Budget Highlights

Catch live streaming and live highlights of the Budget at www.news18.com/livetv.

Stay tuned as Aditya Nair, Ananya Chakraborty and Nitya Thirumalai bring you live Budget 2018 updates:

According to sources, Andhra Pradesh CM Chandrababu Naidu is very unhappy with the Budget and has asked party’s MPs in Delhi to escalate the issue. It was the last budget before the election in the state at the end of this year. Meanwhile, another TDP MP has come forward to express disappointment over the budgetary allocation for the state. “We from Andhra expected a lot. We're disappointed. There is no benefit to Andhra Pradesh. Till now all issues in the govt are pending. They gave so much to Karnataka, Maharashtra. This is our coalition govt. What will we say to the people?” asked CM Ramesh.

The mobile phone industry has appreciated the budget proposal to hike customs duty on mobile phones saying it will increase the share of local manufacturing. Finance minister Arun Jaitley today announced a hike in customs duty on mobile phones to 20 per cent from 15 per cent in a bid to boost local value addition in domestic electronics manufacturing. Chinese firm OnePlus that operates in premium smartphone category said around 85 per cent of all smartphones sold in country are now produced locally and this is an opportune time to introduce next set of regulations to attract investment in manufacturing. According to research firm Gartner the high-end devices are, however, likely to be impacted. "More than 80 per cent of mobile phone demand is met locally but premium, high-end smartphones still depends on imports which will get hit by proposed increase in duty. Increase in duty will further strengthen proposals under consideration for local mobile phone production," Gartner Research Director Anshul Gupta said.

Despite the Rs 40,000 standard deduction, there would be little relief to salaried class as benefits under the proposed deduction will be neutralised to a large extent by inclusion of transport and medical allowances and 1 per cent hike in health and education cess. Already the individual tax payer was getting benefit of Rs 19,200 under transport allowance and Rs 15,000 crore under the medical allowance. Both these components add to the tax benefit of Rs 34,200 crore per annum.

Salaried taxpayers and pensioners need not have to furnish any bills or documents to claim the standard deduction of Rs 40,000 announced in the budget, according to CBDT chief Sushil Chandra. "The budget, this time, has given a large benefit of flat Rs 40,000 as a standard deduction to the salaried class of taxpayers and pensioners. Earlier, some people were getting conveyance allowance and some medical allowance on the basis of production of bills but now we have removed all individual allowances on production of certain bills among others. It is flat Rs 40,000 to every salary earner. You can straightaway claim it," Chandra says.

Sudharshan Venu, joint managing director of TVS Motor Company, has given a thumbs up to the Budget “The Union Budget 2018-19 demonstrates government’s intent to boost investments in rural development, education, healthcare and social sectors and will lead to continued and inclusive economic growth. The strong push for infrastructure will also support this growth agenda. The government’s focus on supporting local manufacturing, skill development under Pradhan Mantri Kaushal Kendra and a heightened emphasis on job creation will lead to greater opportunities for the youth of the country,” he says.

Mamata Banerjee: BJP government at Centre is not fit for governance. This is an anti-common man budget. They have done nothing to control the rising fuel prices, they have not done anything for job creation. This is a super-flop budget. There is no mechanism to meet the projection. There is nothing which can be appreciated, the expectations were high but the country did not get anything to cheer about.

Immediately after Finance Minister Arun Jaitley presented the Union Budget, minister for petroleum and natural gas, Dharmendra Pradhan said petro products will be a part of goods and services (GST) soon. “Once GST settles down, petro products to become part of GST. GST will be a logical platform for petroleum products. Petro products under GST will help rationalise prices,” said Pradhan.

CLICK TO READ | Labour Unions, Including RSS Affiliated BMS, To Hold Nationwide Protests Against Jaitley's 'Fixed-Term Employment' Plan

BMS general secretary Virjesh Upadhyay said the Narendra Modi-led NDA II government has introduced this policy without consulting workers' unions, without any talks or consultations at all and such a policy can only be passed through a tri-partite agreement between factory owners, unions and government.

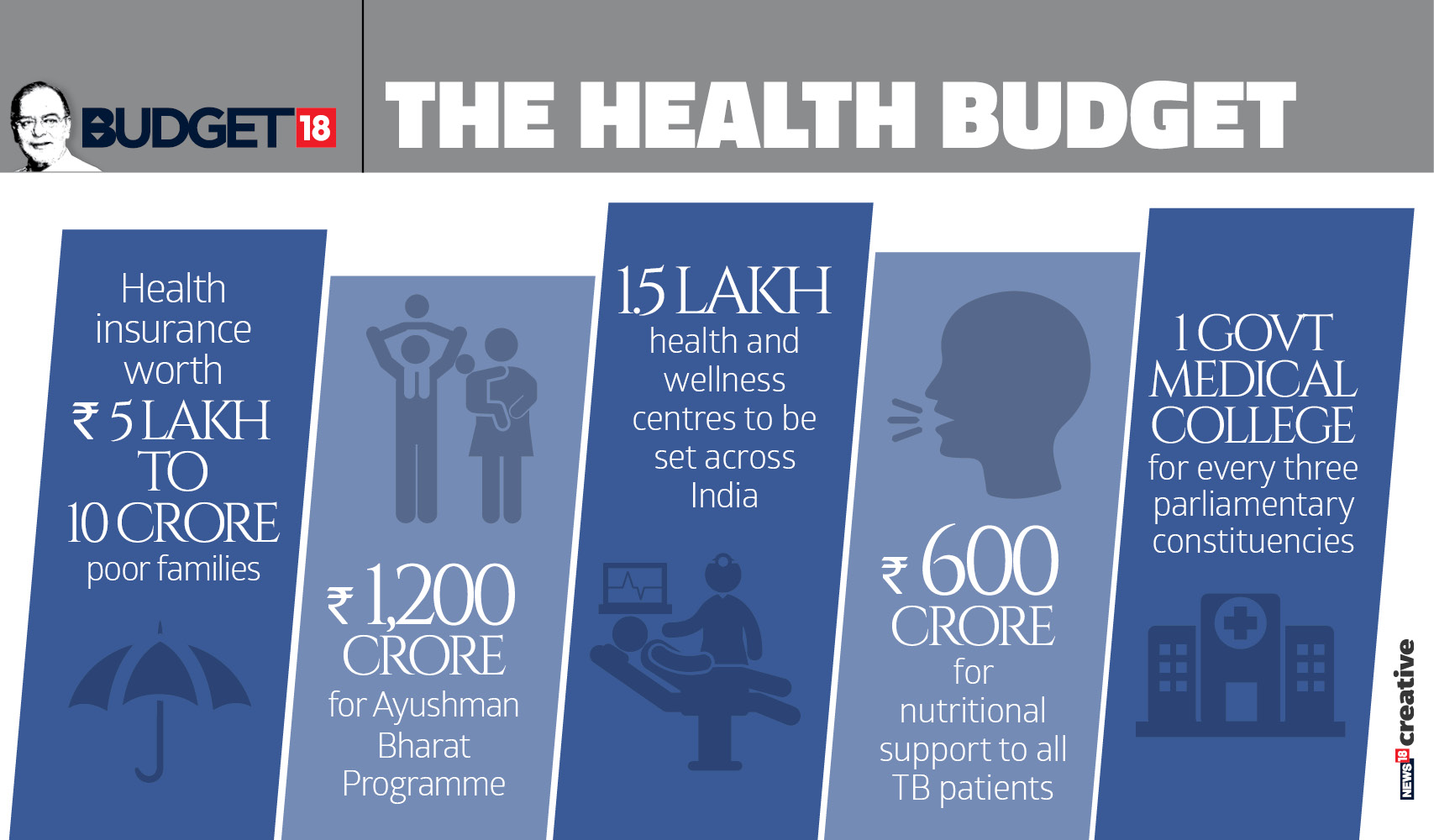

After Chidambaram, some doctors, too, have raised question marks over the implementation of the National Health Protection Scheme. “The problem is there is no effective implementation, no infrastructure or facilities for patients. Rather than only announcing scheme we must focus on making facilities available and proper implementation so it reaches patients,” a doctor from Kalaburagi in Karnataka says.

TDP MP RM Naidu says the party is very disappointed with the budget. “One of the major issues was special status. Nothing was said by FM for Andhra Pradesh. If you take states like Telangana, Tamil Nadu they have huge budget but Andhra has deficit budget. People feel cheated,” he says. The ties between BJP and its coalition partner TDP have been strained for a while and the Budget seems to have widened the cracks. TDP’s parliamentary party leader and union minister of state for science and technology, YS Chowdhary, also said that many pressing state issues like Railway Zone, Polavaram project funding, funding for capital Amaravati and other pending issues of AP are not addressed in the budget.

Defence Minister Nirmala Sitharaman said that the first defence corridor will be built between Chennai and Bengaluru. The announcement for the second corridor will be made soon, she said. Finance Minister Arun Jaitley has proposed two defence industrial corridors to promote domestic production in both public and private sectors. Jaitley said the government will focus on the creation of these industrial corridors to boost investments in the production of defence armaments. When asked about the share of defence budget in GDP being the lowest since 1962 China War, she said that one needs to be ‘realistic’.

Congress president Rahul Gandhi has hit out at the Modi government for its “failed promises” in the last four years, but said thankfully this government has only one more year to go.

4 years gone; still promising FARMERS a fair price.

— Office of RG (@OfficeOfRG) February 1, 2018

4 years gone; FANCY SCHEMES, with NO matching budgets.

4 years gone; no JOBS for our YOUTH.

Thankfully, only 1 more year to go.#Budget2018

Senior BJP leader LK Advani congratulated PM Narendra Modi and FM Arun Jaitley for a budget that “combines ambition and empathy of almost an unprecedented order”. He said that he could not recall any Budget that set such high goals, targets and commitments for the growth of all sectors of the economy and also for securing people’s welfare. Singling out the health protection scheme for praise, he said that earlier ‘Health for All’ was more or less a slogan, but now it will become a reality.

Finance Secretary Hasmukh Adhia has clarified there will be no change for consumers in petrol and diesel price. “Rs 2 excise on petrol and diesel is being reduced and this is being converted into cess. That is the only change we have made. Practically, there is no impact on the final price of petrol & diesel,” he says.

On jobs, the former finance minister said there were no new ideas in the budget and the government fell back on the tried and failed MUDRA scheme. The average loan under the scheme is Rs 43,000. This is mere tokenism, he says. He further said that the government seems to have given up on private investment and made no major announcements for it. He also attacked the Modi government and said there was no relief for middle class earners and savers. “The capital gains tax is also back. Only corporates have got benefit with a cut in levy,” he says.

Continuing his attack, Chidambaram said that even though the government has promised to pay farmers MSP of 1.5 times of production cost, there is no details on how this will be funded. But the biggest problem, Chidambaram said was the National Health Protection Scheme, which Jailtey dubbed the world’s largest such scheme. Calling it a jumla, Chidambaram said that if each beneficiary avails benefits of Rs 50,000 the annual expenditure will be Rs 5 lakh crore per year. “Where will the money come from,” he asks.

Senior Congress leader and former finance minister P Chidambaram tore into the Union Budget 2018, listing point by point the “failures” of the government. First failure, he said was fiscal deficit. The government has failed the fiscal consolidation test and crossed all its previous estimations. It had set a target of 3 percent but has set a revised estimate of 3.3 percent for FY19. Secondly, the government has no news ideas on how to boost exports. The Modi government has run out of ideas. PM Modi had talked so much about it in his address in Davos, but his government has forgotten all about it, he says.

On being asked about where the funds will come from for ambitious schemes like helath protection scheme that gives cover of Rs 5 lakh to 10 crore families and to pay 1.5 times MSP to farmers, Piyush Goyal said that his government is fiscally prudent and not corrupt like the previous government, so fund generation will not be a problem.

Civil aviation ministry will receive an increased budgetary allocation of Rs 6,602.86 crore in the next financial year, with a significant chunk kept aside for purchase of "two new aircraft" to be used for VVIP flights. The allocation is nearly three times higher than the amount of Rs 2,710.31 crore allocated to the ministry for this fiscal. In the Budget for 2018-19 presented today, an allocation of Rs 6,602.86 crore has been made for the ministry. Out of the total amount, Rs 4,469.50 crore would be for "purchase of two new aircraft for special extra section flight operations", as per a Budget document. The two new planes - Boeing 777-300 ER - would be used for VVIP operations.

Railway Minister Piyush Goel, speaking to CNN-News18, rejected claims that a pro-poor budget has been delivered for electoral gains in Madhya Pradesh, Chattisgarh and Rajasthan, all states that have a substantial farmer population and will go to polls before the end of the year. He said that this government has been working for this sector all these years and this budget carried forward the thrust in this direction. He said game changing decision like National Health Protection Scheme and the increased outlay on agriculture, horticulture and fisheries were the need of the hour.

When Arun Jaitley was reading out the Budget, Prime Minister Narendra Modi was often seen vigorously thumping the desk, prompting his cabinet colleagues and NDA MPs to follow suit. Modi also kept encouraging his finance minister. The loudest thumping of desk by the PM was witnessed when Jaitley spoke about the Pradhan Mantri Ujjwala Scheme, which was followed by his announcement of the National Health Protection scheme to cover 10 crore poor and vulnerable sections.

TDP VS BJP Over Budget?

NDA alliance partner Telegu Desam Party has also criticized the budget. Amid strains between the coalition partners, TDP’s parliamentary party leader and union minister of state for science and technology, YS Chowdhary said “We are disappointed with the Union Budget. Many pressing state issues like Railway Zone, Polavaram project funding, Funding for capital Amaravati and other pending issues of AP are not addressed in the budget,” he says, adding that AP Chief Minister Chandrababu Naidu will hold a meeting in Amaravati on this Sunday to discuss these issues.

Calling it a visionless budget, Karnataka chief minister said there were no allocations for the health sector. He said although the government made an ambitious promise for housing for all by 2022, there was no budget allocation for it. “Special Purpose Vehicle for suburban rail was also mentioned. The burden for this will be on the state govt only. We will have to repay the loan. Social welfare, agriculture, health all saw very little allocations in this budget. Managing the 3.3% fiscal deficit also won’t be possible,” he says.

Highlights of 'Ayushman Bharat' programme

- Govt to launch a flagship National Health Protection Scheme to cover over 10 crore poor families providing coverage up to Rs 5 lakh per family every year for hospitalization.

- Govt earmarks Rs 56,619 crore for SCs and Rs 39,135 crore for STs in FY'19.

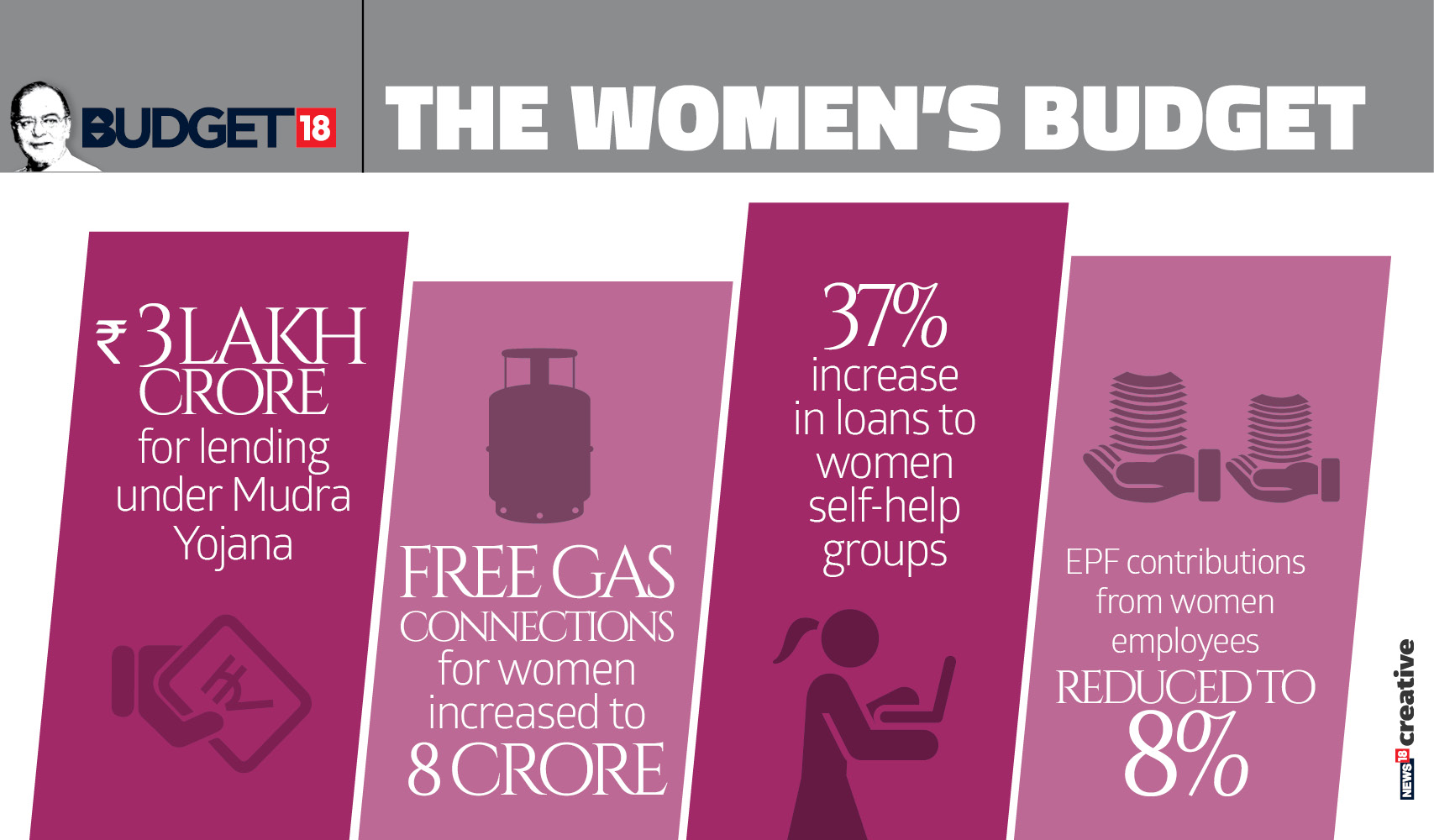

- Sets target of Rs 3 lakh crore for lending under MUDRA scheme.

- Substantial increase I n allocation of National Rural Livelihood Mission to Rs 5,750 cr in FY'19.

Budget Hikes Custom duty

- Customs duty on mobile phones increased from 15% to 20%; also on certain parts of TVs to 15%.

- Customs duty on crude edible vegetable oils hiked from 12.5% to 30%; on refined edible vegetable oil from 20% to 35%.

- Customs duty on perfumes, dental hygiene, after-shave, deodorants, room deodorisers, preparations for use on hair doubled to 20%.

LIVE NOW

LIVE NOW