Credit Suisse Gains An Appetite For Domino's Stock

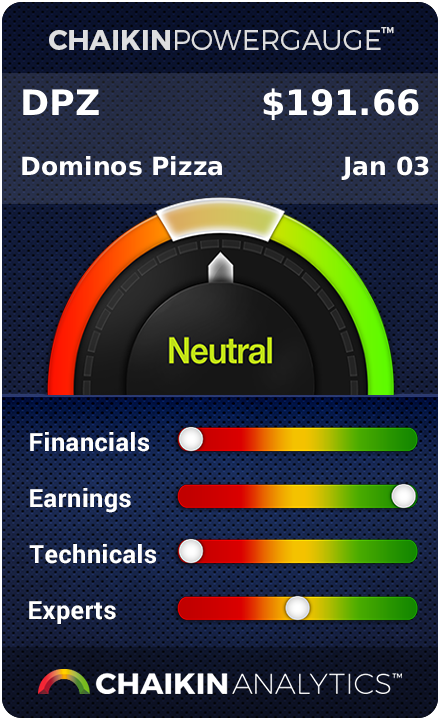

The bull vs. bear debate surrounding Domino's Pizza, Inc. (NYSE: DPZ) will likely continue throughout 2018 but one Wall Street analyst decided to join the bull camp.

The Analyst

Credit Suisse's Jason West upgraded Domino's' stock from Neutral to Outperform with a price target boosted from $205 to $220.

The Thesis

Domino's' stock has fallen more than 10 percent from its all-time high of $221.58 as bears are quick to highlight competitive concerns from third party delivery services and "choppiness" in international sales, West said in a note. But the pullback may have created a scenario where all of the near-term concerns are priced into the stock.

The analyst followed up with five reasons to support a bullish stance, including benefits from tax reform, a proprietary survey that suggests Domino's' potential share loss in the food delivery space is more gradual than feared, and the company is still one of the best growth stories in the entire retail space. The Jan. 10 investor day will likely prove to be a positive catalyst for investor sentiment as management is expected to reiterate its long-term financial targets of 6-8 percent global unit growth, 3-6 percent global same-store sales growth, 8-12 percent global sales growth.

Price Action

A $250 per share stock price is a "reasonable" bull case scenario based on a 28 times multiple on the analyst's 2019 EPS of $9 per share. On the other hand, a bear case scenario in which 2019 EPS comes in at $8.50 would yield a price closer to the $180 range. As such, the stock is set up for a "favorable" risk to reward profile at current levels.

Shares of Domino's gained 3 percent Thursday to $197.52.

Nomura: International Expansion Could Drive Domino's Next Wave Of Growth

Pizza Politics: Rival Pie Slingers Don't Echo Papa John's NFL Protest Complaints

Latest Ratings for DPZ

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2018 | Credit Suisse | Upgrades | Neutral | Outperform |

| Dec 2017 | Deutsche Bank | Initiates Coverage On | Buy | |

| Nov 2017 | Nomura | Upgrades | Neutral | Buy |

View More Analyst Ratings for DPZ

View the Latest Analyst Ratings

Posted-In: Credit Suisse Jason WestAnalyst Color Upgrades Price Target Restaurants Analyst Ratings General Best of Benzinga

© 2018 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.