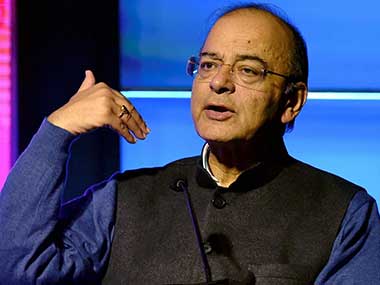

The Finance Minister has announced a populous Budget a year before the general elections in terms of policy announcements for the agriculture and healthcare sector. Notwithstanding, in the direct tax proposals, the Finance Minister has indicated certain changes which impact corporate India.

New regime for long-term capital gains tax with effect from 1 April, 2018: Long-term capital gains exceeding Rs 100,000 on sale of listed equity shares, units of an equity oriented mutual fund and units of an Infrastructure Investment Trust or Real Estate Investment Trust shall be chargeable to tax at 10 percent. The cost of acquisition in case of such securities acquired on or up to 31 January, 2018 shall be computed as higher of purchase price; or lower of sale consideration or fair market value as on 31 January, 2018 (being the highest price on the stock exchange in case of listed securities or net asset value for a unit which is unlisted).

Corporate tax rate for domestic companies having a turnover of Rs 2,500 million during the financial year 2016-17 shall be 25 percent. Equity-oriented mutual funds will be liable to pay tax on dividends distributed by them to unit holders at 10 percent with effect from 1 April 2018.

Transfer of certain securities (being Foreign Currency Convertible Bonds issued by an Indian company, Global Depository Receipts, rupee denominated bonds issued by an Indian company and derivative instruments) by a non-resident in an International Financial Services Centre shall be exempt from capital gains tax.

Alternate Minimum Tax for a non-corporate tax payer operating in an International Financial Services Centre shall be 9 percent.

Certain relief measures have been proposed in the computation of minimum alternate tax and carry forward of losses in case of change of shareholding of more than 49 percent with respect to companies undergoing insolvency proceedings.

Conditions to determine whether a business connection of a non-resident is created in India, have been modified so as to align it with the manner in which a dependent agent of a non-resident is constituted under the amended Permanent Establishment rule in the Multi-Lateral Instrument issued by the Organisation of Economic Co-operation and Development and to which India is a signatory.

Given the digitisation of various businesses which do not require physical presence of any person in India, the concept of ‘significant economic presence’ has been introduced. Significant economic presenceshall be determined based on the ‘revenue’ or ‘number of users’, the threshold of which will be decided after consultation with stakeholders.

The sunset date for incorporation for start-ups to avail a deduction from profits has been extended to 31 March, 2021 from 31 March, 2019. Also, the definition of eligible start-up has been expanded to include entities engaged in innovation, development or improvement of products or processes or services, or a scalable business model with a high potential of employment generation or wealth creation.

In the run-up to the Budget, corporate India had made various proposals which would give a boost to their business from a tax perspective. However, many of these presently remain unaddressed.

Click here for full coverage of Union Budget 2018.

(The writer is Tax Partner, EY; this piece has been co-authored with Anahita Kodia, Senior Manager (Tax), EY)

Published Date: Feb 10, 2018 11:22 AM | Updated Date: Feb 10, 2018 11:22 AM