MANILA, Philippines — Trade Secretary Ramon Lopez has urged critics of the newly enacted Tax Reform for Acceleration and Inclusion (TRAIN) Act to be “objective” and study it first so that they would understand its benefits, following claims that the measure was anti-poor because it would lead to higher consumer prices.

Critics have also threatened to challenge its legality before the Supreme Court (SC).

“Those kinds of remarks, I would say rhetoric, are always used even if they are baseless. If the provisions of the TRAIN are studied... if we are reasonable, we would understand its benefits. We just have to be objective and look at the numbers,” Lopez told state-run radio station dzRB last Saturday.

Lopez said the TRAIN law would pave the way to a “virtuous cycle” because it would generate additional revenues that can fund infrastructure projects like roads, bridges, railways and airports.

“If we have infrastructure, production costs would be lower and there would be more investments because they will be encouraged,” he said.

The Duterte administration is unfazed by the opposition’s plan to question the tax reform law before the SC, also describing their claims as baseless and insisting that the measure would create a “virtuous” cycle in the economy.

Presidential spokesman Harry Roque said the administration is prepared to defend the TRAIN law before the high court.

“Taxation is one of three inherent powers of a state. Hence, it enjoys overwhelming presumption of constitutionality. We can defend it in court,” Roque said in a text message yesterday.

The TRAIN law, the first package of the Duterte administration’s tax reform program, is seen to generate P120 billion in additional revenues. It exempts those earning an annual taxable income of P250,000 and below from paying the personal income tax and raised the tax exemption for 13th month pay and other bonuses to P90,000. Officials said the provision on income tax would benefit 99 percent of income taxpayers.

But the law also imposes new taxes on diesel, liquefied petroleum gas, kerosene and bunker fuel for electricity generation and higher taxes on other oil products.

Opponents of the new tax law fear that the adjustments on fuel will lead to drastic increases in transport fares, electricity costs and consumer prices.

The Makabayan bloc of lawmakers at the House of Representatives has announced a plan to question the legality of the TRAIN law before the SC this week.

Alliance of Concerned Teachers party-list Rep. Antonio Tinio said the ratification of the TRAIN law last month was invalid because of the lack of quorum. He also claimed that the law would cause sufferings to 16 million poor Filipinos who would be burdened by higher commodity prices.

Despite the criticisms, Lopez insisted that the law was “pro-poor.”

“The reforms will bring a very positive cycle in the economy because our countrymen will enjoy a higher take-home pay. They have more money to spend and this will benefit the economy,” Lopez said.

“This is pro-poor because minimum wage earners now have extra income. They have bigger take-home pay,” he added.

The economic team is expected to submit the second package of the tax reform program to Congress this month. The second package will contain provisions on corporate income tax.

Financial woes for OFWs

Overseas Filipino workers (OFWs) face financial woes with the pending implementation of the TRAIN law and other additional taxes.

Leaders of the local recruitment industry yesterday advised Filipinos abroad, particularly those staying in Saudi Arabia and the United Arab Emirates (UAE), to adopt savings plan to cushion the negative impact of higher taxes.

Recruitment official Lito Soriano said though not directly, OFWs are still likely to be hit hard by the TRAIN law.

“Prices of goods and services their families here are using will go up due to TRAIN and since most OFWs are the breadwinners they would be affected, too,” Soriano explained.

Remittances may not be subject to taxes, but Soriano said banks and money transfer companies impose “transfer charges” which are covered by taxes.

“Remittance transfer charges within the Philippines are subject to tax levy and OFWs or their families will have to pay for these,” Soriano explained.

Other recruitment officials said OFWs who will decide to put up new business will also have to pay taxes under the TRAIN law.

Aside from the TRAIN law, Soriano said OFWs in Saudi Arabia and UAE must also pay value added tax (VAT) that the two Arab countries have started imposing since Jan. 1.

Soriano said the governments of Saudi Arabia and UAE imposed five percent VAT on most goods and services to boost revenue after oil prices collapsed three years ago.

“Goods and services in Saudi and the UAE used to be tax-free, that is why many of our OFWs are now complaining because the new taxes will cut down their income,” Soriano said.

Oversight panel for monitoring

Meanwhile, the Senate committee on energy will form an oversight panel to monitor the implementation of the increased excise taxes on fuel to curb abuse by unscrupulous traders and help slow down the expected price increases of basic commodities, Sen. Sherwin Gatchalian said yesterday.

Gatchalian, chairman of the committee, said the oversight body will closely monitor the implementation of the TRAIN law, particularly the provisions on the imposition of excise taxes on petroleum products.

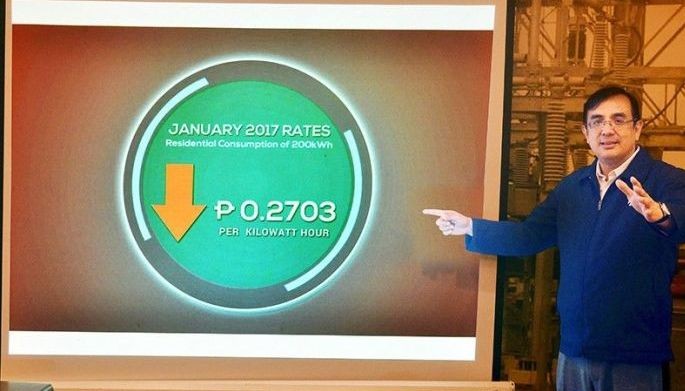

The TRAIN law imposes an excise tax of P2.50 per liter on diesel and bunker fuel starting this year, P4.50 in 2019 and P6 in 2020.

For gasoline, the excise tax will be increased from P4.35 per liter to P7 this year, P9 in 2019 and P10 in 2020.

“We will launch the oversight body, especially that the situation is critical now with the expected price increases,” Gatchalian told dzBB.

He said he sees the subpanel meeting regularly, as often as once a month.

The senator said the panel can get data from various agencies on the importations of oil companies to check their inventories as well as pricing.

Gatchalian said the projected increases in pump prices due to the new tax law should not kick in until next week as oil companies still have old inventories of fuel.

He also prodded the Departments of Finance (DOF) and Social Welfare and Development (DSWD) to immediately implement the P300 monthly subsidies for 10 million poor families to help cushion the impact of the TRAIN law.

Gatchalian said lawmakers agreed to increasing excise taxes on fuel on the condition that the DOF and DSWD will immediately implement the subsidy program. – With Mayen Jaymalin, Paolo Romero

Twitter

Twitter Google+

Google+ RSS Feed

RSS Feed Contact Us

Contact Us