New Delhi: The all-powerful GST Council cut tax rate on 29 goods, including second-hand vehicles, confectionery and bio-diesel, while veering around to simplifying return filing process for businesses. Also, tax rate on 54 categories of services, including certain job works, tailoring services and admission to theme parks, have been lowered.

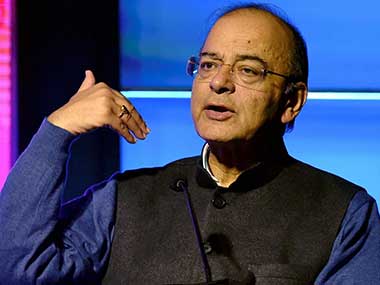

The panel at its next meeting may also consider bringing under the Goods and Services Tax (GST) purview items like petroleum and real estate which are currently outside the new regime, Finance Minister Arun Jaitley said.

The Council cut GST rate on second-hand medium and large cars and SUVs from 28 percent to 18 percent and on other old and used motor vehicles to 12 percent.

Tax on diamonds and precious stones was slashed to 0.25 percent from current 3 percent.

While tax rate for bio-diesel was slashed to 12 percent from 18 per cent, that for public transport buses run on environment-friendly bio-fuels has been reduced to 18 percent from 28 percent previously.

Tax rate on irrigation equipment, sugar boiled confectionery, drinking water packed in 20-litre bottles, fertiliser grade phosphoric acid, tamarind kernel power, mehendi paste in cones, LPG supplied by private distributors, articles of straw, velvet fabric and rice bran was also cut. The new rates would be effective from 25 January.

The Council, in its 25th meeting on Thursday, also discussed process to make return filing simpler with just one return to be filed every month.

Infosys non-executive chairman Nandan Nilekani made a presentation on simplification of the return filing process. The Council discussed the possibility of retaining only GSTR-3B or initial sales return, while mandating sellers to upload their invoices.

Jaitley said the GSTR-3B and the invoices can be matched by tax officers; and in case of difference, at a later stage businesses can be asked to explained.

"It was finally culminating into filing 3B returns and supplier invoice, which would be adequate," he said, adding that the Bihar Deputy Chief Minister Sushil Modi, GSTN chairman Ajay Bhusan Pandey and Nilekani would formalise the structure and a final decision would be taken at the next meeting of the Council. Asked if filing only one return is the way forward, he said "that seems to be the course".

Businesses at present have to file GSTR-3B as well as GSTR-1, which is the final invoice wise sales returns. Jaitley said the next meeting may also consider bringing items that are currently in GST within the new tax regime.

The Goods and Services Tax (GST) was rolled out from 1 July, 2017 by subsuming most of the Central and State indirect taxes into a single tax. But, crude oil, natural gas, diesel, petrol and ATF have not been included in the ambit of GST as of now. Also, real estate was kept out of the GST.

The minister further said that a nation-wide roll out of e-way bill will happen on 1 February for inter-state transportation of goods through roads. Additionally, 15 states have said they will also start off with e-way bill for intra-state movement of goods on the same day. "Therefore, the trade and transport industry have to comply with," he said, adding that the e-way bill would act as anti-evasion measure.

In view of declining GST revenues, the Council, chaired by Jaitley and comprising his state counterparts reviewed the collections in the new indirect tax regime.

Jaitley said so far the government was relying on unilateral declaration made by the business, and in view of declining collections, there was a need for anti-evasion measure.

"So far it was voluntary compliance without anti-evasion measures. With all anti-evasion measures put in place, the collections will pick up," he said.

The GST revenue mop-up has been steadily declining over the month as from over Rs 95,000 crore collected in July, it has come down to about Rs 81,000 crore in November.

Jaitley further said that tax revenues from businesses opting for composition scheme was a matter of "serious concern" as 17 lakh businesses who have opted for the scheme have paid a cumulative tax of Rs 307 crore in the first quarter. "There seem to be under declaration as far as collections from composition scheme are concerned," he said.

Some tweaking in the scheme is expected when the Council discusses amending the Central GST, State GST and Integrated GST Acts in its next meeting, which will be held through video conferencing.

The amendments to these laws would be placed before Parliament in the second leg of Budget session. The first phase of the session will be from 29 January to 9 February. After a recess, Parliament will meet again from 5 March to 6 April. Besides, in view of a hefty Rs 35,000 crore unclaimed credit lying in form of IGST collections, the Council also decided to provisionally divide the amount equally between the

Centre and states.

"It will ease indirect tax position of the Centre and states. In direct taxes, we are ahead of target... In last few months, direct tax has grown substantially," he said.

Besides, the Council also accepted the report of the CBEC Chairperson Vanaja Sarna headed committee on handicraft sector. Now the fitment committee will decide on which handicraft items the rates could be lowered.

Experts react

Deloitte India Director M S Mani: It is expected that an announcement on the return simplification process in the next meeting in ten days would be good if the views of industry are also taken into account in the process as the taxpayers would have many useful suggestions to offer. It appears that the some anti evasion measures will be rolled out over a period of time starting with the e-way bill. - this seems to be influenced by the lower collections in the past two months.

It is clear that the e-way bill is only the first step in curbing GST leakages, several more steps such as reintroduction of reverse charge on transactions with unregistered dealers, scrutiny and audits should now be expected the reduction in rates on several services and goods which are highly employment oriented indicates that the government has considered the larger economic impact of GST the fact that 15 states are rolling out the e-way bill for transactions within the state from 1st February, although they had time till 1 June, indicates that there is significant concern on introducing anti evasion measures. We should expect more steps such as reintroduction of RCM to follow.

Pratik Jain, Leader-indirect Tax, PwC: Two most crucial decisions in terms of simplification of return process and most legislative changes have now been deferred to next meeting. While simplification and merging multiple monthly returns into a single return would be good in concept, it needs to be ensured that invoice level details are made available to the buyers on a real time basis so that remedial action can be taken without waiting for assessment or audit.

Rates have again been rationalized on few items, which is a step in the right direction. One would expect that over next few months, this process would continue, particularly with respect to 28 percent category, which should only be for select luxury and demerit products. In many cases like works contract services or used motor vehicles the reduction of rate might have been due to restriction of input credit. Therefore, there is a good case to further liberalize the input credit regime.

There are indications that reverse charge levy on purchase from unregistered businesses could come back for composition dealers, which is important to plug the possible tax leakage. The highlight of the meeting was focus on 'anti evasion' measures due to dip in revenue collection. This could mean tightening of tax administration over next few months, which industry would need to be prepared for.

Vishal Raheja, DGM, Taxmann: It was highly expected that GST Council would decide the fate of petroleum products under GST to remove cascading effect but unfortunately no decision has been taken yet. Also, all powerful GST Council has not finalized single form return under GST which was the main agenda of meeting. But it is important to note that GST on 29 handicrafts items have been reduced to zero percent which will increase competitiveness in international markets and exports will increase which in turn boost economy. One another major decision which is taken today is to implement mechanism of e-way bill from 1 February.

Abhishek Jain, Tax Partner, EY: Keeping in mind the revenue evasion concern, the Union Finance Minister reiterated introduction of E-way Bills w.e.f. February 1, 2018 for inter-state transactions. Further, 15 States have decided to implement E-way Bills for intra-state transaction as well w.e.f. February 1, 2018 even though they had an option to do it on or before June 1, 2018. Accordingly, it will be very critical for the industry to immediately set up processes around the entire E-way Bill requirement and also train their supply chain team and transporters in this area. Also it is important that the Government portal for issuing E-way bills works bug-free. If either the industry is not ready or the Government IT system is not smooth, it may result in a severe supply chain bottleneck.

Priyajit Ghosh, Partner, Indirect Tax, KPMG in India: A lot of decisions were expected out of the 25th meeting while not many of them appears to be finally decided for implementation. However, it appears that progress has been made on a few relatively complex areas such as simplification of return filing system, tweaking the composition scheme, introduction of reverse charge on certain transaction.

Consensus appears to be in favour of continuance of summary level filing and invoice level supply filing, in some form, instead of detailed 3 return monthly filing system. E-way bill system to be implemented from 1 February is likely to see enhanced level of enforcement as the Government banks on the system to arrest the declining GST collections. No lesser expectation is from the next council meeting, ahead of the Union Budget by the end of this month, which is likely to finalize many aspects including first discussion on inclusion of real estate and petroleum products in GST.

Abhishek A Rastogi, Partner, Khaitan & Co: With an object of generating employment and ease of doing business, certain key decisions have been made. As a corollary, rates were amended for 29 goods and 53 services. This is indeed a populist move including decision of 40 handicraft items. Another important measure is with respect to Form 3B which will continue but has been simplified. The suppliers invoices remain a basis for tax payment and credits claimed.

As an anti-evasion measure, E-way bill to be operative with effect from February 1 for inter-state transactions. 15 States have announced it even for infra-state transactions. This time the compliance starts after robust system testing. While the direct tax collections are well ahead of target, the indirect tax collections needs to be closely watched especially in light of huge IGST credit and transitional credits.

Vinay Sethi, Head, Market Development, Tax and Accounting, Thomson Reuters, South Asia: The 25th meeting of the GST council held against the backdrop of falling GST collections resulted in some positives such as reduction of GST rates on handicraft goods as the higher rate of GST would have adversely impacted the large population employed in handicrafts industry; reduction in rates of multiple services; expediting of efforts towards simplification of return filing process and consolidation of GSTR-1,2 and 3; commitment to bring the petroleum products and real estate under the purview of GST sooner than later.

Mandatory Issuance of inter-state e-waybill from next month is an anti-evasion measure that the government has introduced and it is important that the platform provided to businesses is robust to provide hassle free compliance of the e-way bill process.

(With PTI inputs)

Published Date: Jan 19, 2018 07:47 AM | Updated Date: Jan 19, 2018 08:12 AM