhi attended Nirav Modi's private function in the past. What is the party's take on that?"

Speaking on the Rs 11,000-crore fraud, the Punjab National Bank (PNB) said:

- It is working to bring the perpetrators to book

- PNB has informed all banker about the fraud and

- Has capability and capacity to come out of the situation

- Will honour all the bonafide commitments

- Detected the fraud on 3rd week of January and approached the CBI on January 29

- Mainly, foreign branches of Indian banks were involved

- Already informed lenders during consortium meeting

- Will take full responsibility if investigations place the onus on PNB

- Fraud detected when the customer came for LoU renewal on January 25

- Not received any direction from CBI in this matter

- Have initiated recovery process and ED has begun attaching borrower's assets

Nirav Modi had left the country on January 1 much before the CBI received a complaint from Punjab National Bank on January 29 about a Rs 280-crore fraud, officials said. His brother Nishal, a Belgian citizen, also left the country on January 1, while wife Ami, a US citizen, and business partner Mehul Choksi, the Indian promoter of Gitanjali jewellery chain, departed on January 6, the officials said. The agency issued a look out circular against all the four after registering the first FIR against them, they said. A look out circular is issued by enforcement agencies to all exit and entry ports to inform them about the movement of an accused.

What questions PNB's role in the scam is that initial complaint of Rs 280 crore was filed on January 29 and exactly a fortnight later, on February 13, more complaints totalling Rs 11,000 crore were filed with the agency. The questions that arise before the intelligence agencies are a) Could PNB have conducted a forensic audit in a fortnight. b) The first letter PNB mentions that on 16th January noticed the fraudulent LOUs. Did PNB file a complaint late and allow Nirav Modi leave the country?

Opposition parties tear into the government over the PNB scam. They blame the BJP-led Centre for letting Nirav Modi slip through:

Guide to Looting India

— Office of RG (@OfficeOfRG) February 15, 2018

by Nirav MODI

1. Hug PM Modi

2. Be seen with him in DAVOS

Use that clout to:

A. Steal 12,000Cr

B. Slip out of the country like Mallya, while the Govt looks the other way.

#From1MODI2another

Look what happened at Punjab National Bank ? A scam of more than Rs 11,000 crore. People's savings are not safe. There must be a thorough, time bound enquiry

— Mamata Banerjee (@MamataOfficial) February 15, 2018

There is a pattern in how people who have defrauded Banks in India, are allowed to escape by the Modi govt https://t.co/f3rEXk3lfS

— Sitaram Yechury (@SitaramYechury) February 15, 2018

If this person had fled India before the FIR on Jan 31, then he is here, photographed at Davos with PM, a week before the FIR, after having escaped from India? Modi govt must clarify. #NiravModi #PublicMoneyLoot pic.twitter.com/gQQnKQNjDo

— Sitaram Yechury (@SitaramYechury) February 15, 2018

Congress spokesperson Randeep Surjewala has posed five questions to the central government. One, who is responsible? Two, Prime Minister Narendra Modi was informed about the irregularities on July 26, 2017. Prime Minister's Office had acknowledged it. Why were all the other ministries silent? No was action taken and the PM Modi even took Nirav Modi to Davos. Third, CBI was sent a letter to issues lookout notice against Nirav Modi, so that he does not escape from the country but still no action was taken, who helped him escape? Fourth, how was the entire system by-passed? How none of the auditors noticed this fraud shows that it was backed by some big person. Who is this person? Fifth, how did the risk management system and fraud detecting ability fail?

"We detected the fraud in the third week of January. We got to know that two of our employees conducted some unauthorised transactions. The bank initiated criminal action against our staff members. Mainly foreign branches of Indian banks, barring one, are involved. No person involved in this from our side will be spared. Nirav Modi and his group are coming out with some vague offers that are currently under consideration. This is a standalone incident in one of our branches. If the entire onus is on us, we will pay it. We are not backing out of it but nobody else will be a beneficiary of it," says PNB MD, Sunil Mehta.

"PNB is a 123-year-old institution. We have gove through many ups and down but come out on with flying colours. We have even faced the 1947 crisis. We want the media's help in spreading the work that the bank is doing all it can to stop these frauds. We were the first ones to detect and report these frauds which started in 2011. We are following our clean banking agenda. The bank has the capability and capacity to come out of the situation. We don't wish to speak much on the issue to not become a hurdle to investigations. We request you all to give us some breathing time and space. We will honour all our bona fide commitments. We do not encourage any wrong or fraud practices, we will take this up as a cancer cleansing process. We are committed to clean banking and we have told all our bankers informed of the issue. Out complaint has been lodged in the FIR, which is leading to raids on the culprits," says Sunil Mehta, Managing Director of PNB.

According to a report by IIM Bangalore, there has been a rising trend of non-performing assets (NPAs), especially for the PSBs, thereby severely impacting their profitability. Several causes have been attributed to risky NPAs, including global and domestic slowdown, but there is some evidence of a relationship between frauds and NPAs as well. The data reveals that more than 95 percent of fraud cases and the amount involved in fraud comes from commercial banks, according to the report.

The Reserve Bank of India defines fraud as “A deliberate act of omission or commission by any person, carried out in the course of a banking transaction or in the books of accounts maintained manually or under computer system in banks, resulting into wrongful gain to any person for a temporary period or otherwise, with or without any monetary loss to the bank”.

Information Technology Minister Ravi Shankar Prasad recently told Parliament, quoting Reserve Bank of India (RBI) data, there had been over 25,600 cases of banking fraud worth Rs 1.79 billion reported up to December 21, 2017. Data released by the RBI last March revealed that during the first nine-months of 2016-17, 455 cases of fraudulent transactions of Rs 100,000 and above were detected at ICICI Bank, 429 at State Bank of India, 244 at Standard Chartered Bank and 237 at HDFC Bank. Data shows 64 employees of State Bank of India, while 49 of HDFC Bank and 35 of Axis Bank were involved in facilitating these transactions. Between April and December 2016, a total of 3,870 fraudulent cases were reported involving Rs 177.50 billion, which were facilitated by 450 private and public sector employees.

Enforcement Directorate sources are telling CNN-News18 that Nirav Modi, the absconding prime accused in the Punjab National Bank (PNB) Rs 11,360 crore scam, is in Switzerland. Meanwhile, Top Ministry of Home Affairs (MHA) sources are telling News18 that there is no information yet on whether Nirav Modi has left India. They say it is the Enforcement Directorate's domain.

Actor Priyanka Chopra, the global brand ambassador of Nirav Modi diamond jewellery house, has sued the company for defrauding her. The actor has accused Modi of not paying her for the ad campaign. Meanwhile, Delhi CM Arvind Kejriwal is raising questions on the BJP-led central government. "Is it possible to believe that he or Vijay Mallya left the country without active connivance of BJP govt?" the Delhi CM questioned on Twitter.

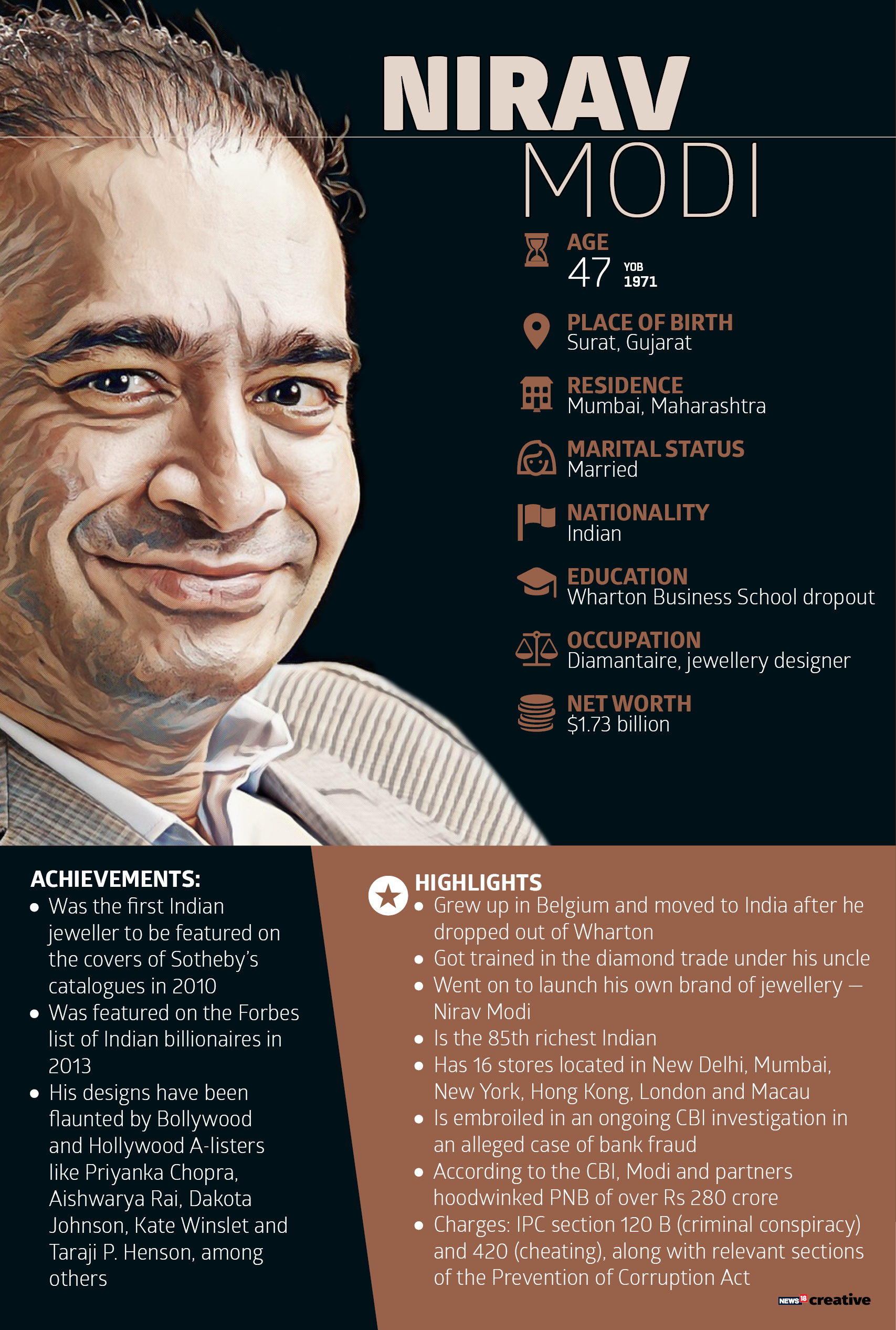

CLICK TO READ | Nirav Modi, the Wharton Dropout at the Centre of Punjab National Bank Scam

Hailing from Gujarat, Modi founded Firestar Diamond with a glitzy retail business in top cities of the world, including Delhi, Mumbai, New York, London, Hong Kong and Macau.

How The Scam Came to Light | On 16th January PNB noticed a set of fraudulent Letter of Undertaking for and on behalf of Neerav Modi companies. This came to light when these firms approached the bank with certain import documents and sought buyers’ credit for making payment to overseas suppliers. Since there was no sanctioned limit mentioned, the bank asked them to furnish 100% cash margin. To this the Modi firms contested sayijng they have been recieving the same in the past as well. But the branch records didn't show any such detail. Then it came to light that Gokulnath Shetty who retired in May 2017 and was working in the import section of Foreign exchange department from 2010 along with Manoj Kharat issued LOUs without taking due documents and did not make entries in the banking system to avoid getting detected

Sources have told CNN-News18 that two PNB bank officials, retired deputy manager Gokulnath Shetty and SWO Manoj Hanumant Kharat, were the first to be detected as working with Nirav Modi. The duo has been named in the FIR. About 10 more employees of the national bank have also come under the scanner of the enforcement directorate. The Central Bureau of Investigations (CBI) received a second set of complaints on Tuesday, and they have been looking into it ever since. Sources also added that searches were conducted on 21 locations on February 3 and 4. Of the total number, eight were on residences, including those of Nirav Modi and bank officials. Documents pertaining to details of accounts in Mumbai and Surat were seized from 13 offices.

12 premises related to Nirav Modi, including a showroom in Kala Ghoda area of Mumbai, is being raided by enforcement directorate officials:

PNB Fraud Case: ED team at Nirav Modi's showroom & office in Mumbai's Kala Ghoda. pic.twitter.com/3YQq4lyKNj

— ANI (@ANI) February 15, 2018

Clarifying its stand, Axis Bank said that it had sold down all the referred transactions with respect to PNB's letters of undertaking. Meaning, Axis Bank has issued dollar amounts based only on PNB’s request. Explaining the course of action Axis Bank usually takes, it said, “The bank undertakes transactions against LoUs issued by banks in normal course of business. The amount is then credited to Nostro account of LoU-issuing bank.”

Shares of Gitanjali Gems today plunged up to 19 percent in morning trade after the company came under scanner of various investigating agencies following the Punjab National Bank's declaration of nearly Rs 11,400-crore fraud. The stock today opened on a bearish note at Rs 48, then lost further ground to touch a low of Rs 47.50, down 18.94 percent over its previous closing price. Similar movement was seen on the NSE as well, where the stock tanked 18.73 percent to a low of Rs 47.50. Meanwhile, some of other jewellery stocks also witnessed similar fate with PC Jeweller slumping 19.50 per cent to Rs 303.00, Tribhovandas Bhimji Zaveri (TBZ) 4.32 per cent to Rs 110.60, and Thangamayil Jewellery 2 percent to 558.55 on BSE. Rajesh Exports fell 1.34 percent to a low of Rs 808.70 on BSE.

LIVE NOW

LIVE NOW