Mukesh Ambani’s Reliance Jio announced a deal on Thursday to acquire younger brother Anil Ambani-owned Reliance Communications’s (RCom’s) wireless infrastructure assets, including towers and spectrum, at an estimated price of Rs 20,000-24,000 crore. The historic deal between the brothers came on their father Dhirubhai Ambani’s 85th birth anniversary.

The two companies have signed binding agreements and the proceeds would be used to pre-pay RCom’s bank loans.

“Jio emerged as the highest bidder in a transparent process conducted under the supervision of a high-powered bid evaluation committee, comprising experts from banking, telecom and law. The company will utilise the proceeds of the monetisation of this cash deal solely for pre-payment of debt to its lenders,” RCom said in a statement.

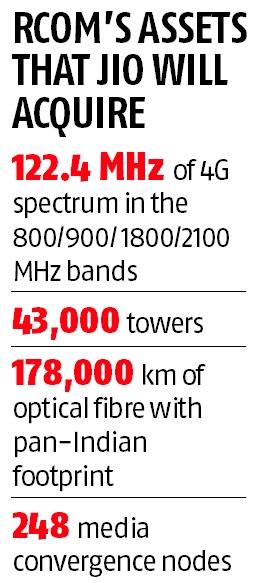

Jio, which has disrupted the Indian telecom sector after the launch of its free voice service last September, will acquire 122.4 MHz of 4G spectrum in the 800/900/1800/2100 MHz bands, over 43,000 towers, around 178,000 route km of fibre with a pan-Indian footprint, and 248 media convergence nodes, covering 5 million sq ft used for hosting telecom infrastructure. These assets are expected to contribute significantly to the large scale roll-out of wireless and fibre to home and enterprise services by Jio.

Both companies said the transactions would close in a phased manner over the next three months ending March 2018, subject to approvals from lenders.

Cash payments, including deferred spectrum installments payable to Department of Telecommunication (DoT), would form part of the deal.

Banks, on the other hand, had to let go of their dues till December 2018 from the beleaguered company. But as the company failed to sign any deal before the December 2017 deadline, the banks will have to consider the account as a non-performing asset and set aside 15 per cent of the exposure as provisions in the December quarter.

The acquisition will put Jio in charge of a sizeable spectrum band even as the telco has already disrupted the sector over the past one and a half year. Jio holds almost 14 per cent of the telecom market share by adjusted gross revenue, according to the Telecom Regulatory Authority of India (Trai) numbers and has been steadily rolling out freebies to telecom subscribers to grab market share.

Apart from this transaction, RCom would also sell real estate and minority stake to reduce its debt by 87 per cent to Rs 6,000 crore.

The company had earlier announced plans to sell prime real estate across New Delhi, Chennai, Kolkata and Navi Mumbai. The Jio acquisition does not include real estate assets.

SBI, IDBI Bank, Bank of Baroda are among the top lenders to RCom. The company was also able to convince China Development Bank, one of its large lenders, to withdraw a National Company Law Tribunal (NCLT) petition to recover Rs 9,600-crore debt from RCom. The RCom stock gained 7.7 per cent to close at Rs 31 on Thursday.