Park County commissioners approved the 2018 county budget Dec. 21 for a total of $32.8 million in revenue and $38.6 million in expenditures.

All dollar amounts were rounded by The Flume.

To balance the budget, $5.8 million will be taken from fund reserves, also called fund balances.

The county mill levy of 20.42 is down slightly from 2017, when the mill levy was 20.76.

But revenues generated from the mill levy will increase by about $340,000 for a total of almost $8.9 million in property taxes.

This is due to a little higher total valuation of property in the county from new growth.

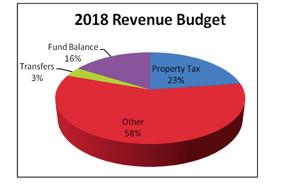

According to a chart in the budget message by County Assistant Manager Cindy Gharst, property taxes are 23 percent of the projected revenue. Another 16 percent of the revenue will come from using fund balances.

Other revenue will come from grants, federal and state payments, departmental fees for services, marijuana taxes and surcharges.

The budget message briefly describes projected revenue and expenditures of each of the 15 funds.

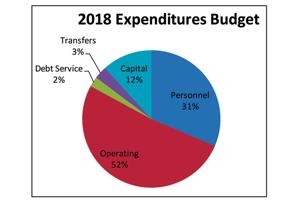

On the expenditure side, personnel costs and operating expenses have increased by two percent each. Personnel costs are projected at 31 percent and operating expenses at 52 percent of the budget.

Capital projects fund expenditures are projected to be $4.6 million, which is down from 2017’s $7.5 million in capital expenditures.

Most of both years’ capital expenditures are for the $8.1 million new county office building being built. It is expected to be finished sometime early summer of 2018.

The repayment of the $5.6 million in certificates of participation that helped fund the building will take 20 years.

Other capital expenditures include improvements at the jail, building an addition on the facilities building, completing a new public works shop in Jefferson and improvements at the main public works shop in Fairplay.

The budget message states that salary increases for the sheriff’s personnel and one additional person for the assessor’s office will be decided after the 2017 books are closed, which will be at the end of 2018’s first quarter.

Three other items were in the message regarding personnel.

No salary increases will occur that aren’t part of the county salary plan.

One veterans affairs officer will become full time instead of half time. The salary increase will come from increased funding from the Veterans Administration.

Lastly, due to the increased health insurance claims in 2017, the medical plan was changed. Vision, dental and life insurance plans remain the same.

The new health plans will have higher deductibles and employee monthly contributions.

Still, transfers from the general fund balance into the self-insurance fund will be needed to pay the anticipated medical expenses.

Another transfer from the general fund will go into the debt service fund to start paying back the certificates of participation for the new office building construction.

Transfers into the grant fund from the general fund will be used to pay the county’s share of the broadband project.

All transfers to other funds total about $1.1 million and will come from the general fund’s balance.

Similar transfers were made in 2017. At the beginning of 2017, the general fund balance was $4.4 million. By the end of 2018, the balance is projected to be $2.9 million.

The public works fund, is projected to have about the same revenues in 2018, at $5.9 million, as in 2017.

Expenditures are projected to be down by about $460,000 to $6.9 million.

The public works fund balance is projected to drop to $1.7 million by the end of 2018. At the beginning of 2017, the fund balance was almost $4 million.

Commissioner Mark Dowaliby has advocated that more state funding for public works could be obtained if the fund balance weren’t so high.

In 2016, the county commissioners decided to spend down fund balances for special projects that weren’t an ongoing expense, particularly in the general and public works funds.

That is easily seen in the 2018 budget’s projected fund balance summaries at the beginning of the budget document.

At the beginning of 2017, all 15 fund balances totalled about $24 million.

By the end of 2018, all fund balances are projected to total $10.1 million.

It is necessary to keep enough in fund balances to cover the first quarter expenses until property taxes start being received.

The 2018 adopted budget and budget message can be found on the county website, www.parkco.us.

Supplemental appropriations

Supplemental appropriations in 11 funds were approved for the fourth quarter of 2017.

Most additional revenue came from fund balances to cover expenditures not anticipated when the 2017 budget was approved in Dec. 2016.

Final construction costs of the new office building were $800,000 higher than appropriated. That amount was transferred from the general fund to capital projects fund.

Another $221,000 was transferred from the general fund to the debt service fund to make the first interest payment on the certificates of participation that helped pay the construction costs of the new office building.

Upgrades to the electrical system and the commercial kitchen at the fairgrounds community center were appropriated from the conservation trust fund balance for $100,000.

The grant fund balance was decreased by $43,660 to provide the county’s cash match for several public health state grants received.

The sheriff’s seizure fund used $7,900 from its fund balance plus $8,091 more from court-ordered donations.

The money was used to pay additional expenses in victim services, DARE, community services and officer welfare programs.

Public works fund used $966,500 from the fund balance. New equipment cost $400,000.

The remaining $566,500 was used for the county match on the Tarryall Road project. Federal Highway Administration paid several million dollars to complete the entire length of the road from Jefferson to Lake George.

The county’s share of the retirement fund increased by $14,800. This was due to a calculation error in the original resolution adopting the 2017 budget. The additional amount came from the fund’s balance.

Fleet services fund used $105,000 of its fund balance to cover fuel, oil tires and correct a calculation error.

The recreation fund received about $11,000 more in fishing fees than anticipated. Of that, $7,600 was distributed to the owners of property in the fishing program. Additional treasurer revenue collection fees cost $150.

About $2,000 was spent on Verizon and leases.

Self insurance fund used $390,000 from its fund balance and $150,000 from a general fund transfer to cover additional medical claims submitted.

Revised marijuana ordinance

The commissioners completed the introduction and first reading of a revised ordinance governing marijuana growth by individuals.

The original ordinance governed just medical marijuana. Most of the changes were grammatical in nature and to strike the word “medical” in the title.

The only substantial change was eliminating the maximum number of plants allowed by an individual or caregiver. Thirty plants was changed to read “the maximum number allowed by state law.”

The Flume did not receive a summary of the weekly vouchers submitted for payment.

Rules of Conduct

Welcome to the discussion.

Log In

Sign Up