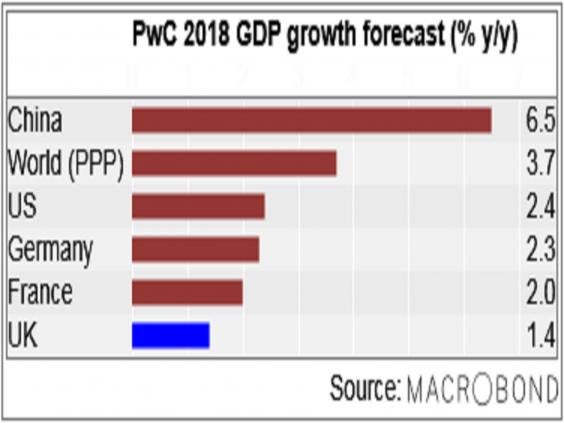

Global economic growth will pick up to its fastest rate in seven years in 2018, while the UK’s economy slumps to its weakest expansion since the last recession, according to the latest forecast from PwC.

The accountancy and professional services firm’s forecasts are for global growth to hit 3.7 per cent in purchasing power parity (PPP) terms next year, the most rapid expansion, by this metric, since 2011.

PwC said that, for the first time since 2010, it is revising its global growth forecast upwards, bolstered by a robust cyclical recovery in the eurozone and stronger growth in the US.

But PwC expects Brexit related-uncertainty to leave the UK on the growth sidelines next year, with a GDP expansion here of just 1.4 per cent pencilled in for next year.

That would be the weakest output in a calendar year since 2009, when the economy contracted by 4.2 per cent.

“We expect global economic growth to be broadly based in 2018, rather than dependent on a few star performers,” said Barret Kupelian, senior economist at PwC.

“While the growth outlook for 2018 is positive, there are some downside risks for business to bear in mind, including the progress of the Brexit negotiations and wider discussions about the future of the EU.”

PwC’s pessimistic 2018 GDP forecast for the UK is in line with the most recent projection from the Treasury’s official forecaster, the Office for Budget Responsibility.

In 2017, the UK’s GDP growth is expected to be 1.5 per cent, itself the weakest since 2012.

Activity has been dragged down by a spike in inflation since the June 2016 Brexit vote, induced by the record slump in sterling on the night of the referendum.

That has crimped household spending. Investment has also been frozen by many firms, attributable to uncertainty about trade relations with Europe after Brexit in March 2019.

PwC said that 2018 could see the European Central Bank halt its money-printing programme altogether, rather than just tapering it down, if inflation in the single currency area comes in a little stronger.

Brexit Britain on the sidelines

“Generally, we expect monetary policy to somewhat tighten in the G7, reflecting closing output gaps in some advanced economies and stable inflation expectations,” it said.

PwC also forecasts the unemployment rate across the G7 to hits its lowest in 40 years, dipping below 5 per cent.

The firm sees GDP growth in the US picking up from 2.2 per cent this year to 2.4 per cent. It sees French growth rising from 1.8 per cent to 2 per cent. German growth is seen steady at 2.3 per cent, while growth in China slows from 6.8 per cent to 6.5 per cent.

- More about:

- global economy

- Brexit

- PwC