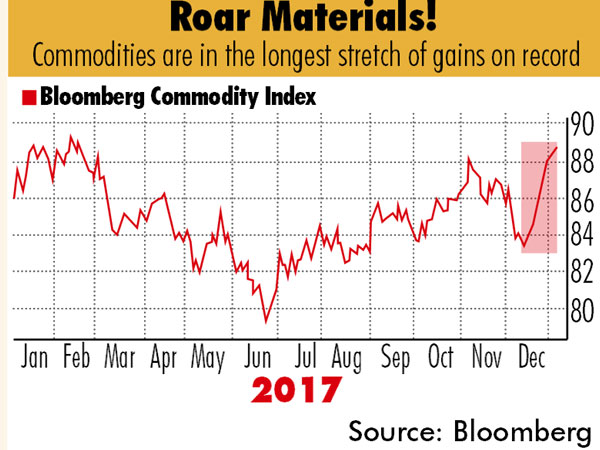

Recovering economic sentiment across the world, particularly in China and the US, has resulted in commodities rallying globally in the last two weeks, after years of volatility. India was no exception. While yellow metal glittered, rising to its highest levels in over three months (spot gold hit $1311.14 an ounce, its highest level since September 2017), base metal too was seen wavering near their recent highs.

This was buoyed by expectations on demand and sanguine economic data from China. Consumption of non-ferrous metals remains in excess of supply as on date, resulting in deficits in the global demand-supply balance. The deficits are largely results of production setbacks across the three key non-ferrous metals, viz. aluminium, copper and zinc, despite muted consumption growths in copper and zinc, experts pointed out.

In the weeks ahead, Chinese credit data and central bank policy will be key to determining whether the gains continue, said Max Layton, the EMEA head of commodities research at Citigroup Inc. “The only reluctance that people have in terms of getting more bullish on metals and bulks is that China has clearly shifted the tone from growth targets to quality over quantity, and people don’t know what that means yet,” Layton said. “Chinese credit numbers are going to be critical to setting the tone for H1, and I think they’re going to be fine,” he added.