Royal Caribbean Is Picking Up Steam as Cruise Demand Accelerates

By-

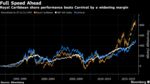

Shares sail to new highs as operator forecasts strong demand

-

Ship improvements aid outperformance against peer Carnival

Royal Caribbean Cruises Ltd.’s share performance has trounced its biggest competitor as well as the broader market for years. Following its latest earnings report, 2018 outlook and three-year earnings target, analysts continue to see smooth seas ahead.

The Miami-based cruise operator saw its shares reach their highest level ever this week after posting year-end results. The stock has risen ten-fold since its market debut in 1993, outperforming competitor Carnival Corp. by almost 4,000 basis points and the S&P 500 Index by about 3,710 basis points.

Royal Caribbean’s net yields, a closely watched measure of how well cruise lines are doing, showed growth in 2017 that Chief Financial Officer Jason Liberty called “the best in more than a decade,” increasing 6.4 percent. And the yields, which account for ticket prices and on-board spending while leaving out variable costs such as commission and transportation, are forecast to grow 1.5 percent to 3.5 percent this year.

The share outperformance comes as revenue yields have been accelerating for all cruise operators amid strong demand. For its part, Royal Caribbean’s ship-hardware improvements and cost efficiencies have contributed more toward operating-margin expansion and faster earnings growth than Carnival over the last decade as the company made double-digit returns on capital a strategic priority, according to Bloomberg Intelligence analyst Brian Egger.

While the midpoint of Royal Caribbean’s 2018 yield forecast trailed the mean estimate of 2.98 percent compiled by Consensus Metrix, the company continues to be quite optimistic as demand shows no sign of abating, according to Liberty. Bookings over the past three months are even stronger than last year, in both load factor and rate. The booking window, or the number of days in advance trips are being reserved, “continues to extend,” he said in a phone interview.

‘Considerable Upside’

Analysts also remain decidedly bullish, with 19 buy ratings, six holds and no sell recommendations, despite the below-consensus yield target. Bernstein’s David Beckel described the company’s profit and net-revenue yield guidance as “way too low,” setting up Royal Caribbean “solidly for another year of beat-and-raise.” Stifel’s Steven Wieczynski sees “considerable upside” to both forecasts.

Liberty underscored an acceleration in on-board spending that Royal Caribbean has been seeing. Passengers continue to shell out money for experiences rather than material goods, and are spending more on food, beverages and excursions. They also seek customization for multi-generational and more personal experiences, he said.

Bears have been backpedaling from Royal Caribbean as well. Less than 0.6 percent of the shares available for trading were sold short this week, according to data compiled by IHS Markit. That’s down from an eight-year high of 8.5 percent at the end of December 2016.