GBP/USD Forecast: Cable At The Upward Trendline Support

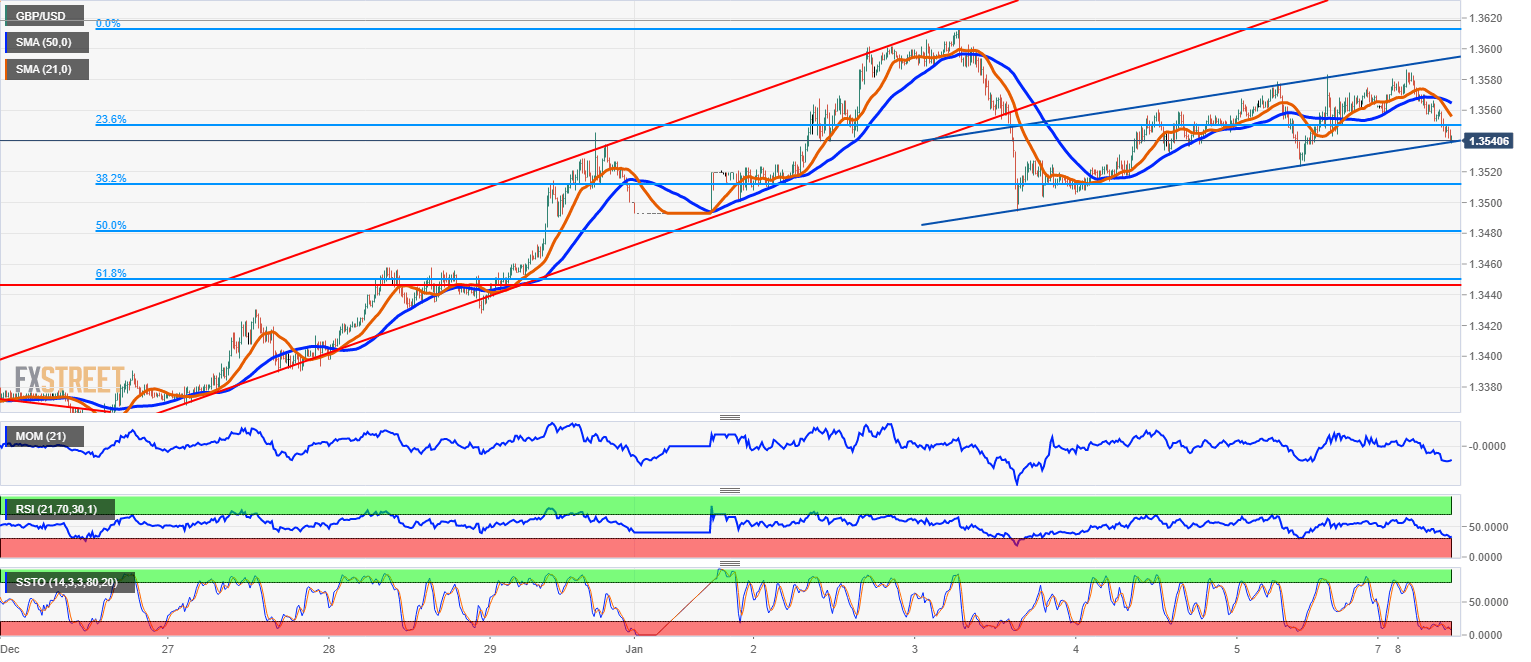

The US Dollar is in a consolidation phase after falling lower at the beginning of 2018. The GBP/USD is trading slightly lower at 1.3540, testing the upward rising trendline support line.

As there are second rank data due in the economic calendar this week, the FX market is likely to shift its attention to political issues with the talk of Theresa May’s government reshuffle dominating the domestic agenda this week.

As it is highly unlikely for May to change her key ministers like Chancellor Philip Hammond, Brexit Minister David Davis, and Foreign Secretary Boris Johnson. May is going to appoint a new minister responsible for managing Brexit ‘No Deal’ contingency plans, but this is unlikely to move currency markets much.

The technical indicators are therefore likely to dominate. The GBP/USD is currently trading within the upwardly rising channel with lower boundary starting at $1.3490 on January 3, 2018.

The technical oscillators are at lower levels with the Relative Strength Index approaching Oversold territory and the Slow Stochastics being heavily in Oversold condition.

Should the lower boundary of the upwardly rising channel trendline at $1.3535 hold, the GBP/USD is likely to rebound up toward $1.3570-$1.3600.

Given the trend exhaustion, the limit on the downside is likely to be at $1.3510 representing 38.2 percent Fibonacci retracement of the upmove from $1.3350 to $1.3615.

GBP/USD 15 minutes chart

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2018 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.