EUR/USD: Break Below $1.2000 Opens Way To $1.1950

The EUR/USD is trading in a consolidative mode at the beginning of the second trading week of 2018 with the main currency pair falling as low as 0.4 percent breaking $1.2000 hurdle on its free fall lower.

The EUR/USD was benefitting from the US Treasury yield stagnation and the overall optimism for the European economy, especially after last Friday’s non-farm payroll data came out at 148K missing the expectations of a 190K increase.

The net long positioning of the market has also been demonstrated by CFTC report that showed another jump to a new multi-year high in long Euro positions. The FX market discounts the CFTC report and amid lack of fundamental data sold the EUR/USD past psychological support level of $1.2000 to target $1.1950 representing 38.2 percent Fibonacci retracement of current upmove from $1.1717 to $1.2088.

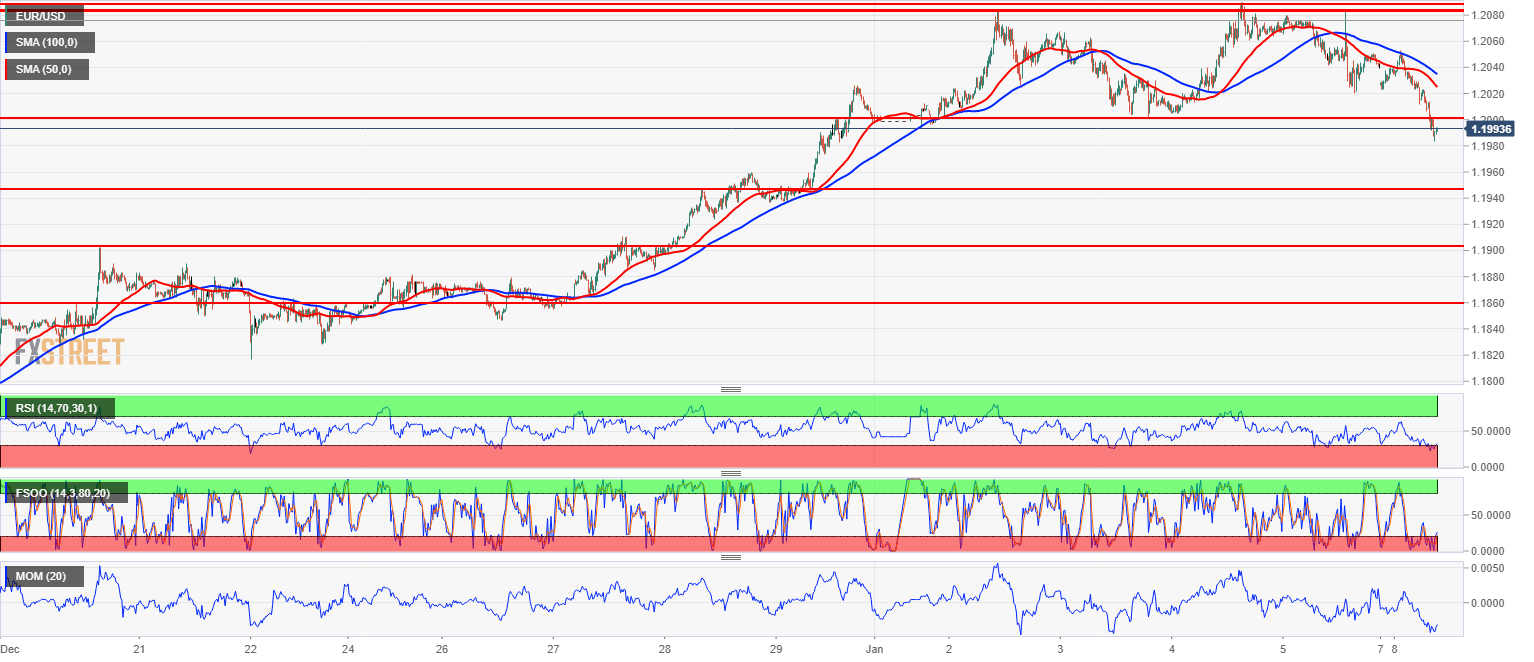

Technical indicators are pointing lower on 15 minutes chart with both the Relative Strength Index and Fast Stochastics moving into the Oversold territory on Monday. The Momentum indicator is in negative territory but has a potential to fall lower.

With EUR/USD returning back above $1.2000, the corrective move on EUR/USD is considered over with $1.2088 immediate target on the upside.

Should momentum of the corrective move lower sustain, $1.1950 representing 38.2 percent Fibonacci retracement of current upmove should be the next target.

EURUSD 15 minutes chart

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2018 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.